Insight Focus

- Record-breaking April milk collections in New Zealand due to favorable weather conditions.

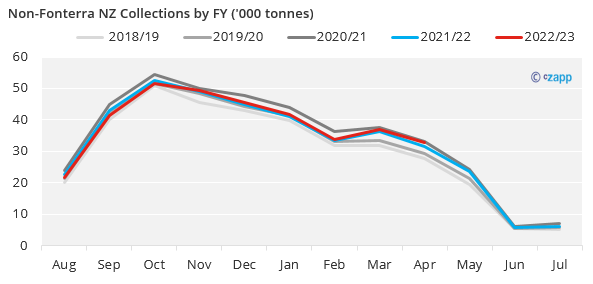

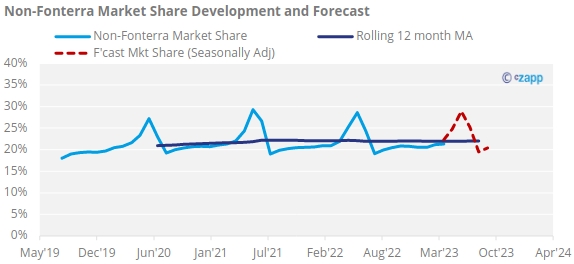

- Non-Fonterra collections show growth and maintain market share.

- Complex market dynamics for SMP could see enhanced price volatility.

New Zealand Collections:

- April numbers are now in across the board and New Zealand has printed its strongest milk collections for April ever. This strength has been driven by sustained warmer conditions (1.1 degree above average) and wetter soil moisture. These conditions have continued in New Zealand across the month of May, though rainfall is now down.

- Surprisingly, April collections were led by a huge month for Fonterra’s North Island farmers, up over 10% YoY.

- Fonterra still remains slightly behind on aggregate collections this financial year to date.

- Non-Fonterra collections were up 4.31% in April. This meant that they maintained the 21.3% market share held in March. This is a downside surprise as my “Normalised Seasonally Adjusted Non-Fonterra Market Share” modelled value was 22.3% for April (and is 24.8% for May).

- Recent Global Dairy Trade (GDT) results indicate that in NZ Skimmed Milk Powder (SMP)/Butter remains increasingly, and substantially, ahead as the leading stream return. SMP/AMF is also now in front of the Whole Milk Powder (WMP) stream. With higher milk flows than usual heading to processors who can optimize, expect more of these products to be made in NZ.

- I am also hearing that Chinese local milk collections remain strong. This is likely to negatively impact demand for Chinese WMP imports in the medium term. This is corroborated by my friend Sandro Schulz who is hearing similar from his network.

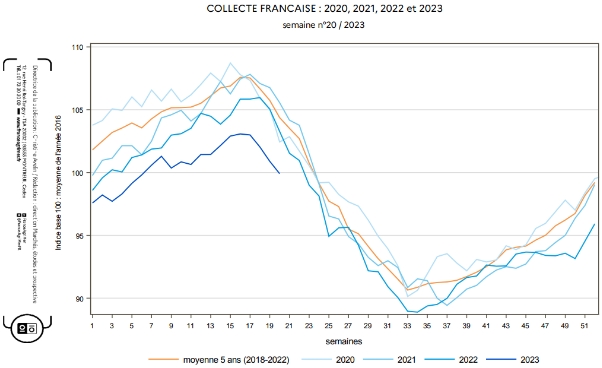

A look at Europe:

- European milk supply peak appears to have passed and was slightly lower than in 2022 but considerably lower than the 2023 forecast. This is largely driven by France which is well below prior years.

Source: France AgriMer

- Butter pricing is soft/stable in Europe. Cream is weak but seasonal sentiment factors (Wimbledon etc.) could be supportive in the short term. German retail butter tender pricing was unchanged MoM, the short tenor of these tenders indicates a bearish sentiment in the face of an unusually stubborn fat market.

- European traders are facing challenges in executing the “carry trade” for butter as reefer warehousing space is increasingly hard to access.

- There is a large rumor in the market that many traders have sold SMP into physical milk powder tenders uncovered. The surprising demand strength from Algeria may be giving these shorts cause for concern and could keep the SMP market at least stable. A supply shock could be very disruptive in the immediate term.

- However, European SMP prices have started to soften again which is giving traders an opportunity to cover. We are hearing of some backfilling from NZ suppliers also. This softening is may also lead to more demand being tabled in North Africa at advantageous levels.

Inflation in EU/US:

- Weak demand for retail products such as cheese in domestic EU and US markets is expected to continue due to pressures on household spending.

- US cheese pricing has been tanking this year which may see more milk redirected into the SMP/fat stream and complicating the overall SMP outlook.

Source: CME