Insight Focus

- New Zealand dairy sector eyes ‘cost-of-farming’ crisis

- US May milk production lower than expected

- Upheaval in Dutch farming industry from nitrogen oxide cut plans

New Zealand:

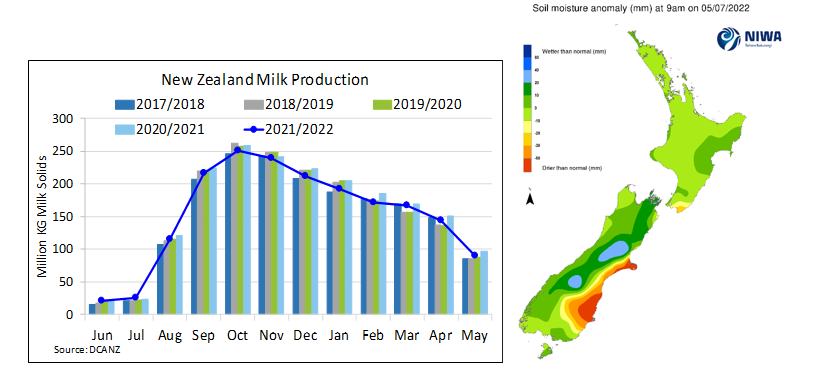

May milk production data officially wrapped up the season, which ended 4.1% lower than the previous one as producers were unable to match last year’s high autumn collections. Soil moisture has improved seasonally into winter, and, with a record opening milk price forecast for this upcoming season, milk production should rise as long as the weather cooperates (currently forecast to be a mild second half of the year). Exponential growth over the next five years will be limited by producers preparing for stronger taxation (in the form of the Emission Trading Scheme) and taking on more debt to focus on technology improvements on-farm (to mitigate the rise in labour costs). As Craig Hickman (equity manager on a 1000-cow dairy farm in mid-Canterbury) said: “Just as New Zealanders are grappling with a cost-of-living crisis, farmers are coming to terms with what is rapidly becoming a cost-of-farming crisis.” The final cost/taxation to dairy farmers under the Emission Trading Scheme has yet to be finalized but will ultimately be on farmer’s minds as another input to worry about, alongside expensive labour, high diesel and fertilizer prices and supplemental feed uncertainty that has pushed break-even levels to new heights. Expanding is not an option and there is a heightened need for investment toward genetics and technology if New Zealand wants to squeeze even more milk from fewer cows.

United States:

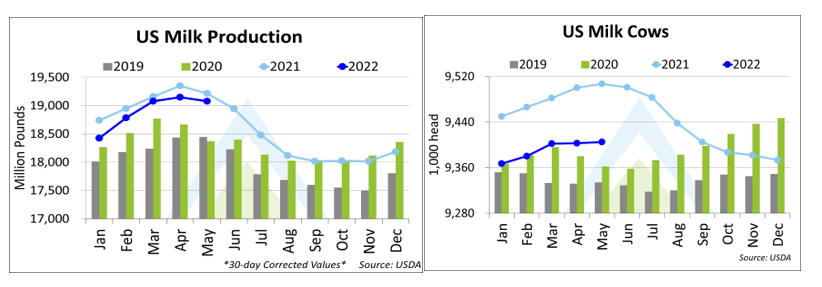

US milk production came in slightly lower than expected in May for the second consecutive month, but the fall was not out of the realm of possibility to mark a mostly neutral reaction to the data. The widely awaited report confirmed that milk output was lower year on year for the seventh consecutive month, as expected, as the herd size remains well below the previous year’s. The 0.7% year-on-year fall was slightly less than the 1.0% April drop that was not revised this month. Total milk volume was lower in May than in April, meaning that US output peaked seasonally in April, consistent with the trend in three of the past five years. Milk seasonally peaked in May in 2018 and 2019.

While milk volume was lower yet again, components continued to rise. The data is one month delayed, but the April US milkfat average test was 4.08%, up from 3.99% a year earlier. The 2.3% rise marked the highest April milkfat test on record. Milkfat is lower than in January on a seasonal basis, as expected, but the strength is notable and slightly reduces the impact of lower milk volume. While protein data is not available on a national basis, May data is available; in Federal Milk Marketing Order 30, covering Wisconsin and Minnesota, the May protein test averaged 3.15%, up slightly on the year at the highest May protein test on record for the FMMO.

EU27+UK:

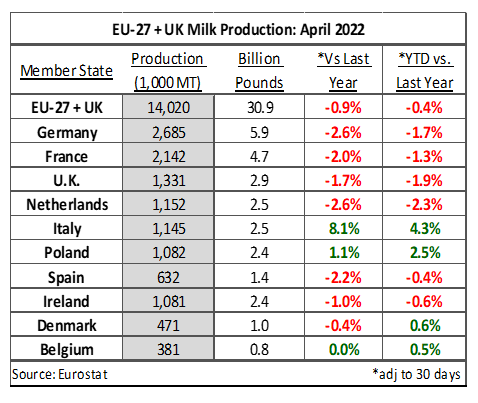

Top milk producing nations within the EU continue to drive losses from the region, most notably Germany. April milk production fell 72,070 tonnes on the year in Germany, the steepest drop in volume of all countries, followed by France and the Netherlands. The falls in these countries were aligned with recent trends. It will be difficult for each of these countries to return to a strong-growth model given pressure from governments and consumers.

In recent days, the Dutch government unveiled goals to reduce emissions of nitrogen oxides drastically to protect the environment, a plan that would lead to major upheavals in the Netherlands’ multibillion dollar agriculture industry and has already angered some farmers.

Ireland, Italy and Poland had been top countries to record gains in milk over the past year and while very strong gains in milk volumes were reported from Italy in April yet again, growth from Poland has now tempered and Ireland reported a fall in collections for the second consecutive month.

Before March, Spain was also reporting solid gains on milk (for 10 months) production but have now reported two consecutive months of weaker growth into April; April’s falls were the strongest recorded since February 2021.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial