This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The US sugar market remained quiet with stable prices. Beet and cane harvests progressed well despite minor weather disruptions. Refined sugar sales were slow, with ample supply and mixed sentiment among processors.

The cash sugar market was quiet during the week ended November 22, as processors sought buyers for remaining quantities of sugar for 2025, while activity for 2026 was limited to preliminary discussions. Prices remained unchanged, and contracting for corn sweeteners advanced.

Weather Supports Beet, Cane Progress

Only a few USDA state offices reported progress in the beet harvest as of November 17, with sources in some states indicating the harvest has since been completed. In certain cases, slightly lower beet tonnage was offset by higher sugar content, processors said.

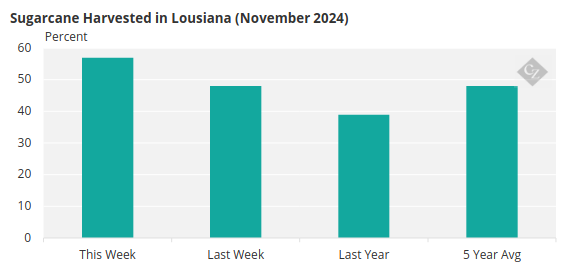

The sugarcane harvest continued in Florida and Louisiana. The USDA state office in Louisiana reported that the harvest was 57% complete as of November 17, compared with 39% at the same time last year and the 2019–23 average of 48% for that date.

Source: USDA

Except for brief hurricane delays in Florida and minor hurricane damage in Louisiana, both cane and beet growers benefited from mostly favourable harvest weather. The exception was Michigan, where warm weather initially delayed the harvest, though growers have since caught up.

Sugar beets in northern regions are now subject to weather conditions. A cold winter and late spring would be ideal to freeze outdoor piles and maintain them through slicing campaigns, which are expected to run into spring, particularly in the Red River Valley. Weather appeared cooperative, with nighttime temperatures already well below freezing.

Refined Sugar Sales Slow Amid Steady Prices

New sales of refined sugar for 2024–25 was sluggish. Sellers noted difficulty in finding buyers for remaining 2024–25 sugar supplies, which were larger than expected due to this year’s significant sugar beet crops.

One source mentioned a seller aggressively offering sugar near or below the bottom of the quoted Midwest beet sugar price range. Other sellers kept prices within the middle of the range, preferring to carry over unsold supplies rather than lower prices. One beet sugar seller remained out of the market due to lower-than-expected production.

Prices for 2024–25 remained steady, with mixed sentiment depending on how much sugar processors still had to sell. Most processors were well sold despite the robust beet harvest.

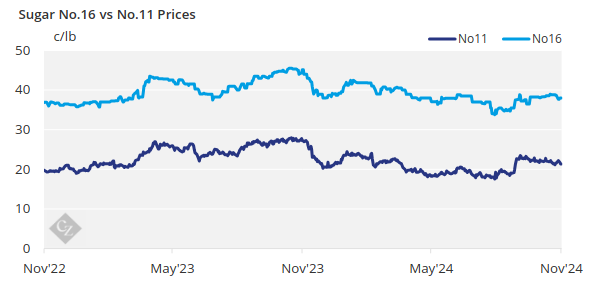

Cane sugar prices for 2024 and 2025, on a calendar-year basis, also remained unchanged. Some sources suggested that beet sugar prices might still have upward potential due to their significant discount to refined cane sugar prices. Refined cane sugar prices were not expected to decline as long as No. 16 futures remained in the 37–38¢/lb range.

Sellers Hold Out for Higher Bids

Inquiries for 2025–26 continued, with reports of significantly lower bids for beet sugar. However, sellers were reluctant to lower offers so far ahead of planting, which is still about five months away, and while sugarcane harvesting is ongoing. Minimal business for 2025–26 has been transacted to date.

Discussion of sugar demand persisted. Bulk sugar deliveries remained soft, while bagged sugar deliveries met or exceeded expectations. The cumulative impact of GLP-1 drugs, reformulations, government policies and other “anti-sugar” factors was thought to have a small but noticeable effect on demand.

Annual contracts for 2025 corn sweeteners were being finalised, mostly at rollover prices compared to 2024, according to trade sources. Some discounting of 42% high-fructose corn syrup (HFCS) was observed, but strong domestic demand for 55% HFCS and regular corn syrup (glucose) kept prices steady, despite lower corn costs.