Insight Focus

US crops are looking good, while parts of Europe struggle. The varying crop reports from around the world make any price predictions precarious while northern hemisphere combines roll. But markets need buyers and sellers, not just funds.

The Markets

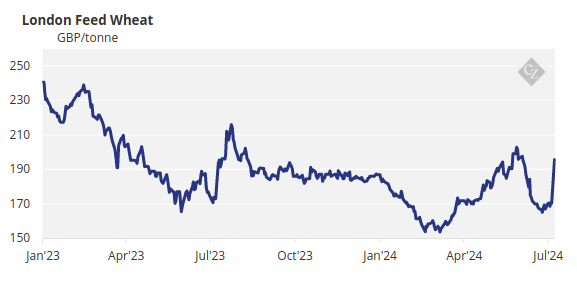

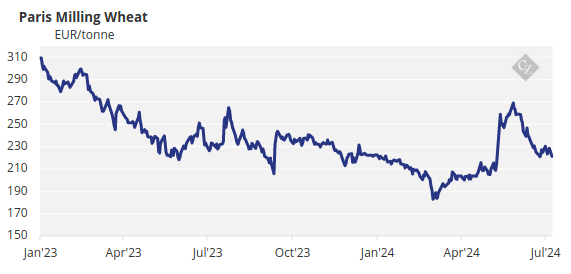

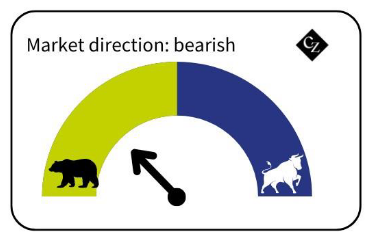

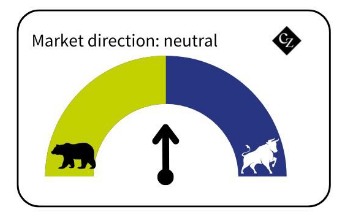

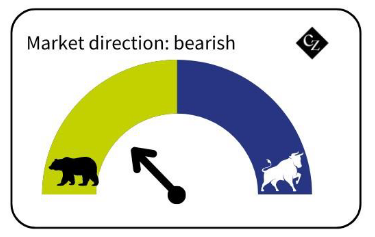

With bullish reports from a region one day, to bearish crop ratings from another the next, wheat markets are currently struggling to find a solid, consistent direction. The charts below demonstrate just how the ups and downs have persisted over the last couple of weeks.

Current Price Drivers

1. The US

Although markets have reacted to weather forecast swings, the overriding news from the US is:

- The winter wheat harvest is progressing well, at 63% harvested versus 43% last year and the five-year average of 52%.

- Spring wheat ratings report 75% of the crop in good/excellent condition, up from 47% last year.

- Wheat sales this month have set the marketing year off to a bullish start with figures above expectations for the last two weeks.

With a good crop currently being harvested together with strong exports, the US is likely to be a bigger seller than in recent years.

2. Europe

The UK, France and Germany on the west side continue to experience sub-optimal weather.

In France, wheat ratings are at 58% good/excellent, down from 60% last week and 81% last year.

Crops have undoubtedly struggled in the west, while in the east, where harvest continues, expectations are much more positive. Romania, Bulgaria and Croatia are all reporting good results.

But in the Black Sea, things remain uncertain. Ukraine is a couple of weeks ahead of normal with harvest, but as war rages, final production numbers are complicated.

In Russia, wheat estimates are varied, from 81 million tonnes to 84 million tonnes — the outcome of which will influence its ability to reach export predictions as the world’s largest seller.

3. Argentina and Australia

Weather has been less damaging and there are hopes that wheat crops, due at the end of the calendar year, will see improvements on last year, with greater export possibilities.

4. The importers

The buyers are just as important as the sellers in a market. As we have seen in the falling market over the last couple of months, few buyers have been active enough to rally any bullish sentiment.

Turkey’s ban on imports last month, to protect domestic producers, adds to the lack of enthusiasm to push prices up. The likes of Iran, Pakistan and various North African countries are appearing relaxed as their immediate needs are covered.

The biggest unknowns this year may be China — as the world’s largest importer — and India, who may need significant imports if its crop is not large enough.

5. The Funds

We have seen funds adding to their short positions in both Chicago and Kansas markets, while in Europe a significant long has been radically shed over the last couple of weeks. The funds will react to news and their shorts have helped the bears. Their uncertainty has enhanced the current volatility.

Concluding Thoughts

The supply side is full of uncertainties. Firstly, Western Europe is not expecting a good crop, while the East is looking better. The Black Sea is also unpredictable, with Russia’s crop needed, as the largest exporter.

Meanwhile, North America’s increasing exports may cover potential shortfalls from Europe and Argentina and Australia are optimistic about playing their role in global trade.

Prices are on the low side for farmers’ margins, but even this is not tempting a rush of buyers. But the long-term downside is probably limited, as maintaining prices will be critical to farmers planting the 2025 crop in the autumn months. Nonetheless, that may not stop further falls in the short term.

But it wouldn’t take much to swing the pendulum in the other direction. Chinese imports or a buying spree from India could disrupt the bears and drive the market much higher than today’s levels.

There is also a USDA WASDE June report due at the end of this week, which could inevitably throw in a surprise or two.

The upside price risk would certainly appear to outweigh the downside, even though the market bulls are hiding away for now.