- Ethanol producers’ molasses demand is increasing as energy rallies.

- Molasses and cane juice are often converted into ethanol for gasoline blending.

- Today’s climbing oil prices mean ethanol production is more profitable.

How Does the Energy Crisis Impact Molasses?

Oil prices are sat near 80 USD/barrel, Brazilian ethanol prices FOB Santos are sat between 750-840 USD/CBM, T2 FOB Rotterdam ethanol is over 1,400 EUR/CBM, and natural gas prices are near record highs in Europe.

The most immediate impact on the global molasses market has been the increase in transportation costs from mill to port; bulk liquid tanker freights and local distribution of molasses. This, of course, is not specific to the molasses market and the impact of higher oil and fuel prices is being felt across most developed economies. The US and other members of the G7 and OECD facing sustained inflation for the first time since the financial crisis in 2008, for instance.

The second impact is increased demand for molasses from ethanol producers. In the large sugar producing countries, molasses and cane juice are converted into ethanol for gasoline blending. The increase in oil prices improves the economics of ethanol production.

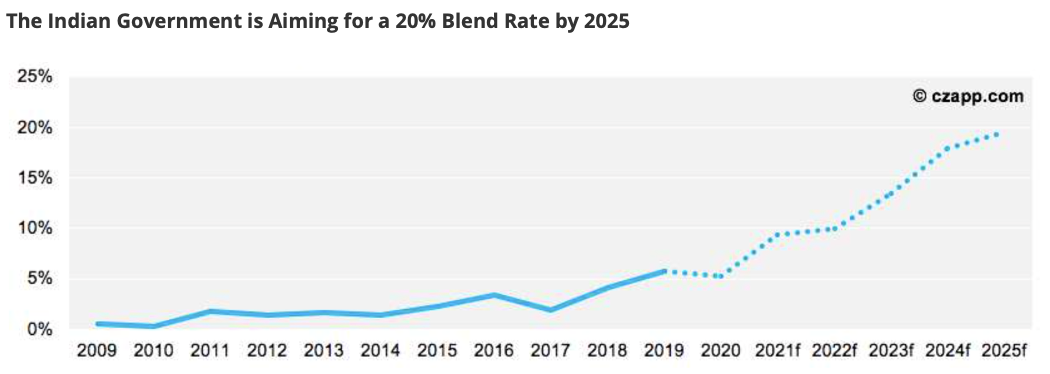

We’re also seeing an increased push in India to develop their domestic ethanol and gasoline blending programme, with the aim to reach E20 by 2025.

The roadmap produced by the Indian government called for a large increase in grains-based ethanol production. However, molasses is available in the local market and will likely be used in the initial ramp-up phase of ethanol production.

In the short-to-medium term, this heightened ethanol demand will constrain molasses supply and result in higher prices, looking purely at the supply of sugar and molasses.

Longer term, there could be more inflationary impacts of the current energy price rises. The cost of production of sugar and transport of molasses could remain at elevated levels. Fertilizer prices have increased, which could result in less well-capitalised farmers using less fertilizer, which may impact cane and beet yields next year.

The tanker market is harder to forecast as the supply and demand of vessels would need to be modelled, but they will likely face a period of higher running costs.

The molasses market is not alone in facing these challenges. The main difference is the high percentage of molasses, which is converted to ethanol for gasoline blending. This is compared to other commodities where the use for human and animal consumption is much higher compared to the use for energy.

Other Insights That May Interest You…

World Sugar Market Five-Year Outlook

Explainers That May Interest You…

The Indian Ethanol Industry