Insight Focus

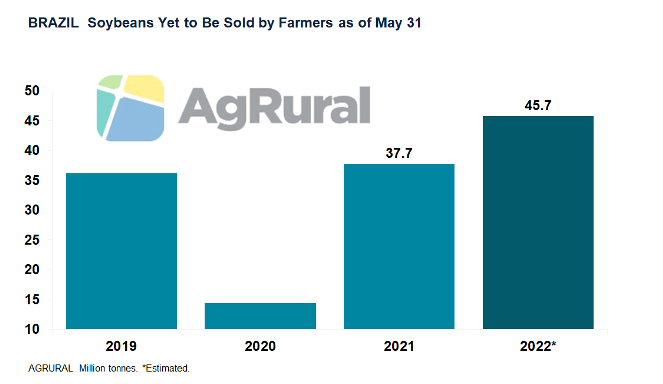

- Over 45m tonnes of 2021/22 soybean crop still to be sold, up from 38m a year earlier.

- Farmer selling slowed by expectations of higher prices later this year.

- Brazilian soybean prices usually rise in Q4, but Chicago futures inverse might change this in 2022.

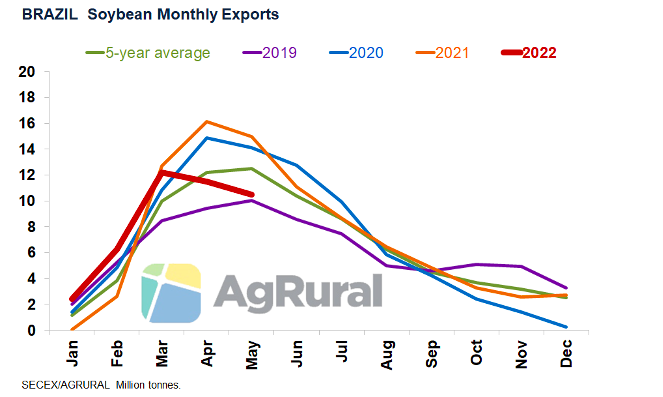

The volume of soybeans Brazilian farmers still have left to sell over the next seven months, before the next crop starts entering the market, is significantly higher than a year earlier despite Brazil having just harvested 123m tonnes, well below the 145m tonnes initially forecast because of drought in the 2021/22 season.

A monthly survey conducted by AgRural shows that 63% of 2021/22 production had been sold by farmers by the end of May, compared with 73% a year earlier. That means that producers still have more than 45m tonnes of soybeans on their hands. A year earlier, when production hit a record high of 138m tonnes, the volume waiting to enter the market was just below 38m tonnes.

Weaker Demand and Falling Prices

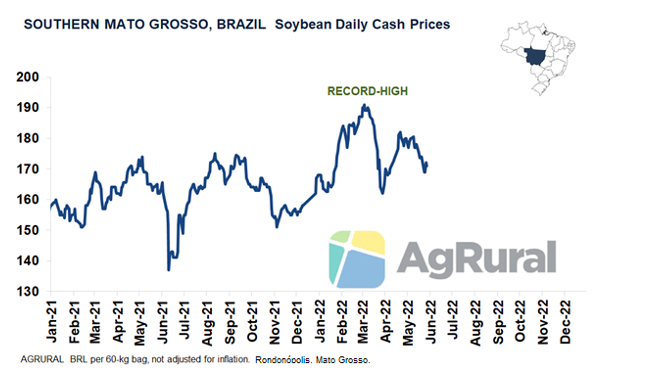

This year’s slower-than-normal selling by farmers is down to two main factors: weaker Chinese demand, which doesn’t give enough support to export premiums for prices to reach the levels sought by farmers; and producers’ own expectations of higher prices in the second half of the year, which might revisit the highs so far this year (and in Brazilian history, in nominal terms) hit in early March. But, with a steep inverse in Chicago futures and a larger volume of soybeans waiting to hit the market over the next few months even after a crop failure, this strategy of waiting for prices to increase might be dangerous.

Betting on US Weather Woes and a Weaker Real

So why have Brazilian producers been so reluctant to sell their soybeans? Firstly, because there was a crop failure, and most of them feel like supplies are tight – which is true in some states, but not in the country as a whole because farmer selling has been slow.

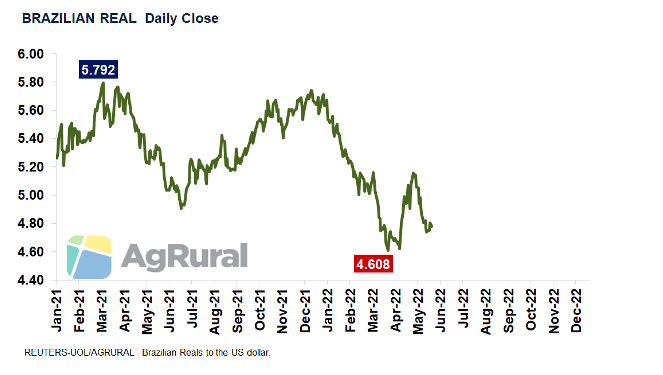

Secondly, because the recent strength of the Brazilian real against the dollar is putting pressure on prices, and producers expect this scenario to change in the coming months, betting on the volatility that usually marks the Brazilian market in presidential election years (they are scheduled for October) to make the currency run out of steam and give prices a boost.

Last but not least, Brazilian farmers are also betting on weather rallies in August, when US crop yields are defined and Chicago quotes can offer good pricing opportunities. With a little luck, a fourth factor might also come into play if the additional international demand for Brazilian soybean meal and oil over the past few months remains strong. That would give local crushers more room to bid higher for soybeans later this year.

Competition for the US in the 4Q?

Of all those bets, the safest would be a weaker real as it would make prices in the Brazilian currency more attractive to farmers without necessarily implying a price increase in dollars – something to stimulate imports in times of inflation and sluggish Chinese demand. If the real really does fall to over 5 to the dollar and Brazilian exports maintain their lackluster pace since April in Q3, it is possible that Brazil will have enough soybeans at competitive prices to compete with the US for an extra slice of world demand in Q4.