Main points

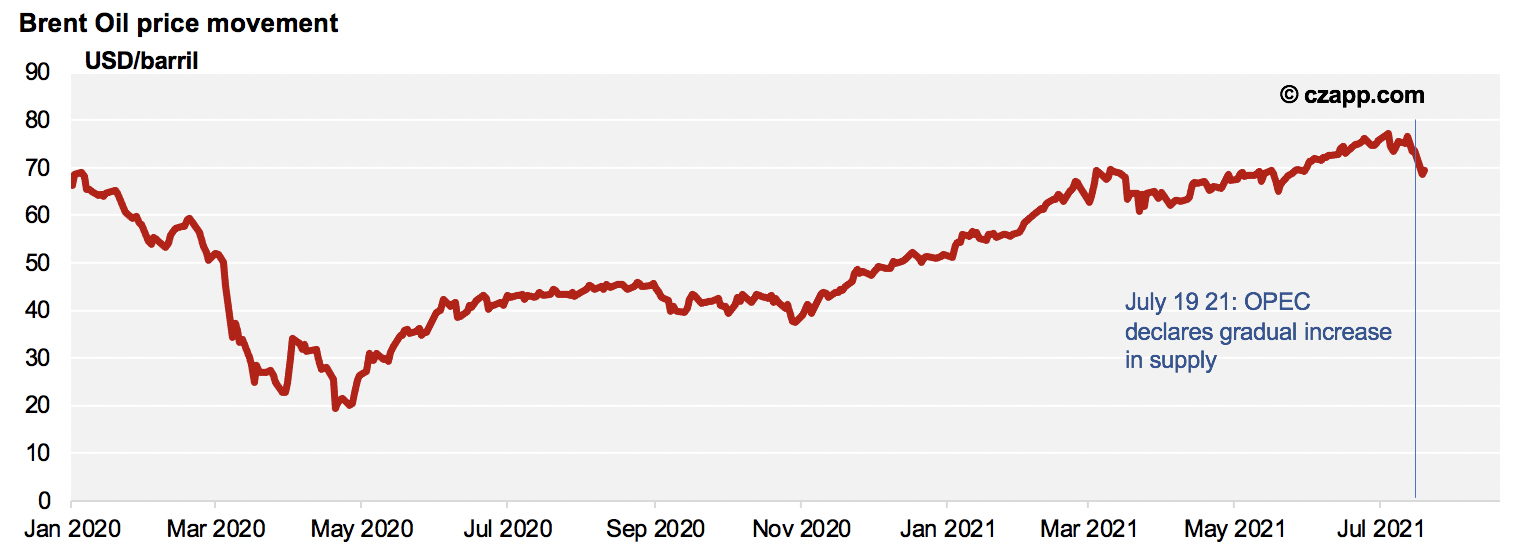

- OPEC decides to increase oil supply, resulting in a recent price drop;

- This could pose a risk to the ethanol ceiling;

- But the adjustments depend on how Petrobras will react and transfer it to the pumps.

Recording last year

- Last year, the energy market went through a roller coaster.

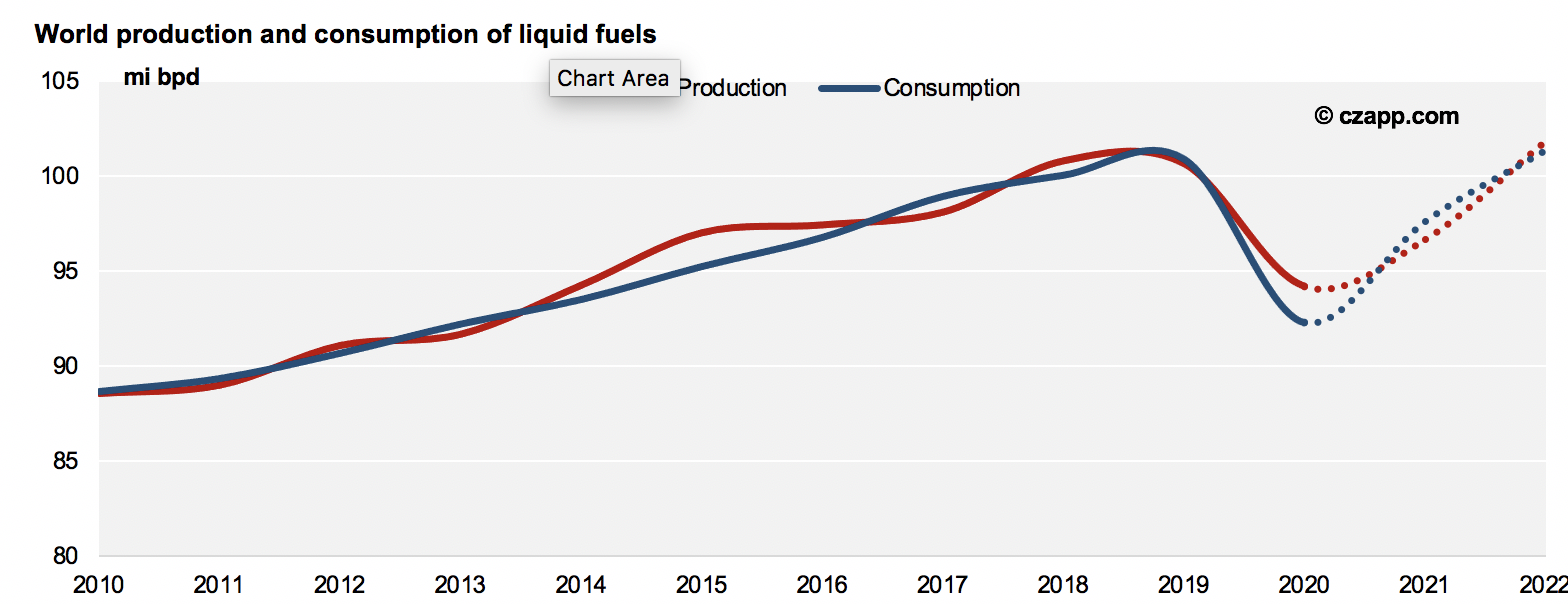

- Prices were pressured by the drop in demand caused by restrictions to contain the pandemic – the WTI even reached negative values: -38USD/barrel.

- In an attempt to reverse the fall in prices, OPEC made a historic agreement to reduce production.

What is happening now..

- As the global economy recovers from the pandemic, the economy warms up again.

- Prices maintained a positive trajectory, even surpassing pre-pandemic values.

- However, last Sunday (July 19, 2021), OPEC+ members agreed to increase the supply of oil from August to curb the rise in prices.

- The increase in production is expected to be 400,000 barrels per day until all production stopped last year returns.

- However, the group left open possible revisions if needed.

- After the announcement, oil prices fell by around 6%.

The impacts here in Brazil…

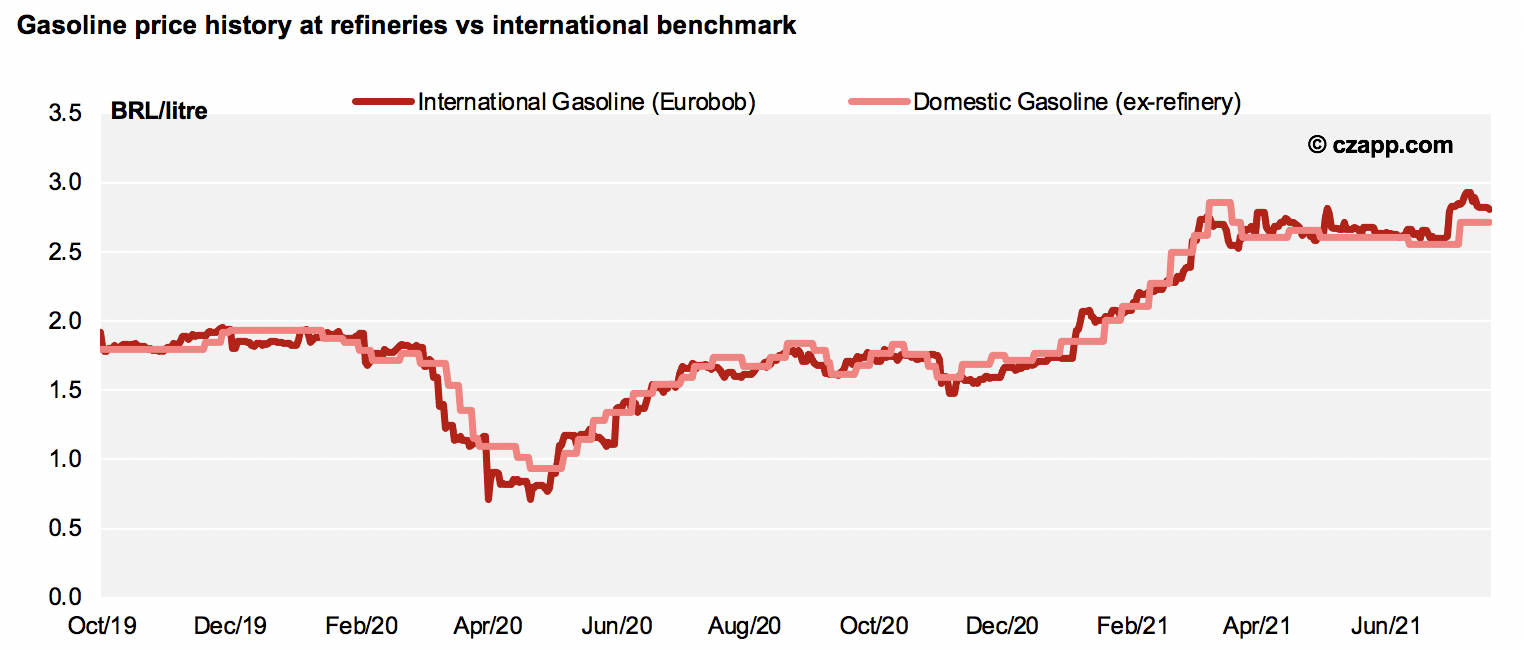

- The drop in the spot and future price of oil impacts the behavior of its derivatives, including gasoline.

- With the weaker international gasoline price, reductions in domestic gasoline prices may be necessary.

- Currently, the parity between domestic and international gasoline remains negative, reducing the need for a readjustment in the short term.

- But if oil weakens more or the Real strengthens, Petrobras may have to revise its price levels…

- For the sugar-energy sector, the lower the price of gasoline, the more ethanol must fall to maintain its competitiveness.

- In other words, there is a risk of a lower price cap for ethanol.

- But noting that everything will depend on the continued drop in oil prices and Petrobras transfers.