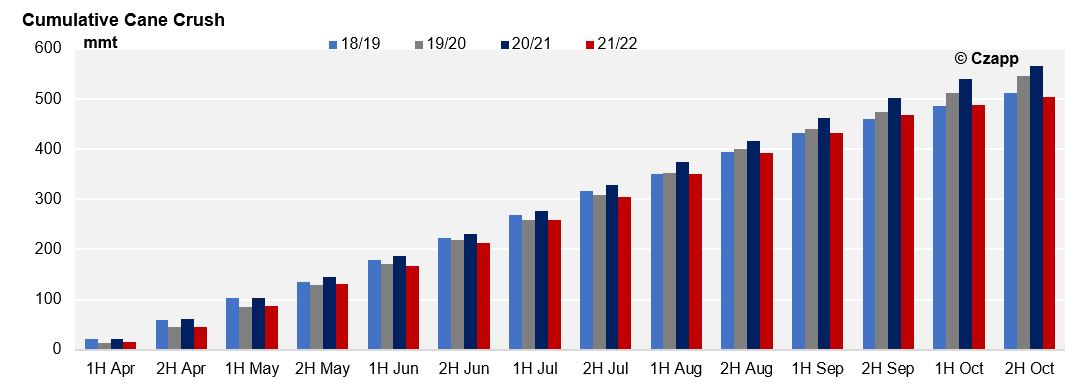

- Just before the end of operations, CS exceeded 500 mmt of processed sugarcane – putting behind the fear that the region could crush below this number, as some houses had suggested.

- This resulted in a total of 31.2 mm of sugar and 25 billion of ethanol (from sugarcane) produced.

- So far, 123 mills have completed their harvest

Crop 2021/22 – 2H October

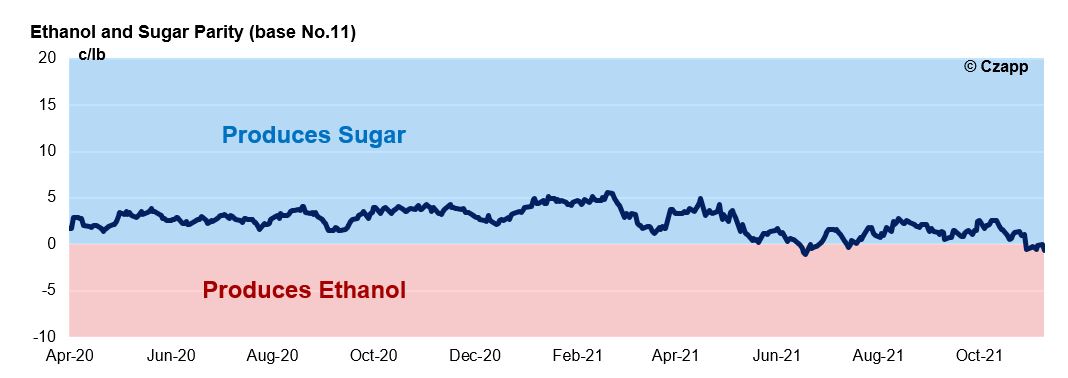

Ethanol Paying More

- Looking at spot parity, today the favored one is ethanol with more than 50pts of advantage over sugar.

- But we are already at the end of the harvest, and changes in the mix now do not have a big impact on the total sugar produced in this crop.

- In any case, this biofuel advantage may have influenced mills, especially in border states with uncommitted volume to allocate more sugarcane for ethanol production.

- Consequently, the sugar mix came lower than expected in 37%.

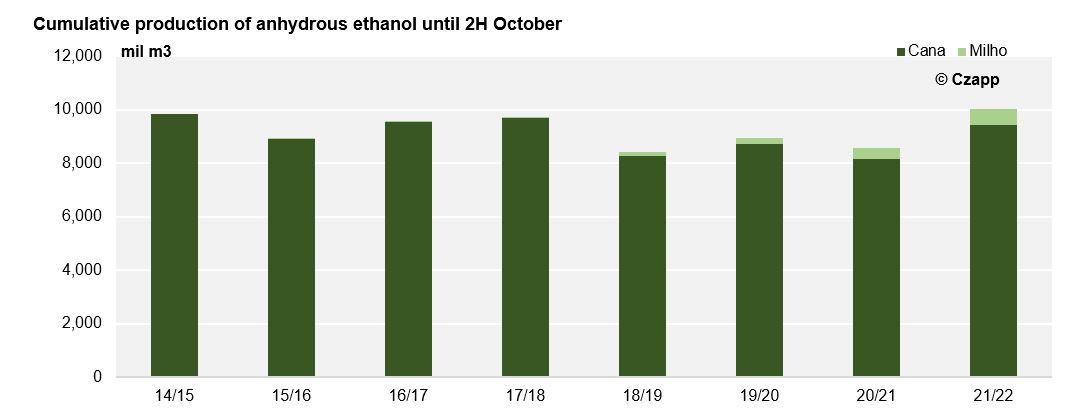

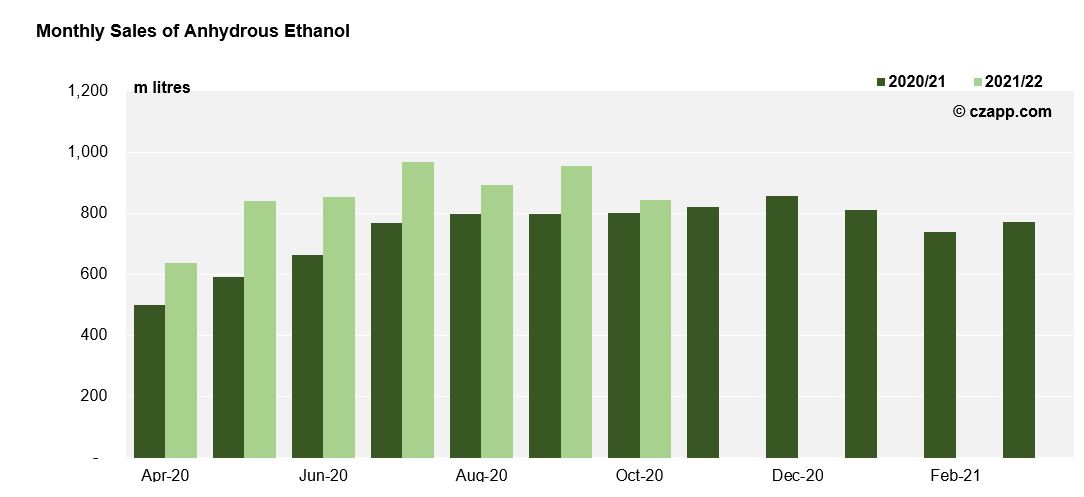

- Another interesting fact from the last fortnights is the greater allocation for anhydrous production – used in the gasoline blend.

- The concern with stocks and availability of pr oduct for the off-season led producers to prioritize anhydrous ethanol.

- Production until the 2H of October totaled 10 billion liters – considering volumes of anhydrous ethanol from sugarcane and corn.

Harvest exceeded 500 mm tons

- The volume of cane processed at the end of October was 17 mtc – higher than expected given the heavy rainfall recorded in the last fortnight.

- However, it was still 37% lower than the same fortnight of 2020.

- As a result, CS reached a cumulative crush of 504,413 mtc – 11% less than last year

- As we already know, the lower volume processed is a result of low agricultural productivity:

- According to UNICA, data from a sample of 64 mills for this fortnight point to a drop in productivity of 11% year on year:

- 55.4 mtc/ha against 62.4 mtc/ha

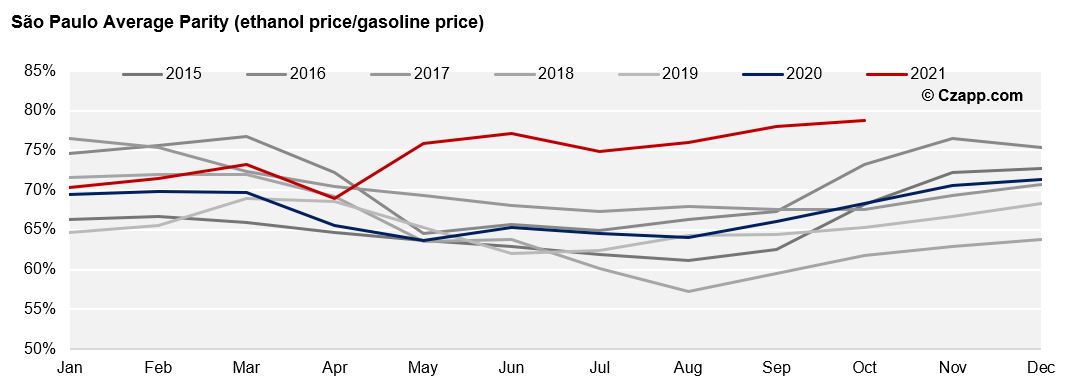

Ethanol market – anhydrous continues with the preference

- Since May, hydrous ethanol has had the worst competitiveness (parity at the pump) on record.

- Consistently above 75%, some of the demand shifted to gasoline.

- And with 27% mandatory blending, it resulted in greater demand for anhydrous ethanol.

- As a result, sales have continued at a strong pace in recent months:

- In October, 842.7 million liters of anhydrous were sold – 5.3% more compared to 20/21.

Reports that you might like:

Dashboards that you might like: