Insight Focus

American corn ethanol no longer qualifies for SAF tax credits. Meanwhile, Brazilian sugarcane ethanol meets the requirements. The corn industry reacted angrily to the news.

US Corn to Lose Out on SAF Credits

The US ethanol industry has been in turmoil recently over the realisation that almost no corn-based ethanol will qualify for the sustainable aviation fuel (SAF) credit under rules recently unveiled by the Treasury Department.

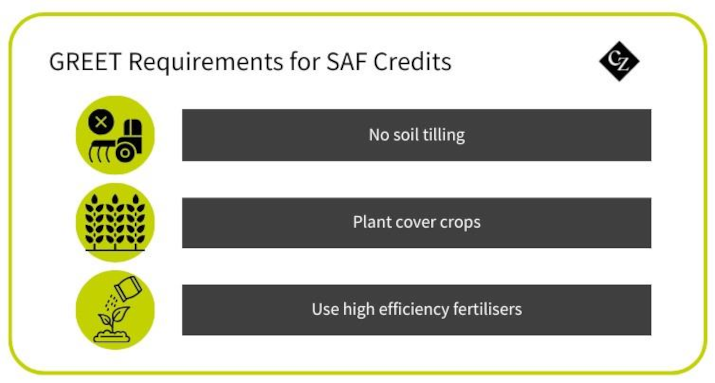

The industry angst arose from a recent change to the Greenhouse Gases, Regulated Emissions, and Energy use in Transportation (GREET) model that calls for ethanol producers to verify that their corn comes from farms using three climate-friendly farming practices in tandem: not tilling the soil, planting cover crops and using higher efficiency fertilisers.

As almost no US farms use these practices at the same time when growing corn, the ability to constrain corn’s carbon intensity (CI) is severely restricted. A CI score of 0 equates to carbon neutrality. The higher the score, the poorer impact the creation of the product has on the environment. Currently, the estimated national average CI score for corn is 29.1g GHG/MJ (greenhouse gas per megajoule), measured with units specifically for ethanol production.

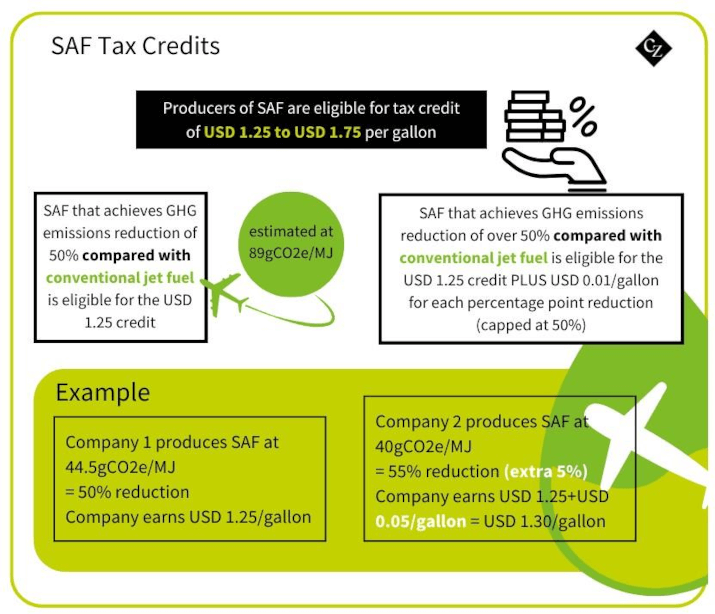

Government regulators say corn’s CI score is too high. The plan calls for a CI score of 20 or less. At stake is a USD 1.25/gallon tax credit in the 2022 Inflation Reduction Act reserved for SAF that demonstrates a 50% reduction in lifecycle greenhouse gas emissions compared to regular jet fuel.

Meanwhile, sugarcane-based ethanol from Brazil meets GREET standards and is readily imported into the US for blending.

Corn Grower Leaders are Troubled

“We are deeply disappointed that this updated model requires farmers to implement environmental practices that are not practical for all acres of the large and varied geographic region in which corn is grown,” said Minnesota farmer and NCGA President Harold Wolle. “This requirement in GREET will significantly hinder the chances corn growers have in accessing the SAF market, even as higher blends of corn ethanol offer great promise in the country’s fight against greenhouse gas emissions and climate change.”

The sentiment was echoed by Chris Grams, president of the Nebraska Corn Growers Association. “This announcement sets Nebraska farmers back as corn should continue to be a viable source of low-carbon feedstocks for ethanol and ultimately sustainable aviation fuels,” he said. “The guidance has very limited positive outcomes for Nebraska farmers and farm families as it forces voluntary practices to become mandatory for farmers across Nebraska’s variation of environments where the practices may not be feasible.”

The market requires a nuanced approach to the program, Wolle added. “When farmers all over the US are forced to implement practices to qualify for market access, the one-size-fits-all approach is unworkable. The difference in climate, soil and season makes it difficult for Nebraska farmers to subscribe to the same conservation regimen in all areas of the state, much less in all areas of the country,” he said.