Insight Focus

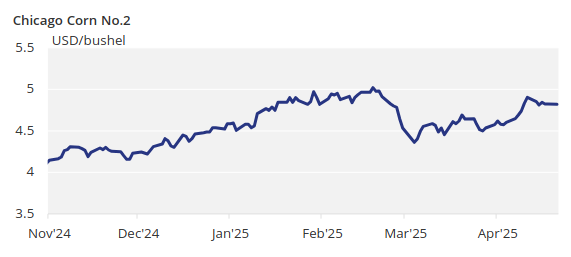

Grains saw a negative week following last week’s rally. Weather in the US Corn Belt and Europe could delay planting, offering some market support. Chicago corn prices remain forecast at USD 4.55/bushel, with downside risk from the trade war.

It was a negative week for all grains across all geographies, driven by profit-taking following the rally of the previous week.

The rains expected in the US Corn Belt could delay planting progress and provide some support to the market. In Northwestern Europe, ample rains in France and Germany are likely to delay planting as well. We continue to expect the USDA to increase demand for ethanol usage in any of the upcoming WASDE reports. Short-term risk is expected to remain flat or skew to the upside.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), with an average price of USD 4.55/bushel, though there is some downside risk depending on the trade war. The average price since September 1 is running at USD 4.46/bushel.

Corn Trades Sideways

Corn in Chicago opened negatively last week after the bullish WASDE report from the previous week triggered some profit-taking. However, the market found solid support by Wednesday and traded sideways, ultimately resulting in weekly losses of about 1.5%. US corn export sales were better than expected by the end of last week, helping to support the market after two negative days.

In Europe, expectations are for higher Ukrainian corn production this year, although final figures for the old crop haven’t been published yet. Planting has begun and is 2% complete. Russian corn planting is 3.7% complete.

US corn planting is 4% complete, compared to 6% last year and the five-year average of 5%. In Brazil, Safrinha planting was completed last week, about level with last year. The summer corn harvest is 65.5% complete, compared to 56.7% last year.

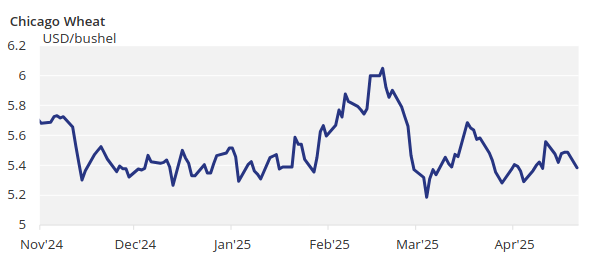

Wheat Prices Decline

Chicago wheat had a negative week, but losses were more pronounced in Euronext, which was hit by a stronger Euro and rumours that French wheat had not been accepted in a tender by Algeria.

US wheat condition is at 47% good or excellent, down 1 percentage point from last week and compared to 55% last year.

The US is expected to experience cold temperatures and rain this week. Brazil is forecast to have favourable weather, with a combination of mild temperatures and rain by the end of the week, similar to conditions in Argentina, where temperatures will be lower. Ample rain is expected in northwest Europe, while the Black Sea region is anticipated to be warm and dry.

We are now in full corn planting season in the Northern Hemisphere, where weather will be critical for planting progress and corn development. It’s also very important to confirm the 94.5 million acres projected by the USDA for US corn acreage.