Insight Focus

- Maersk and Hapag-Lloyd have announced the new Gemini Cooperation after Maersk leaves 2M.

- The new alliance aims to create global “productivity hubs”.

- But where does this new alliance leave the rest of the container industry?

Gemini Cooperation is Born

Danish ocean carrier Maersk Line and its German counterpart Hapag-Lloyd have jointly announced the formation of a new container shipping alliance named Gemini Cooperation. The new partnership is set to become operational from February 2025, marking a significant shift in the dynamics of the container shipping industry and causing a reshuffling of partnerships among major box carriers.

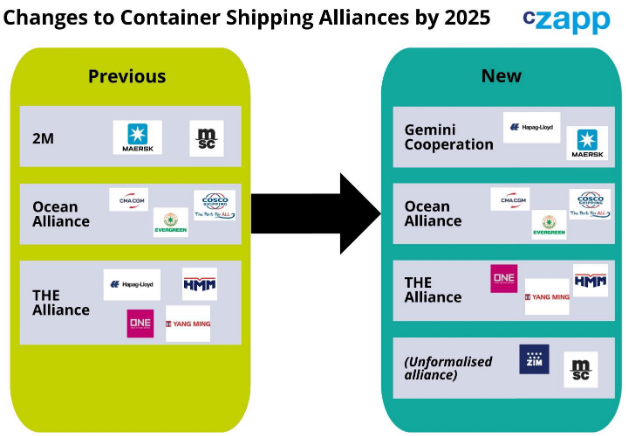

To launch Gemini Cooperation, Hapag-Lloyd will exit THE Alliance, its current partnership with Ocean Network Express (ONE), HMM, and Yang Ming, in January 2025. Concurrently, Maersk will terminate its current 2M alliance agreement with MSC.

The changes would create four partnerships to replace the current three by February 2025.

THE Alliance’s Response

The announcement of Gemini Cooperation has led to speculation about the future of THE Alliance. The reaction of the remaining members to the departure of the alliance’s largest entity will play a pivotal role in shaping the future of the industry and the ensuing dynamics.

While THE Alliance’s next moves are uncertain, there are various possible scenarios.

Scenario 1: Hapag-Lloyd Replacement

In response to Hapag-Lloyd’s departure, a logical step for the remaining members of THE Alliance could be to seek a replacement carrier. Yang Ming’s former chairman, Bronson Hsieh, has suggested that Wan Hai Lines could be a suitable substitute for Hapag-Lloyd in THE Alliance.

With over 590,000 TEUs of capacity, including approximately 110,000 TEUs on order, the Taiwan-based Wan Hai Lines ranks as the 11th largest operator globally.

Source: Alphaliner

Hsieh believes that if Wan Hai renews its ambitions of starting services to Europe, it could be invited to join THE Alliance.

Another potential replacement for Hapag-Lloyd in THE Alliance could be ZIM, as its “operational cooperation agreement” with MSC has not yet been formalised as an alliance. However, Hsieh expresses scepticism about the likelihood of the Israeli ocean carrier being accepted into any alliance due to the current war in Gaza and the resulting ongoing Red Sea Crisis.

Scenario 2: THE Alliance Maintains the Same Structure

In this scenario, ONE, Yang Ming and HMM would continue their partnership without replacing Hapag-Lloyd. This would lead to THE Alliance relying heavily on the Singaporean container line ONE, which currently has a larger TEU capacity than the combined capacity of Yang Ming and HMM.

However, this would also mean a significant reduction in THE Alliance’s overall power, as its members’ combined capacity of around 3 million TEUs would not match the capacities of the other container shipping alliances.

Scenario 3: The End of THE Alliance

The third scenario envisions the dissolution of THE Alliance. Given that the largest member of the partnership has chosen to leave, it’s not out of the question that the remaining three members may follow suit. In this case, the three carriers would likely seek to join other alliances, resulting in a complete transformation of the container shipping industry’s landscape and dynamics.

It is worth noting that this scenario is plausible, as the departure of even one of the three remaining lines could compel the others to dissolve the alliance and explore new partnership opportunities.

The Role of Hapag-Lloyd in Gemini Cooperation

Following the announcement of Gemini Cooperation, shipping consultancy firm Linerlytica outlined in a report that Hapag-Lloyd is poised to join the alliance in an “unfavourable position”.

Linerlytica noted that Hapag-Lloyd’s fleet of 1.98 million TEUs, which is less than half of Maersk’s fleet, will potentially diminish the German company’s influence within the alliance.

In response, Hapag-Lloyd emphasised that both companies will not assign their entire fleets to the alliance’s services. According to a company spokesperson, “the new collaboration will comprise a combined fleet pool of around 290 container ships and an overall capacity of 3.4 million TEUs.” Maersk will deploy 60% of the capacity of this cooperation, while Hapag-Lloyd will deploy 40%.

This new network will rely on terminal hubs located in South-East Asia, Middle East, East Mediterranean, West Mediterranean, and North Europe. “These hub terminals are in 10 of 12 cases, owned or controlled by Hapag-Lloyd or Maersk,” said the Hapag-Lloyd spokesperson. “The other two are carefully selected third parties (Singapore and Cartagena) with whom Hapag-Lloyd has established long-standing partnerships.”

Still, a critical challenge for Hapag-Lloyd will be its dependence on the Maersk/APM Terminals global network. The German carrier does not have any major stake in terminals along the main East-West routes. Additionally, its home terminal of Hamburg will only feature in five out of the 26 mainline services, having been excluded from all of the 14 European shuttle services that will connect at the main European hub ports of the Gemini network.

But Hapag-Lloyd doesn’t seem to be worried about this. It seems that, while Maersk might provide more terminal capacity in one area, such as South-East Asia, Hapag-Lloyd will do so in others, such as Europe, by virtue of the more niche yet strategic Damietta or Wilhelmshaven.

Appendix: Container Line Alliances

Container shipping alliances function as strategic partnerships among ocean carriers where the partner lines strategically deploy their vessels on joint services to optimise operational efficiency and enhance global reach. This can offer a strategic advantage to the alliances, among other benefits, which include:

1. Enhancing Reach

Alliance members leverage each other’s existing networks, enabling an expansion of reach that goes beyond individual capacities. The synergies ensure broader coverage and improved access to diverse markets.

2. Fleet Deployment and Transit Time Optimisation

By collaborating, shipping lines enhance fleet deployment efficiency and optimise transit times. This strategic coordination allows for the streamlining of operations, reducing transit times and enhancing overall service reliability – not to mention reducing costs.

3. Risk Mitigation

Investments in large container vessels come with considerable risk. Alliances provide a mechanism to spread and share these risks among partners, mitigating the impact of fluctuations in demand.

4. Capitalising on Expertise

Larger companies within alliances can tap into the specialised knowledge of smaller carriers, particularly in niche routes. Simultaneously, smaller lines benefit by ensuring increased loaded cargo on their vessels, thanks to the expansive clientele provided by their larger partners.

The establishment of new container alliances, as well as the restructuring of existing ones, plays a pivotal role in shaping the dynamics of the industry.