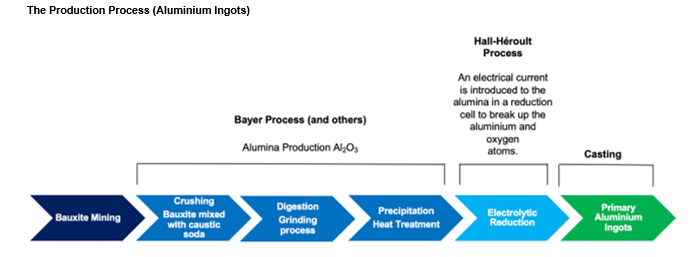

Aluminium Production

- The initial part of the production process to is to produce aluminium ingots.

- Aluminium ingots are a tradeable commodity future on the London Metal Exchange (LME), the New York Mercantile Exchange (COMEX), the Shanghai Futures Exchange (SHFE) and the 2019 addition of aluminium on the Indian Multi Commodity Exchange (MCX).

- The midstream part of the process is to manipulate aluminium into useful shapes and forms as alloys.

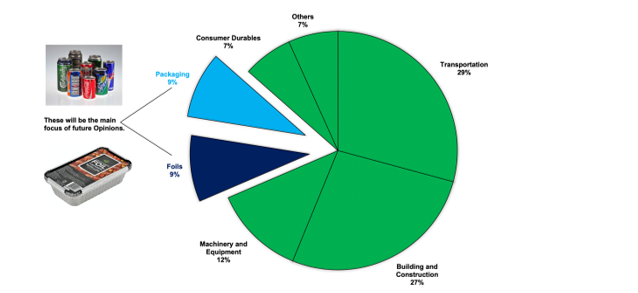

Aluminium’s Main Uses

Aluminium’s uses spread far and wide, but some key examples are as follows…

Foundry Alloys: Automobile industry (e.g. cylinder heads, engine block, bed plates), building (e.g. rod and slab), electrical industry, transportation (e.g. aircraft and rail), cladding.

Extrusion: Shutters, ladders, railings, skylights, windows.

Rolling: Packaging Materials e.g. (trays, foils, cans, bottle caps). consumer durables (e.g. kitchen and cooking appliances), lithographic sheet.

Recycling: this is an important and growing area especially in the canned beverage market. This can save up to 90% of the energy costs (from re-melting) associated with producing new primary aluminium.

We’re interested in is its usage in packaging and foils.

- In 2019, the global aluminium market was estimated to be worth $147 billion and could be worth $190 billion by 2026/27.

- This means the current combined global market for packaging and foils is a substantial $26.5 billion.

- The market abounds with new technologies, from improved carbon emissions, to the combining of aluminium with flexible films to produce lightweight and flexible packages, allowing the contents to expand to the shape of their contents and contract as the product is consumed; think of TV dinners.

- Technologies in pharmaceutical blister packs and foils that can preserve produce without refrigeration are also developing.

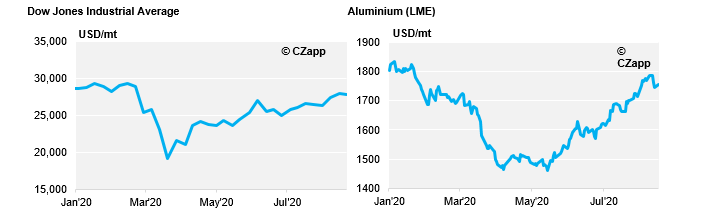

Aluminium’s Price Influencers

- The prices of aluminium ingots and recycled products are dominated by the health of the global economy due to the overweight representation of the transportation, building, and construction sectors.

- This can be seen in the recent overall pricedeclines in aluminium prices as a result of the global contraction from COVID-19.

- It is interesting to note that the aluminium price was a leading indicator compared to the laggard DJIA (Dow Jones Industrial Average) because China was the first country to experience COVID-19.

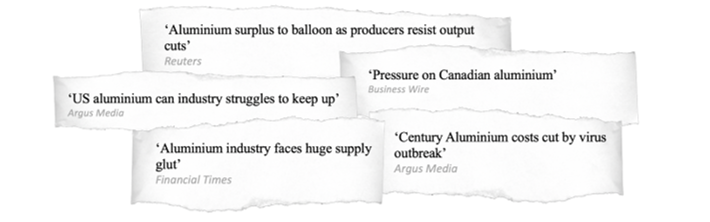

The Volatility of the Aluminium Market

- This is a volatile market with a complex supply chain. In recent months, global supply has been tested by the coronavirus and occasionally broken down.

The aluminium market is also complex because there are regular distortions to trade from both sanctions and tariffs, and in some cases, they can be severe.

1. In October 2020, the US Department of Commerce imposed anti-dumping rates on China, with duty spanning anywhere between 58.51% and 63.47%.

2. Rusal, a major Russian producer spent several years under US sanction for ‘malign activities’ by the Russian Government.

3. The EU filed complaints against US aluminium (and steel) tariffs with the WTO, rejecting the US’ claim that such tariffs were justified on the grounds of ‘national security’.

A further source of volatility is that some of the leading aluminium producers do not operate at maximum capacity.

1. India runs at approximately 91% capacity, China runs at approximately 81% capacity, and the US runs at approximately 60% capacity.

2. This has consequences for employment and indicates one of the reasons the US has been so active in market interventions in recent years.

A Final Example:

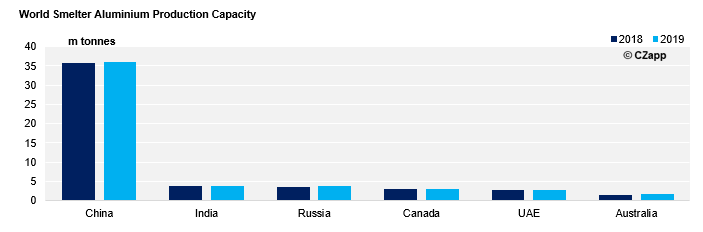

- China is the pre-eminent processor of aluminium products.

- It is important for producers in the derived packaging and foils sector to watch the benchmark primary prices, as it does influence prices in these more specific sectors because the ingots are, for example, rolled into different sheet thicknesses for the production of cans and aluminium foil.

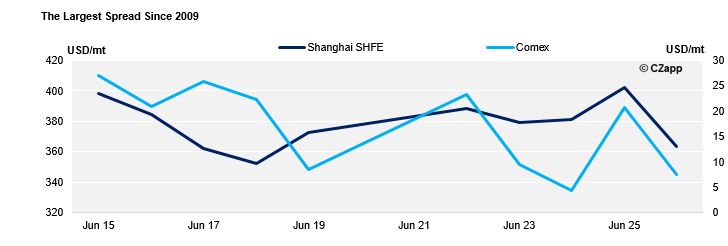

- Also, it is not just the primary aluminium price, but the prices in different markets, as price spreads and associated discounts and premiums in the different global markets and exchanges can fluctuate dramatically.

- Alongside this, a basic knowledge of toll processing fees to produce aluminium sheet is another part of the equation.

The Future of Aluminium

- The future for aluminium is promising because of its ever-improving environmental profile.

- Consensus estimates predict a growth in the Compound Annual Growth Rate (CAGR) of over 3% between 2019 to 2025.

- Growth in some sectors, such as aluminium foils, is expected to be even more dynamic, with a consensus CAGR of over 5%.

- Another important consideration is the origin of the bauxite, alumina and derived primary aluminium as most of its production is in the hands of a few countries and companies.

- Production tends to be concentrated in countries that have competitive electricity prices and, in some cases, fewer environmental protections.

- In forthcoming Opinions, we will examine the relationships between the largest producers in more detail.

- To better understand the premiums and discounts for primary aluminium between different markets, we can look at the unusual situation that is currently occurring in both the Chinese and the Canadian/Midwest markets (at the time of writing).

China

- The Shanghai aluminium futures remain firmly above RMB 13,500 ($1,900) per tonne, compared to the LME price of $1,500, giving rare arbitrage opportunities at a spread of $400.

- Chinese buyers have been scouring overseas markets for imports, as economic stimulus and modest recovery encourages China to resume production, compared to lacklustre markets elsewhere.

- They rarely import primary aluminium (from alumina not scrap), but imports between May and July could exceed 500k tonnes; Russia is likely the main supplier.

- Chinese inventories of aluminium have also increased based on ‘cheap’ foreign supplies.

- Imports for all of 2019 were around 75k tonnes vs. an output of 35m tonnes.

The American Midwest

- Similarly, discussion in the coming weeks will show the American Primary Aluminium Association (APPA) aiming to encourage the Trump Administration to reinstate Canada’s non-duty-free status for entry into the US’ primary aluminium market. This will cause a surge in the Midwest premium over COMEX.

- On 22nd June, Bloomberg reported that the US is considering re-imposing tariffs on Canadian aluminium imports of perhaps 10%.

- The effect would be to drive some Canadian production into Europe through the Rotterdam duty-paid market and putting pressure on prices there.

You might also be interested in …

· July PET Update – Warmer Weather Supports PET Demand