939 words / 6 minute reading time

A Brief Overview

Welcome to the first of a seven-part series that will touch on some key production regions and commodity products in the dairy market. We will start with a brief overview of this writer’s home market, New Zealand.

- New Zealand is largely a pasture-based farming system.

- This means that the cows predominantly live outdoors and are grass-fed.

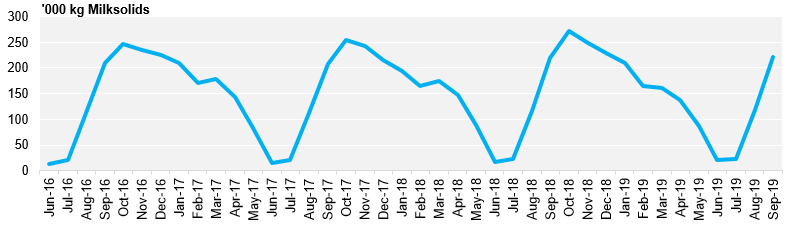

- It also means that milk production is much more seasonal, as farmers generally match their herd to grass production cycles and the seasons.

- Most farms begin calving in July and August, so the milk-flows tend to dramatically rise from this point and usually peak in late October. This dynamic, along with the Southern Hemisphere’s opposite seasons, means that New Zealand’s supply and demand outlook is a major factor in dictating global prices from October to April.

New Zealand Milk Production

The North and South Islands

- New Zealand is split into two islands; the North Island and the South Island.

- The North Island homes 72% of New Zealand’s herds. However, the herds here are typically smaller, with the total milk solids collected being 56% of the nation’s total.

- Waikato (27% of nations milking cows), Taranaki (10%), Bay of Plenty (7%) and Northland (6%) are the key regions on the North Island; all are very susceptible to weather as the grass is less irrigated.

- The South Island has seen a huge conversion to dairy farming from sheep, beef, and cropping. It is also home to many larger corporate-style farming operations.

- Canterbury (19%) in particular has immense irrigation schemes which insulate it from dry conditions that can quickly bite with its porous soil structure.

- The other key region in the South Island is Southland (12%).

Map of Key Regions with % of Nations Milking Cows

Weather

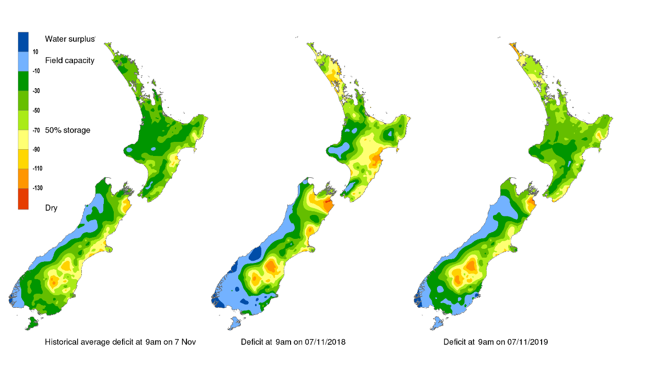

- Southern hemisphere springtime conditions dictate the peak milk flow in late October and crucially set up the soil moisture for the upcoming summer.

- Milk production increases at a slower rate if the cows are too cold or if the spring is either too dry or extremely wet.

- Therefore, this period has a fine balance, with steady rain and warmer temperatures being optimal.

- Summer is where the weather volatility exists, which can materially impact soils, pastures and thus milk flows; this is particularly prevalent in the North Island.

- At present, soil moisture is healthy in most of the key regions, with the exception of Northland, which is slightly drier than usual. This health is of particular importance given the depth of dryness at the end of last season which, if not replenished, could have been a risk to grass growth and thus milk flows this season.

Map of New Zealand’s Soil Moisture (as of 07/11/19)

- NZ National Institute of Water and Atmospheric Research’s three month weather forecast increases the likelihood of temperatures being above average, with soil therefore being drier in Waikato, Bay of Plenty, and Northland. This is countered by the likelihood of warmer and wetter conditions in the remaining key dairy regions.

- New Zealand’s milk collections are dominated by Fonterra, collecting 81% of the country’s milk solids in September 2019.

- The companies’ assets are fully utilised at the peak collection point in the season but allow for substantial optimisation at other times.

- The key variables are the value of product streams and the cost of geographical milk moves.

- There are five other processors who account for the bulk of the remaining solids collected, with varying focuses on commodity and niche products and their abilities to optimise. Their commodity products can be impactful to the marginal sale from New Zealand and thus market price. At this early stage of the season, all parties are believed to have firm order books keeping available stocks tight.

Exports

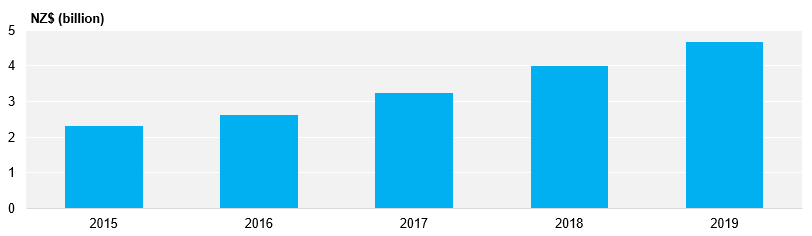

- NZ’s largest dairy export is whole milk powder (WMP), with over 1mmt usually being exported each year.

- Exports of WMP to China more than doubled, to 30,600 m tonnes, in September.

- Other key export products for New Zealand are Skim Milk Powder (SMP), Anhydrous Milk Fat (AMF), butter, and cheese. As the world’s largest exporter of dairy products, New Zealand has strong trade relations with many countries; China accounts for roughly one quarter of exports by value and volume.

New Zealand’s Monthly Dairy Exports to China

- Global Dairy Trade (GDT) is a fortnightly auction where dairy producers from around the world can offer fixed supplies of product in an ascending-price clock auction. It sets benchmark FAS (Free Alongside Shipping) prices for NZ products and is increasingly impactful to globally traded prices.

- The index moved higher again at the most recent event, continuing a strong run. Key product WMP prices were up 3.6% vs. last event, possibly driven by a large increase in Middle Eastern demand. The forward curve did not steepen as much as expected though, watch for the deferred contracts (where weather risk exists) to begin developing more of a premium.

- SMP continues its strong run with order books in NZ and Europe firm and demand apparently solid.

- Cheddar continues to miss, while the US market is priced substantially higher, potentially due to cheap products being pushed out of Europe. As fixed term contracts roll off, expect demand for relatively cheaper NZ supply to pick up (this is urgently necessary to attract milk to cheese production).

- WMP is currently yielding ~100c per kg of milk solids more than cheddar based on prices at the last GDT. Cheddar prices would therefore need to increase to $4,300 USD/mt to ensure greater production from milk solids.

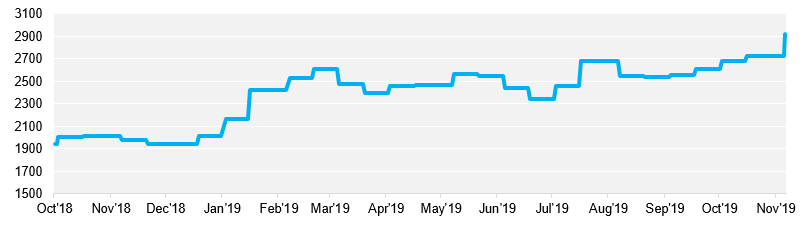

GDT SMP Medium Heat C2 Index Rally Over the Past Year