Insight Focus

- German milk production falls on rising input costs, low-quality silage, focus on animal welfare.

- New Zealand’s farmers are battling unfavorable weather after a strong 2021.

- US milk production was lower again in February, contrary to market expectations.

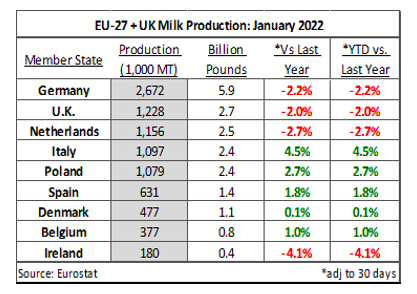

European Union

Despite a temporary lift in milk collections last May, Germany has recorded strong losses over prior year for 15 of the past 16 months as rising input costs, low-quality silage and a focus on animal welfare all contribute to lower output from the country.

Starting in April, there will be a new labeling standard for refrigerated dairy products that states the product came from a dairy farm that adheres to animal welfare standards initiated by QMilch advisory board.

The Netherlands continues to experience a reduction in milk, which will be intact for the foreseeable future as the Dutch government focuses on reducing their carbon footprint through their 13-year multibillion-euro plan that includes paying Dutch livestock farmers to relocate or exit the business. Ultimately, they proposed a 30% reduction in the dairy herd by 2030.

Poland continues to see expansion in its domestic milk production but, with the exception of a small increase in SMP in January, cheese, butterfat and WMP all recorded lower productivity than a year ago. Poland’s largest export has been fluid milk & cream by volume and China is the largest customer, reaching record levels in 2021, so perhaps that’s where excess milk is flowing. Ireland’s January milk production losses were the steepest since December 2019 as they fell 7.77k tonnes year on year to the weakest January figure observed in four years. Ireland relies heavily on imported fertiliser and feed from the Black Sea region where conflict ensues, and milk production will have a difficult time throughout their peak production months in Q2 as a result.

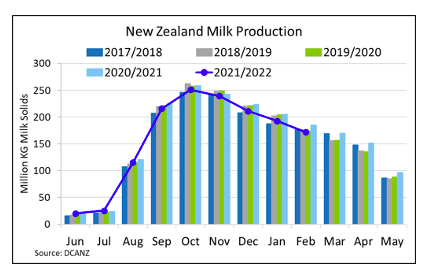

New Zealand

The streak continued for the seventh month as negative milk collections remain intact into the end of the season. Farmers remained challenged by unfavorable weather conditions against what was a great prior year, which will mean negative milk productivity throughout the end of the current season despite a record payout.

Farmers in the Waikato report that grass growth is extremely limited, and they’re starting to dry off herds while feeding out maize. Though into this week, heavy rain warnings were in place for Waikato, Bay of Plenty and Gisborne. This will be welcome moisture for the next season but there remain limited growth expectations over the next couple months with these recent rains. Even though grass growth has been good in Canterbury, milk production is still struggling against prior year levels. Conditions are very dry across the Southland region and have reached a critical juncture in western and southern areas. Winter crops are struggling, and grass growth is slow. Taranaki producers report that the region is still looking good, but dryness is increasing in the northern region.

Short milk supplies on a global scale continue to underpin historically strong dairy prices. Much like the US and Europe, New Zealand is not tipped to record improved milk collections any time soon. The country has been at peak milk for some time now so the growth will need to be a result of yield growth. Without favorable weather and heading into next season potentially short on feed (also on a global scale due to the Eastern European conflict and high input costs), the milk price outlook for 2022/23 still looks strong. It would likely be a shift in demand that puts pressure on markets before a supply response is anticipated, but there’s not been any evidence yet that key dairy importers are pushing back on current price levels.

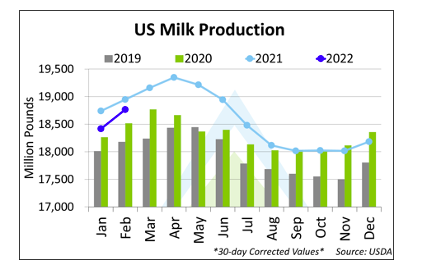

United States

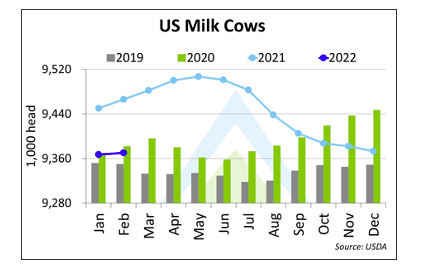

Milk production was weaker yet again in February, an expected result that is neutral versus market expectations. HighGround had expected a February milk output decline of 0.9% versus the prior year, with the realised 1% drop in the month on par with anecdotal evidence that showed milk remained weaker versus prior year levels in many parts of the country into late winter. The sharply lower herd size remains a key driver of lower production; however, the herd increased versus the prior month in February to mark the first monthly build since May 2021 after eight consecutive months of declines.

While cow numbers grew just a negligible 3,000 head, the departure from recent trend was driven by sharply higher milk prices in recent months that have some farmers looking to increase milk output to drive incremental profitability. The desire to build cows is in sharp conflict with a vastly increased cost of production, though, meaning any decision to increase cow numbers is a carefully executed strategic decision balanced against steep feed and other costs that have cut into margins that would usually be expected with the current Class III and Class IV milk values.

There are many factors impacting milk production currently, with trends in the coming weeks critical for when output will return to growth in the US. While high milk prices would seemingly, at the surface, incentivise a quick return to growth, farmers remain cautious about feed, energy, labor, and other costs that have grown sharply. HighGround forecasts that show milk production will be ABOVE prior year throughout the entire second half of 2022, with total calendar year production up 0.3% this year.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial

Other Insights That May Be of Interest…

Brazil and USA to Boost Fertiliser Output on Russian Invasion

Will Mexico Become a Regular World Market Sugar Exporter?

Explainers That May Be of Interest…