A Quick Overview

As agricultural dry bulk commodity exports took a dive Q1’20 and painted a gloomy picture for Panamax and Handymax freight rates, a stunning second-quarter comeback has nearly tripled freight rates.

While total agricultural export volumes are now solidly up in the first half of the year, they are not mind-blowingly high, and export volumes in the first quarter of 2020 certainly offered little help. A significant rise in demand for shipping and a boost in exports in April, May and June on the other hand, has saved the day for Panamax and Handymax freight rates. So much so that freight rates have jumped from USD 5,000 per day to USD 10,000-13,000 per day by 26 August. The rates bottomed out in mid-May and have been supported by South American grain exports heading into Asia since then.

Q2 Agricultural Exports Up 22% Year-on-Year

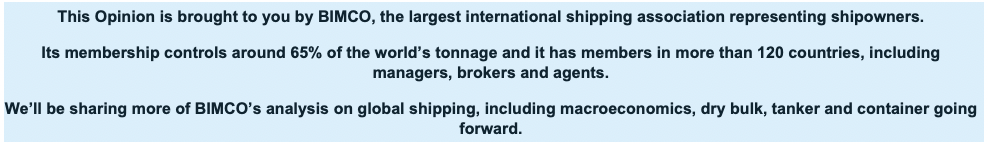

Combined agricultural export volumes from the US, Argentina and Brazil rose to 148.6m tonnes in the first half of 2020, from 136.8m tonnes in the first six months of 2019. The rise was fuelled by strong Brazilian soya bean exports which drove total agricultural exports out of Brazil up by 40% in the second quarter compared with the same period last year.

This stunning comeback in Q2 replaces weak exports in Q1, which were hit by a 15% drop in US exports, primarily as a result of declining soya bean exports. The first quarter saw this high-volume commodity falling the most, as exports were 2.4m tonnes (-20%) lower this year than in the first three months of 2019.

US coarse grains and wheat exports fell by 13% and 11% respectively, losing a combined 2 million tonnes. As total exports declined by 4.4m tonnes, 59 Panamax loads (75,000 tonnes) were lost.

“As the COVID-19 pandemic took hold, it was clear that seaborne exports of agriculture bulks were this year’s wild card, the one that could grow, whereas the rest of the commodities were bound to fall,” says Peter Sand, BIMCO’s Chief Shipping Analyst and continues:

“As the main exporters in the western hemisphere were able to ship 22% more agricultural goods in Q2 this year than in the previous quarter, much of it long-haul, charterers ran down tonnage lists and drove up freight rates.”

“If exports of soya beans and corn from the US are strong from the beginning of the new marketing year, we will see healthy support for the dry bulk market from 1 September,” Sand says.

Argentinian exports were steadier, rising in both quarters dominated by wheat exports in Q1. The country’s export of wheat rose by 2m tonnes – a 38% rise – while coarse grains rose by 1.6m tonnes in June alone. Both commodity groups saw high volumes exported to Asia, with 41% of the wheat and 33% of the total coarse grain exports heading for the Far East.

US Agricultural Exports Move Towards Corn

Looking at the three large exporters of agricultural dry bulks in the Western Hemisphere (Brazil, US and Argentina), a change was noticed in terms of the type of commodity exported by the US and when.

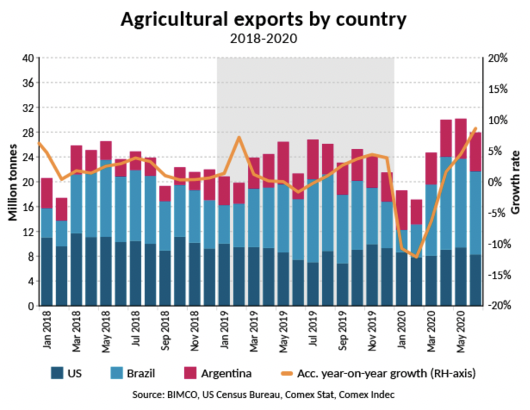

The main commodity moving up the US coarse grains exports was certainly corn. With 21.9m tonnes exported in the first half of the year, corn accounted for 87.7% of total coarse grain exports. In a distant second place was grain sorghum with a 12.2% share. So far this year, 24.9m tonnes of coarse grains have been exported, accounting for 49% of total US agricultural exports.

Mirroring the general picture, Q1 of 2020 was marked by slow exports from the US to Asia. During Q2 however, 6.4m tonnes of corn were exported, a 24% rise from the first three months of the year.

The other major agricultural exporters, Brazil and Argentina, have not seen significant changes in terms of the split between commodities exported. Soya beans continue to dominate Brazil’s agricultural exports, while in Argentina, coarse grains maintain the largest share of the total volumes.

US Soya Bean Exports to Asia Drop One Third in the 1H’20

The US exported far fewer soya beans to Asia in the first six months of 2020 year-on-year. A total of 9 million tonnes were exported in the first half of the year, a 33% fall compared with 13.7 million tonnes in the first half of 2019.

Despite the solid January volumes, soya beans took only a 29% share of total agricultural exports out of the US in the first half of 2020.

Soya bean volumes have seen a plain drop, particularly in the second part of Q2, which was exacerbated by the deteriorating geopolitical environment. However, in addition to this, low volumes can be attributed to seasonality, as the marketing year for soya beans ends on 31 August.

The geopolitical conditions clearly paved the way for Brazil to take the lead, exporting37.6 million tonnes of soya beans in the second quarter of 2020.

“As the North American agricultural exports season is about to kick in, all eyes will be on US exports of soya beans from day one,” according to Sand.

“After falling three marketing years in a row – from 2016/17 to a depressing low point in the just ended 2019/2020 season – the 2020/21 season may finally see higher exports,” Sand says.

Other Opinions You Might Be Interested In…