Insight Focus

- China exported a record amount of PET in Q4’21.

- European PET imports were hit by shipping problems.

- US PET imports were strong due to previous factory outages.

China’s Bottle-Grade PET Resin Market

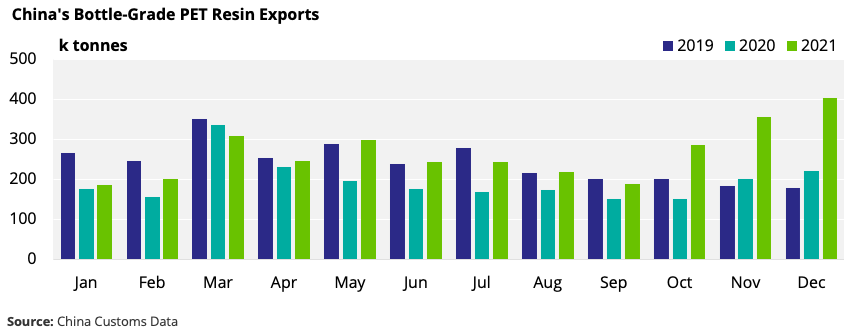

Monthly Exports

- China’s bottle-grade PET exports hit 403k tonnes in December, up 13% month on month, and 83% year on year.

- Its PET resin exports reached a record high in December, with 12 countries each importing more than 10k tonnes.

- Traditional destinations, such as Russia, Indonesia, and Uzbekistan, were overtaken by Latin America after production outages tightened regional supply, including Indorama’s fire at its plant in Brazil. (See previous report Production Outages Harm Americas’ PET Supply)

- Flows to Turkey and Tanzania also leapt, with monthly volumes of over 20k tonnes each.

- Large breakbulk cargoes are responsible for some of these swings; volumes may average out over the coming quarter with fewer smaller shipments.

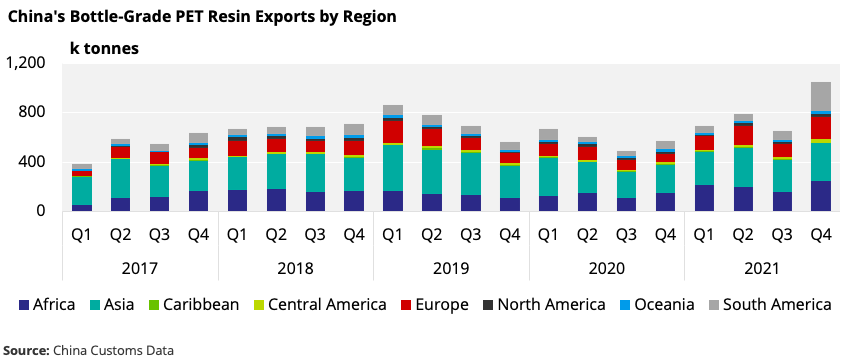

Quarterly Exports

- By region, South America experienced the largest increase in Chinese exports, taking over 233k tonnes in Q4, up 225% from Q3.

- Chile, Peru, and Colombia were the largest contributors to this increase.

- Exports to African destinations, particularly Kenya and Tanzania, also grew a steep 56% from Q3, to almost 250 kt.

- Russia led gains to Europe and was the largest export destination for Chinese PET resin in Q4’21. Exports totalled nearly 90k tonnes, up 94% from Q3

- Chinese PET resin export orders neared 400k tonnes in February, as they did in January.

- This follows on from record orders of around 1.08m tonnes in Q4’21.

- January and February data (released in mid-March) should show sustained, high shipments through Q1 as a result.

- However, fallout from the Russian invasion of Ukraine could dent future orders for Chinese PET resin.

The EU’s Bottle-Grade PET Resin Market

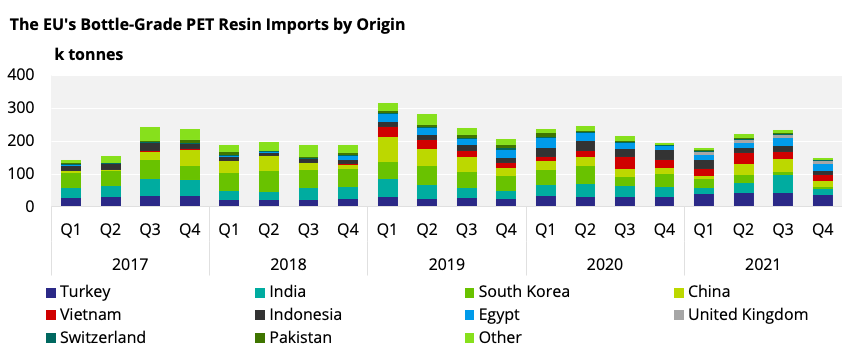

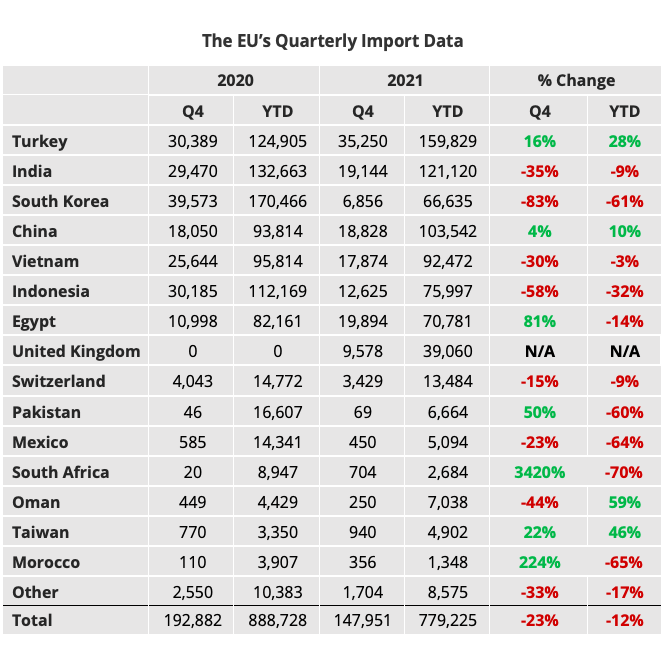

Quarterly Imports

- EU-27 bottle-grade PET imports totalled 148k tonnes in Q4’21, down 36% from Q3 and 23% year on year.

- Those exporting countries on the periphery of Europe were the largest sources.

- Turkey was the main supplier in Q4 (just over 35k tonnes) followed by Egypt (around 20k tonnes).

- They supplied 15% and 13% less on the quarter, respectively.

- India, China, Vietnam, and Indonesia were the major sources of material from Asia, but their volumes slumped 20-65%.

- South Korea’s continued low contribution was noticeable, with volumes down 36% on Q3 and 83% year on year.

- At present, Europe awaits significant imports volumes already shipped by Asian producers and due for arrival in Q1 2022.

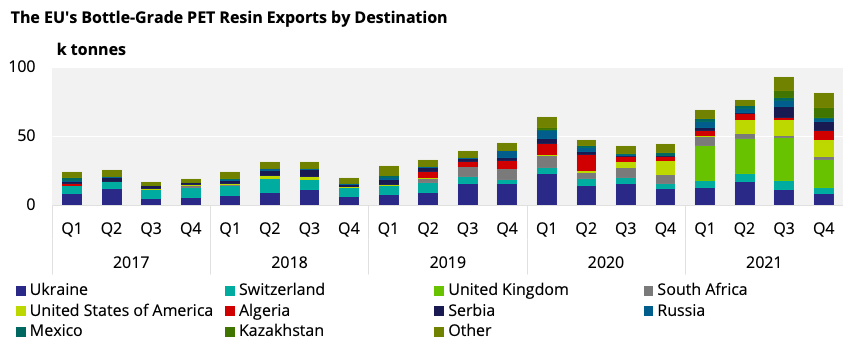

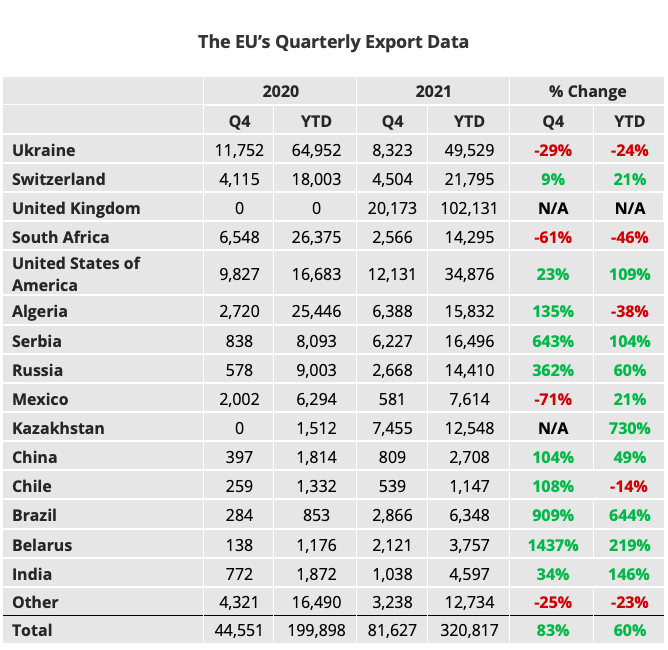

Quarterly Exports

- Despite a tight domestic market, EU-27 PET resin exports held close to Q4’s record high.

- UK and EU exports totalled around 82k tonnes in Q4’21, down 12% on Q3.

- Q4 exports to the US grew 3% on the quarter, and 23% on the year on supply constraints across the Americas.

- Exports to Brazil, although modest in volume (2.8k tonnes for Q4), were up by over tenfold year-on-year.

- Within Europe, exports to the UK decreased by 3.5% to 20k tonnes in Q4 as seasonal domestic demand weakened.

- Volumes to Ukraine fell 2.7% on Q3, but 29% down year-on-year, in the run up to the Russian invasion of the country.

US Bottle-Grade PET Resin Market

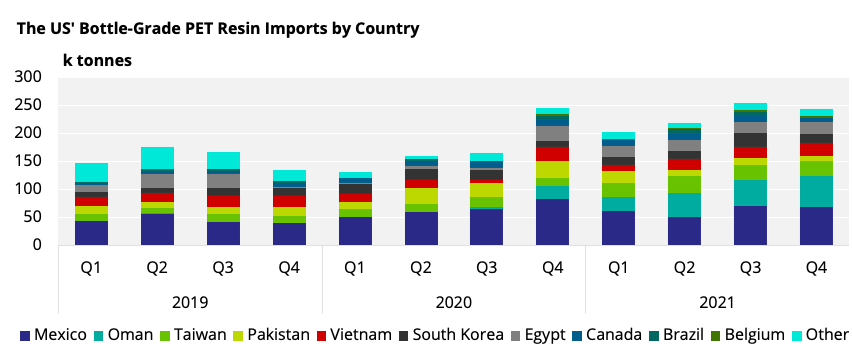

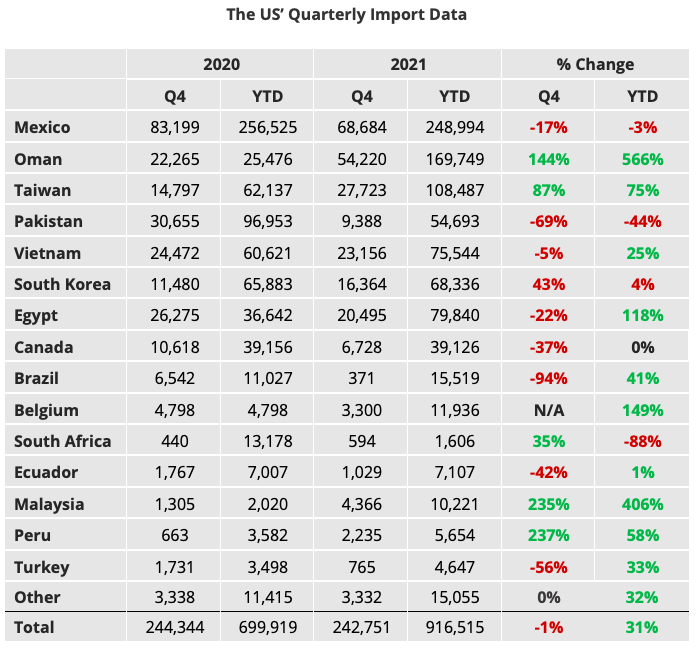

Quarterly Imports

- US bottle-grade PET imports totalled 273k tonnes in Q4’21, down 4.6% on the previous quarter and 1% year on year.

- Despite this, Q4 imports remained well above historical levels due to supply constraints caused by previous outages across the Americas, which resulted in low inventories.

- Origins with the greatest volumes (all above 20k tonnes) include Mexico, Oman, Taiwan, Vietnam and Egypt.

- Oman was the second-largest source of imports after traditional flows from Mexico, accounting for over 54k tonnes, up 13% on the previous quarter and 144% year on year.

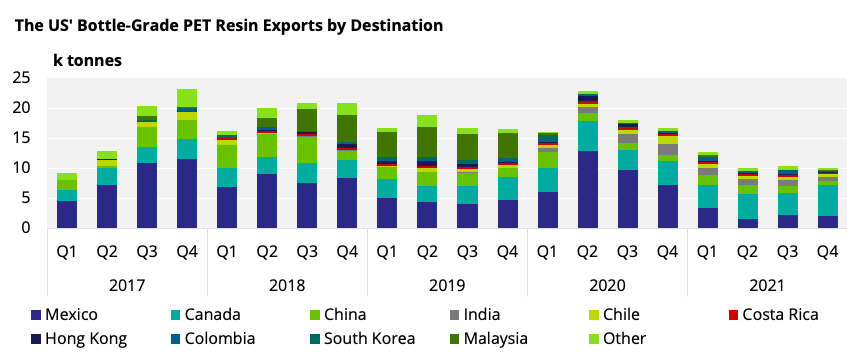

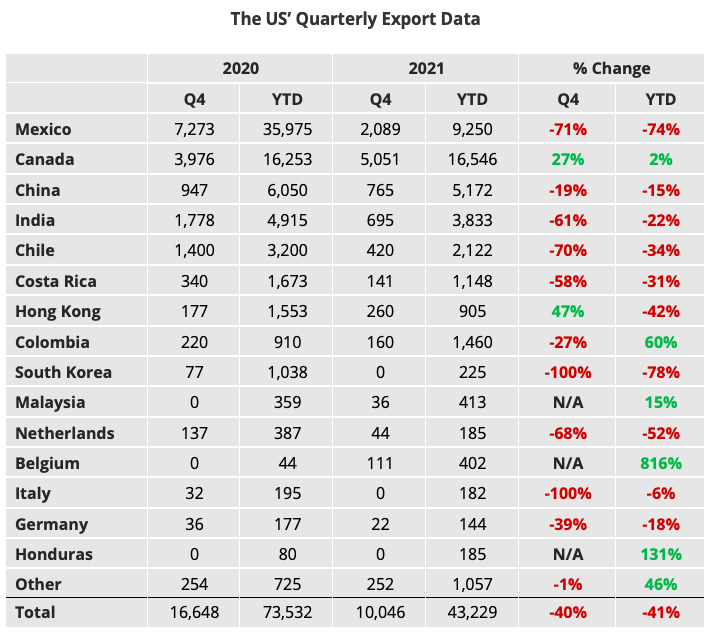

Quarterly Exports

- US bottle-grade PET exports totalled just 10k tonnes in Q4’21, down 3.4% on the previous quarter and 40% year on year.

- As is traditional, over 71% of the total export volume remained with North America with Canada the largest destination, followed by Mexico, with 5k tonnes and 2k tonnes in Q4 respectively.

- Given the continued supply constraints throughout the region, exports should remain subdued into the next quarter.

If you have any questions, please get in touch with us at GLamb@czarnikow.com

Other Insights That May Be of Interest…

What the Ukraine Crisis Means for PET