A New Year, a New Dairy Series

- Welcome to Czapp’s latest dairy instalment, a three-part series on some of the important tenders run in the dairy market.

- I thought this would be an interesting topic to cover, given the mechanics are often not well publicised and many people ask about them.

- We will begin with Cuba (Alimport), then move to Vietnam (Vinamilk), finishing with Algeria (ONIL) the largest tender, whilst briefly touching on some of the others as well.

Cuba (Empresa Cubana Importadora Alimentos – “Alimport”)

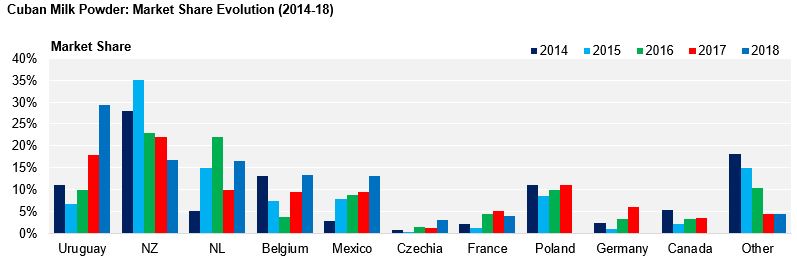

The local dairy herd in Cuba produces roughly 50% of the country’s dairy needs, supplying fresh milk to the domestic population. However, nearly all manufactured dairy products are imported, with Whole Milk Powder (WMP) and Skimmed Milk Powder (SMP) accounting for over 90% of all imports. Additional liquid milk demand that is not supplied locally is reconstituted from milk powder imports. Typical suppliers are the EU (37%), Uruguay (29%), and New Zealand (17%); Uruguay have increased their supply in recent years, displacing New Zealand, after establishing friendlier trade relations with Cuba. Other common flows come in from Canada and Mexico (who had 13% share of powders imports in 2018 – the sharp increase could possibly be NFDM re-exported from the USA).

Alimport is a state-owned company in Cuba which was established in 1962. It has a broad remit, tasked with running all foreign trade operations related to the import and export of foodstuffs and raw materials for the food industry in Cuba. Alimport account for approximately 95% of all agricultural imports into the country.

Alimport dairy tenders are typically for 8-25k tonnes of WMP and SMP. The trade will typically have some forewarning of their release and then the formal tender process usually lasts for two weeks, but can at times run for four weeks depending on the schedule of the decision-making committee who must meet to discuss the purchase. To participate in food tenders, suppliers must have registered the required documents and must also have their products registered (including technical approval).

The purchasing committee often take a risk-averse approach for their $130m+ USD spend on dairy. They will almost always award volume to a geographically diverse group of suppliers, provided prices are not extreme from a given location.