390 words / 2 minute reading time

In this unprecedented coronavirus crisis, the world of molasses is continuing to tick along with ports open and demand from the animal feed sector providing a continuing source of demand.

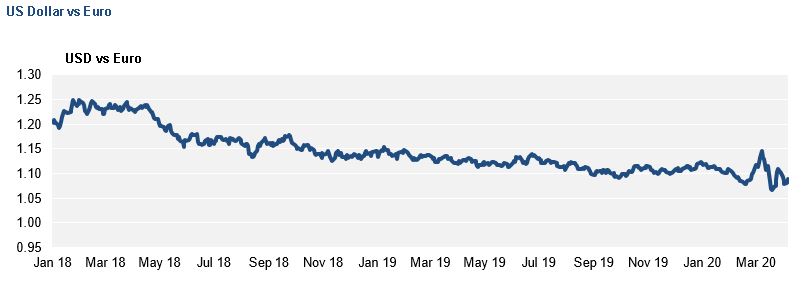

In Europe the majority of cane molasses demand is from the animal feed sector and terminals have remained open to supply molasses to the feed industry across Europe. Prices are still quite high in local currency terms with the Euro and Sterling continuing to be weak vs. the US Dollar.

Industrial and fermentation demand in Europe for cane molasses has been tracking at lower levels in recent years due to substitution for cheaper beet molasses, therefore we have seen little impact so far in this sector.

Beet molasses is on the whole much quieter, with the market looking towards new-crop projections for EU and Russian harvests from September onwards.

Asia is a much more volatile picture feeling the impact of the crash in crude oil and ethanol prices. Ethanol demand is more important in Asia in terms of domestic fuel ethanol production and imports for potable alcohol production. What happens over the next few months is not clear; we have seen an extremely volatile crude oil price – moving

double-digit percentages in a day. Over the next few weeks we will hopefully get a better view on how the market will develop and the trajectory of demand in the region.

In the Americas region we continue to see the general tightness in supply of cane molasses drive CIF values higher across North America and the Caribbean. This tightness will persist until new-crop Central American becomes available from late-November onwards.

The specialised tanker freight market continues to send mixed messages and present some big challenges. The impact of coronavirus has the potential to slow down international logistics, with justified concerns about vessels being caught in quarantine and ports being shut at short notice. It is impossible to make any firm predictions, but we can see that molasses is still being loaded and vessels are shipping cargo in all important molasses markets, therefore supply chains are still ok at present.

Over the next few weeks we can provide some more guidance on EU sugar beet crop projections and how Asian demand for cane molasses develops.