1378 words / 7 minute reading time

We’ve Teamed up With UM Group!

- We’re delighted to have teamed up with UM Group, specialists in global trading, marketing of molasses and related products, as well as the storage of bulk liquids.

- With their expertise now on-hand, we are going to be offering a range of molasses analysis.

- Every fortnight, we’ll be publishing their latest commentary on Czapp.

Maharashtrian Cane Molasses Export Ban

On the 27th December 2019, the State of Maharashtra announced an immediate ban on cane molasses exports until September 2020. This was unforeseen and definitely caught the molasses industry by surprise. The direct and immediate impact was to remove up to 350k tonnes of potential cane molasses from the international market. In context, this is around 10% of the total globally-traded cane molasses by sea. In our December report, we had made the statement that the market will need to see Indian cane molasses available to keep prices in check. With the ban in place, Indian exports will fall 50% compared to 2019.

Thai Cane Crop Worse Than Expected

United Molasses (UM) had expected the Thai cane crop to be smaller than that of 2019, especially as 2019 was almost a record year with 130m tonnes of cane crushed. In the end, the crop is much lower than forecast at under 85m tonnes, with the effect of the drought more severe than we had anticipated. This will see molasses production fall to under 4m tonnes and limit exports onto the world market. The fall in exports year-on-year (YoY) will be 400k tonnes. In combination with the Maharashtra export ban, around 750k tonnes of molasses have been removed from the global cane market.

IMO 2020 Regulations

Freight rates were expected to be more volatile as regulations placed a cap on vessels’ sulphur oxide emissions and thus owners faced an increase in bunker costs and uncertainty surrounding the supply of compliant fuel (VLSFO). Freight levels were much stronger in late December and into January as bunker costs were higher than forecast, which owners were able to pass on in a strong winter market with increased demand for freight.

The market has cooled somewhat in recent weeks. The development of the coronavirus is likely to shape the direction of freight rates in the coming months with multiple factors intersecting; oil prices, bunker prices, Chinese demand, global GDP, possible quarantine and the supply of vessels. With this level of uncertainty, it is difficult to offer any forward guidance on the freight market; we will be watching things closely.

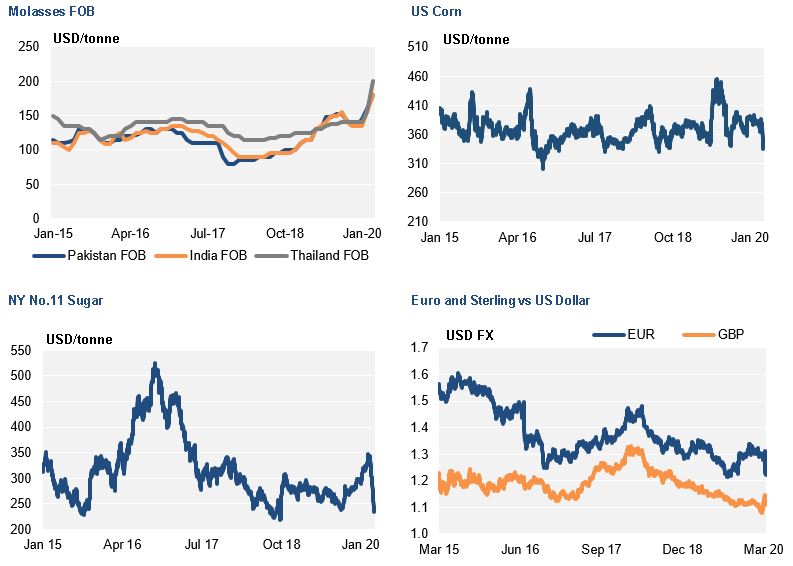

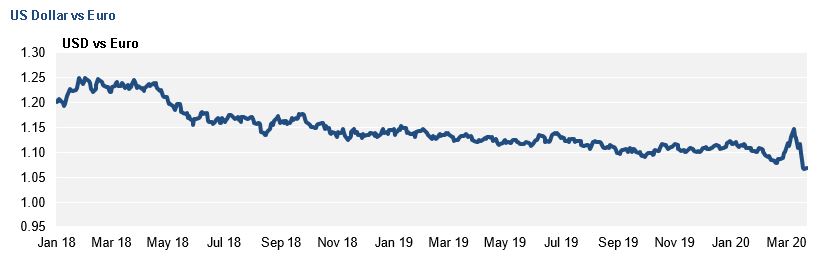

FX Rates – Coronavirus Drive to Safety

The Euro vs. the Dollar is now trading at its lowest level in almost three years; we face a combination of the continuing weak Eurozone area, strong US Dollar and a drive to safe havens as the impact of the coronavirus on the global economy is seen. Sterling has also crashed to multi-year lows, with the recent falls reversing the slow improvement in rates over the last six months. Traditional safe havens in a time of crisis will see the US Dollar, Yen and Swiss Franc strengthen. It is difficult to predict anything else in the current volatile markets!

Beet Molasses – Egypt Will Be the Primary Supplier For the Next Six Months.

The European and Russian beet crops proceeded as expected with the European crops down slightly YoY and the Russian crop was good.

The US beet crop was as poor as expected and we have seen an increase in beet molasses imports into North America, and in addition, at least one cargo of beet molasses imported in the US Gulf. Poland has been the primary source of beet molasses for North America, however, with a disappointing crop in Poland, further exports from this crop may be limited.

The focus will now switch to Egypt with up to 300k tonnes of beet molasses available from mid-March until October. The first tenders have taken place and prices are around $30 / mt higher than they were in 2019. This is due to the higher cane molasses price the reaction to the slightly lower EU beet crops and molasses availability.

Looking ahead to the new crop beet in Europe, it is too early to make any projections. The weather conditions were the main driver of the lower beet crop in 2019, and we will have to watch this season closely. World and European sugar prices have now recovered from the lows in 2018 as the global sugar market has flipped into deficit, which may create an incentive to plant more beet. We will be watching forecasts closely!

The Impact on European and Asian markets – Demand Under Pressure

Higher cane molasses will place pressure on demand across Europe and Asia, especially when combined with weaker FX rates. Prices for competing commodities in the feed sector have not been nearly as volatile as molasses prices, with the exception of sugar, which is relevant for the industrial sector.

One area to monitor closely will be the possible increase in substitution of beet molasses for cane molasses in European feed markets, with the potential reduced supply and higher prices of cane molasses encouraging more beet into the feed sector. This is just a continuation of the existing trend in Continental Europe, where countries such

as Belgium, the Netherlands and Germany have transitioned over the last decade to a primarily beet molasses based feed market at the expense of cane molasses.

Another important factor is the potential impact of the coronavirus on Asian economies. In addition to mainland China, the economic impact may be felt across South-East Asia, as supply chains are affected and economic activity slows. This could eventually affect the demand for molasses across the region for animal feed and ethanol.

Summary

The phrase “a week is long time in politics” could be substituted for “a month is long time in molasses”. If we were writing this report a month ago we would still be confident about Thai and Indian exports, no one had heard of the coronavirus and the US and China seemed to have concluded the first round of their trade war. Things are very different now, with the supply of cane molasses a concern and the potential human and economic impacts from the coronavirus.

With the smaller than expected Thai sugar crop and the ban on molasses exports from Maharashtra, supply will be the biggest challenge in the cane molasses market. The fall in exports from just those two origins is around 750k tonnes compared to 2019; this will definitely place strain on alternative supply sources.

The short-term impact has been an increase in molasses prices across the board. As we enter into the off-crop period in the Northern Hemisphere, the stresses on supply will possibly increase further until the end of the year. In the middle of the year, the crush will start in Indonesia and Australia, although the dry weather and bush fires in Australia will impact their cane crop.

The market for specialised tankers has cooled somewhat from the volatility at the turn of the year.

The world economic picture is most definitely less clear than it seemed. The impact of the coronavirus, not just in China, but on global supply chains will have to be monitored closely. The consequences for FX rates may be a stronger US Dollar as investors move to safety.

The availability of beet molasses will be stable and supported by consistent exports from Egypt from mid-March onwards. At this stage of the year, it is difficult to make any projections about the crop later this year; weather plays such an important role in EU sugar and molasses yields. There is an incentive to keep planted areas at least stable, or to maybe even increase them, with the EU sugar price back at a sustainable level for the most efficient producers in the EU.

When we release our next report in May, we will be able to take a stance on the imminent Australian and Indonesia cane crops. We will also have forecasts for the planted area of sugar beet in Europe, and the trajectory and impact of the coronavirus, both on the economy and the human race, will be clearer.