Opinions Focus

- New Zealand whole milk powder exports to Southeast Asia lead way.

- Anhydrous milkfat exports also impressive.

- European exports to China struggle.

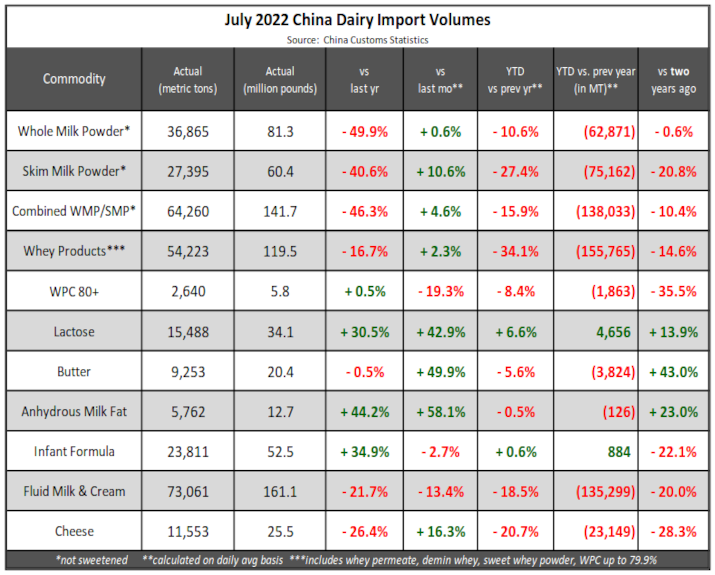

China

The stronger imports from the US were in the form of lactose and whey products. July lactose imports from the US hit an all-time high of 12,673MT (+60% YoY), which pushed total volumes to a record as well. Whey imports from the US were the highest since May 2018 (32,149MT, +6% YoY). Total dairy import volumes from Europe (EU-27+UK) struggled the most versus a year ago due to reduced imports of fluid milk & cream (40,780MT, -37% YoY) from the region. Skim milk powder imports were also notably lower at just 7,723MT (-61% YoY). Anhydrous milkfat (AMF) imports were the strongest since April 2021 as China takes advantage of the discounted fat from New Zealand. Imports from New Zealand reached 5,582MT, UP 1,998MT or 56% from one year ago. Whole milk powder (WMP) volumes were the lowest for July since 2016 as imports from New Zealand halved from a year ago. Losses were also observed from Australia, Uruguay and Europe. Trade with Australia reached six-month highs as China brought in higher levels of fluid milk & cream from the country (12,157MT, +51% YoY). Skim milk powder (SMP) imports also recorded growth from prior year, UP 42% to 5,530MT.

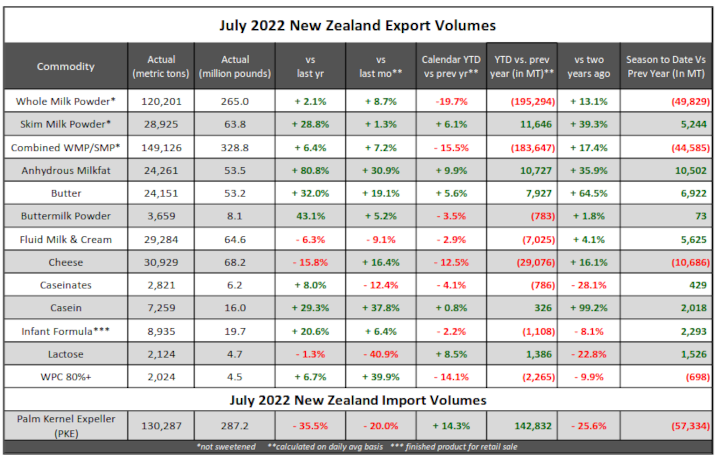

New Zealand

Whole milk powder (WMP) exports increased over prior year for the first time since last December, increasing 2,528MT YoY but not because of growth into China. WMP growth was ultimately observed into Southeast Asia and Algeria. Strong trade with Southeast Asia echoes Global Dairy Trade behavior throughout 2022. Anhydrous milkfat (AMF) shipments were impressive, the strongest since October 2016 with record volume sailing to China during the month. AMF moving to Mexico was the strongest since January 2017. NZ-sourced AMF is a value buy against global butterfat suppliers. July skim milk powder (SMP) volumes were the strongest for the month since 2019 with a jump in exports to China. Shipments to Southeast Asia recorded similar growth with losses focused on the Middle East.

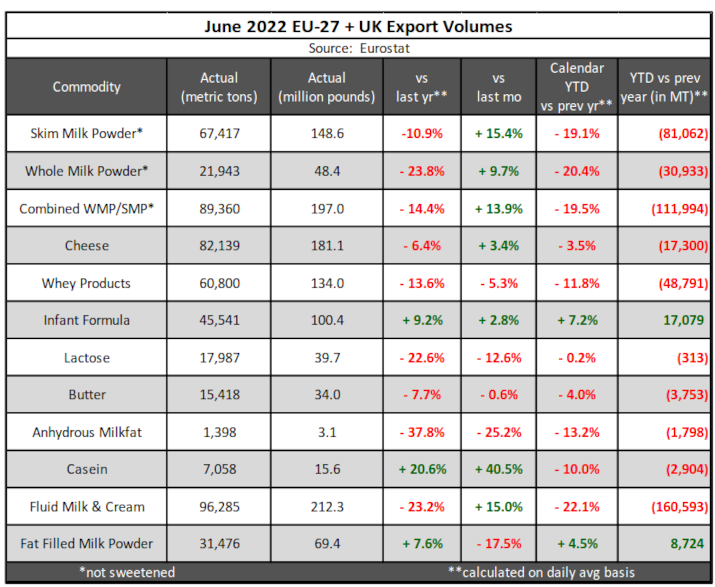

EU27+UK

Fluid milk & cream shipments experienced the steepest losses from prior year, falling 29,166MT YoY as volume to China dropped significantly. The EU exported 42,694MT of fluid milk to China, a loss of 28,535MT or 40% from a year ago. Weaker shipments to China have been evident all quarter with Q2 volumes the lowest since Q4 2018. Skim milk powder (SMP) losses continue but shipments have improved slightly into June, reaching 10- month highs. It is worth noting that volumes were strong into Libya (2,014MT, +1,514MT YoY), Morocco (1,586MT, +1,092MT YoY) and Kenya (1,060MT, +1,060MT YoY). Casein volumes were impressive, increasing due to demand from the US and Mexico. The EU sent 1,802MT to Mexico, an all-time high into the country and UP 65% from prior year. The US remained the top destination with shipments reaching 2,357MT, UP 22% from a year ago.

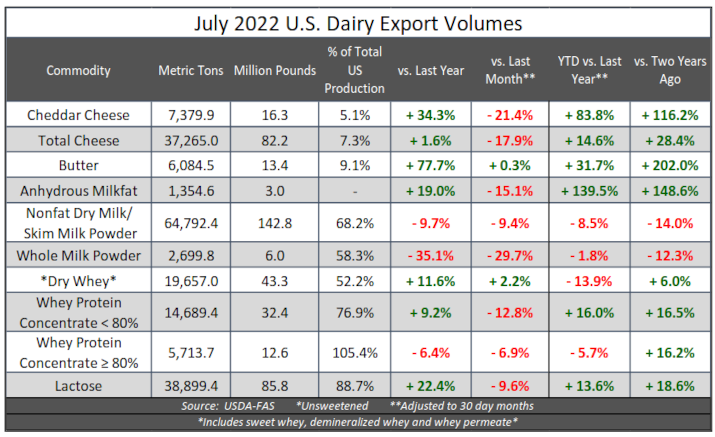

USA

Exports to Indonesia were notably higher than prior year due to stronger nonfat dry milk volumes sailing from the US. Total dairy exports to the country were the strongest on record for the month of July with increases also observed in dry whey, lactose and cheddar cheese shipments. The second biggest gain over prior year was shown into Canada due to dry whey and fat shipments. Year-to-date, dry whey exports to Canada are the highest since 2008. Butter & milkfat volumes into Canada are the highest on record through July (HS code 0405). Lactose exports reflected the strongest gains over prior year by volume as the US has experienced record shipments through July. Large volume is being driven by demand from China, followed by New Zealand. Notable demand was also shown from Japan and Indonesia. July cheese exports were higher versus prior year for the 13th consecutive month and were the strongest for the month on record. Mexico, Australia and Saudi Arabia experienced the biggest gains over prior year, but volume to Japan fell lower and dropped to six-month lows.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial.