Insight Focus

- There’s been no news from Russia about whether the grains corridor from Ukraine will be renewed.

- Turkey is ready to extend the deal for a further year.

- No new deal could slow the flow of grains from the region.

Forecast

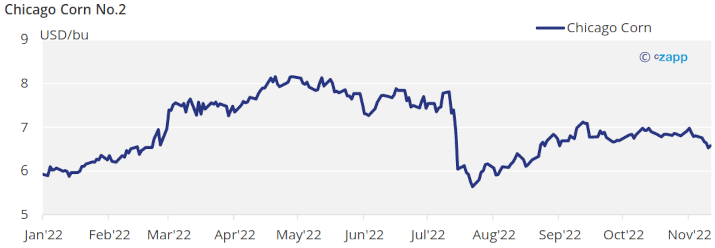

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

Negative week for grains after a bearish November WASDE, talks of extending the grains corridor out of Ukraine and better than expected harvesting pace in the US.

All the focus this week is on the extension of the agreement to maintain the grain corridor from Ukraine alive. The agreement expires this week Friday and there was no news yet of an extension from the Russian side. Only Turkey has confirmed they are ready to extend the deal for another year which could have been behind the weakness last week too. Talks were held in Geneva last Friday but at the time of writing there were no news about the extension of the agreement. Expectations is for the extension to occur but it should have been announced over the weekend and nothing has been said. If negotiations extend no new deals will be done which will slow Ukrainian exports and give some reason for prices to trade higher. But as soon as there is some clarity on the extension, that upside risk will tend to disappear. Information about the grain corridor from Ukraine shows the flow of grains through the Black Sea continues to work with some 669k ton being loaded last week.

Although the WASDE did not alter very much the S&D balance, both globally and for the US, the market reacted negatively to the data probably interpreting all the damages from the very hot and dry summer are already reflected in production forecasts and the upside risk to prices may have come to an end.

The November WASDE increased US Corn ending stocks by 10 mill bu as they revised yield higher to 172,3 bpa vs. 171,9 before resulting in 35 mill bu of higher production which was partially offset by higher demand for feed. Despite the higher supply, stock to use remained unchanged at 8,2%.

Global Corn ending stocks were marginally reduced by 260k ton. South African production was increased by 600k ton to 16,7 mill ton, the EU was reduced by 1,4 mill ton to 54,8 mill ton.

Conab in Brazil forecasted their 22/23 Corn production at 126,4 mill ton which is very much in line with the 126 mill ton of the WASDE.

US Corn is now 87% harvested which continues to be above last year and 11 points above the five year average. Corn harvesting in Ukraine is 39% complete still very much delayed vs. 69% harvested last year and yields continue to be some 17% lower yoy. Corn planting in Argentina is 23,4% complete vs. 28,4% last year and condition improved three points but still showing a very poor 9% good or excellent. Brazil’s summer Corn crop is 43% planted vs. 54,5% last year.

In the Wheat front, the WASDE slightly reduced US ending stocks by 5 mill bu all coming from higher demand and leaving production unchanged. Immaterial to the market.

But global Wheat ending stocks were increased although also marginally by 280k ton. Argentina’s production was revised 2 mill ton lower to 15,5 mill ton, Australia 1,5 mill ton higher to 34,5 mill ton, the EU 400k ton lower, and Russia was stubbornly left unchanged at 91 mill ton which contradicts official Russian data which has already harvested 105 mill ton. The UK was also increased by 800k ton. All these changes on the production side were fully offset by higher consumption resulting in the mentioned marginal increase of global ending stocks.

US winter Wheat is 92% planted, which continues to be very much in line with last year’s and the five year pace.

In the weather front, the US Corn belt is seeing warm temperatures which should favor Corn harvesting operations but the upper Midwest is expected to receive rains and cold weather. Brazil is expecting to receive rain again across all producing states, together with Argentina. Weather in Europe is expected to receive some rain.

The correction seen last week might have been enough as the November WASDE although bearish, did not change very much the S&D balance and it just gave the signal all the damage from the hot and dry summer is already in the production numbers and further downgrades to Corn production are unlikely. On the Wheat side is all said with the northern hemisphere crops fully harvested and the bumper Russian crop of 105 mill ton should be priced in despite the WASDE not recognizing that size.