Insight Focus

- Reductions in production in China and India remain a concern.

- Both will be major wheat importers in the coming months.

- Wet weather has reduced the amount of quality bread-making wheat available.

Introduction

The wheat markets have shown a little more stability as they have gently flattened out over recent days.

The August report of the monthly USDA WASDE (United States Department of Agriculture, World Agricultural Supply and Demand Estimates) did little to excite the market ‘bulls’ or ‘bears’.

As the northern hemisphere harvest rolls on production numbers become more meaningful. With the rain disruption we are also beginning to grasp the quality impact of the wet weather.

Ukraine has become a beacon of resilience in so many areas since the Russian invasion of February 2022. Following Russia’s withdrawal from the Black Sea Grain Corridor Agreement just over one month ago, Ukraine has simply explored alternatives to continue their exports in the face of the continued Russian aggression.

Wheat Markets

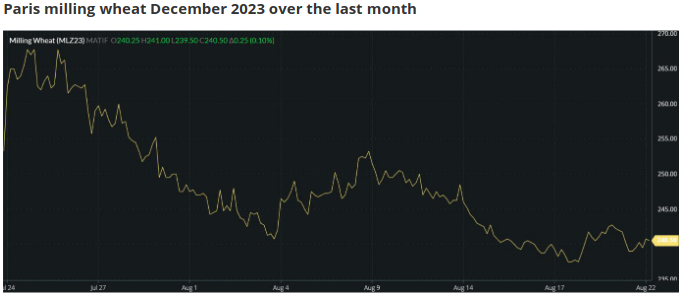

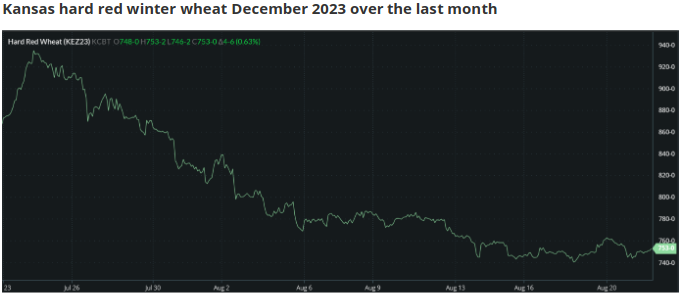

The charts below show how the World’s wheat markets have begun to calm a little over the last month, since the ending of the Black Sea Grain Corridor Agreement.

Source Barchart Comodityview

The USDA WASDE

The August edition of the monthly report provided little to set the market alight. Although there was a slight initial rally, this was probably due to a small reduction in forecast global ending stocks.

2022/23 world end stocks were estimated at 268.31mmt (million metric tonnes) vs 269.31mmt in July.

2023/24 world ending stocks were estimated at 265.61mmt vs 266.53mmt in July.

Subsequently the markets appear to have moved on as they consider global economic outlook, with the possible bearish tones to the world’s finances. Particular interest is being directed towards China with slowing economic data, raising questions as to the impact on global wheat demand for the coming year.

The 2023 Wheat Harvest

The weather has played its part in wheat harvests thus far, with more stories anticipated before the year end.

Weather concerns for the growing wheat crops in the southern hemisphere countries of Argentina and Australia are a long way from being put aside, with harvests still many weeks away.

Reported reductions in production for China and India are an ongoing concern, as China becomes the world’s largest wheat importer, while India may import up to 9-10mmt from Russia in the coming months.

The northern hemisphere harvest is making progress, but as with China, India and potentially the southern hemisphere to come, the weather has considerably reduced the amount of quality bread making wheat available to the market.

A probable continuation of high premiums for the best milling wheats is likely to endure for the coming months, with further hikes possible.

The Black Sea

We reported in our last article about the collapse in the Black Sea Grain Corridor Agreement and the subsequent assertions by both Russia and Ukraine that they now see all shipping to the other’s ports as potentially supplying cargoes to support the respective war efforts.

As news headlines report the successful navigation of the Joseph Schulte vessel from Odesa to the Bosphorus Straits, time will determine whether this is an isolated success or the beginning of many.

Ukraine has, within the last week signed an accord with neighbour Romania to ramp up grain exports by land to Romanian ports for shipping. The intention is for 4mmt of capacity per calendar month.

These efforts to continue exports show enormous resilience from Ukraine, while further diminishing Russian President Putin’s influence. This despite the Russian military bombardment of Ukrainian port and river shipment terminals, as well as their recent boarding of the civilian vessel the Sukru Okan.

Conclusions

The markets have shown a little more stability over the last couple of weeks.

Although poor weather impacts yield, large acreages were planted for the 2023 harvests. We are likely therefore, to see a reasonable crop globally.

Nonetheless, as poor quality milling wheat is dumped on the feed market, we may well see downward pressure on the feed markets, while opposing upward pressure on the premium quality milling wheat values.

Another year of interesting dilemmas ahead!

The Black Sea issues will continue, but as the needs of importers remain, Ukraine will no doubt remain resolute in their determination to export. Thus far showing encouraging success despite Russia’s ongoing aggression.

Weather is the ever-present conundrum, with values showing signs of diverging between differing types and qualities of wheat.