Insight Focus

- Strong feedstock demand from renewable diesel industry.

- Confidence the EPA will reconsider its Dec’22 eRINS mandate.

- Aviation fuel demand could be beneficial for agriculture.

I attended Bank of Montreal’s Farm to Market conference in NYC Wednesday and Thursday (many thanks for the kind invitation to attend and gracious hospitality shared by certain readers who made all that possible) and had the opportunity to listen to the CEOs and CFOs of the large, publicly listed agricultural companies opine about the future (TSN, INGR, ADM, PPC, BG, ANDE, DAR, GPRE, JBB3 amongst others all presented).

Both the ADM, BG, and DAR leadership teams reiterated certain themes from their recent earnings calls:

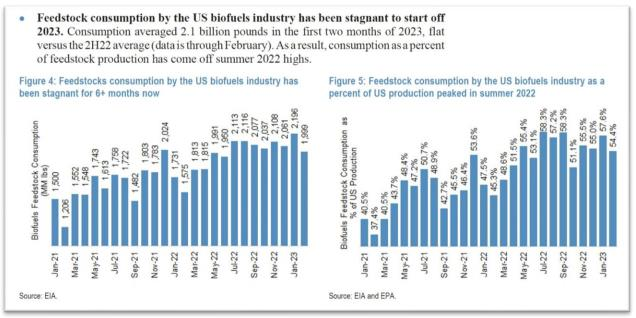

1) unusually strong feedstock demand unfolding in the here and now from the renewable diesel (RD) industry that should lead to robust RD refining rates instead of the recent flat to lower rates (see JPM’s charts of EIA and EPA data below) due uptime issues which I think continues to surprise those of us in the RD feedstock industry given our limited understanding of the complexities of sustained catalyst processes necessary for RD production,

2) strong confidence that the EPA has reconsidered its December 2022 expansive eRINS mandate and limited biomass based diesel (BBD) mandates for the next three year’s RVO with final details to be announced in June to the RD industry’s benefit, and

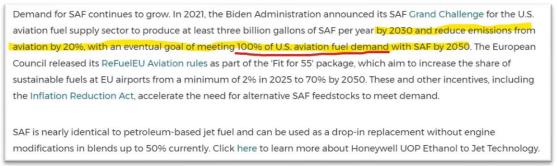

3) the potential for an aviation biofuel blend mandate and potential demand for alcohol to jet (ATJ also known as ethanol to jet or ETJ) and RD to sustainable aviation fuel (SAF) that far surpasses current BBD and ethanol blends for road fuels.

CEO Randy Stuewe from DAR, always a treat to listen to given his penchant for bluntness and jaundiced humor toward many constituencies, said something akin to this: “there is a coming intersection between aviation and agriculture that will be extremely beneficial for the future of agriculture.” When pressed on which technology wins the prize for providing the aviation industry with a sustainable jet fuel he answered “both.” His point: the global demand for aviation fuel is so large that both BBD as a feedstock and corn and sugar ethanol as feedstocks to produce aviation fuel are required.

Agriculture supporting aviation is a mega theme for future consideration and there was a level of enthusiasm that the collective agricultural processing company CEOs brought to the topic that suggests their commitment and their firm’s capital is committed to expansion and growth. Maybe more stories like the below in the offing?

Stepping back from thoughts of this aviation/agriculture future co-dependency, the nearby demand for vegetable oils from the RD industry, though widely discussed during the Q1 2023 earnings calls and at the BMO conference, is not a feature of the vegetable oil trade yet. Prices for global vegetable oils continue to drift lower and prices for palm oil, the largest produced and most consumed vegetable oil globally, whose price discount to other world vegetable oils has recently narrowed dramatically, meander. Palm’s narrowing price remains very supportive to prices overall.

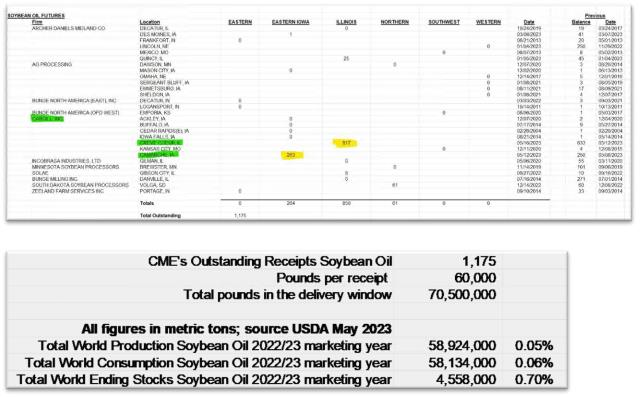

I have recently detailed the May 2023 soybean oil futures (now expired) delivery process at the Chicago Mercantile where a major producer, Cargill Inc., loaded the delivery window with hundreds of 60,000- pound equivalent receipts, and major producers ADM and Bunge, “took” it. And as of Friday those receipts continue to sit in the delivery window (see CME table below) for all the vegetable oil trading universe to see.

As I mentioned in recent notes, until ADM and Bunge take the next step with their receipts, and demand Cargill load that soybean oil into rail cars and start shipping it to destinations that ADM and Bunge select (their customers’ locations for food or fuel processing), the receipts sit in the delivery window and act like a millstone on bullish sentiment. This past week featured a weakening futures curve structure, significant fund selling (primarily trend following, systematic strategies), but a stable middle part of the curve where the funds rarely travel (due liquidity constraints), AND an equal and offsetting purchase of those fund sales by commercial traders like ADM and BG who primarily use fundamental inputs (like seeing significant demand from the RD industry for feedstock) and discretionary strategies for their trading operations. A quick review of the CFTC’s weekly report on trader positions allows me to make those observations.

You are probably asking yourself how delivery stocks representing less than half a percent of total world production, a little more than half a percent of total world consumption, and 7/10’s of a percent of global ending stocks is having such an outsized impact on pricing (see above table). All I can say is this (unless you have 2 hours and can listen to a Futures Trading 101 Seminar): welcome to the pricing power from participating in the delivery function of futures contracts as either a maker (Cargill) or a taker (Bunge and ADM). Also, welcome to the impact of delivery stocks sitting on an exchange (here the Chicago Mercantile Exchange) for everyone to see and to make pricing conclusions from (in this particular instance, I cannot “see” Cargill’s internal emails or read their traders’ texts to one another, but I can conclude from their public actions at the CME that they do not “see” the nearby robust demand discussed at length by ADM’s, BG’s, and DAR’s leadership teams during last week’s conference).

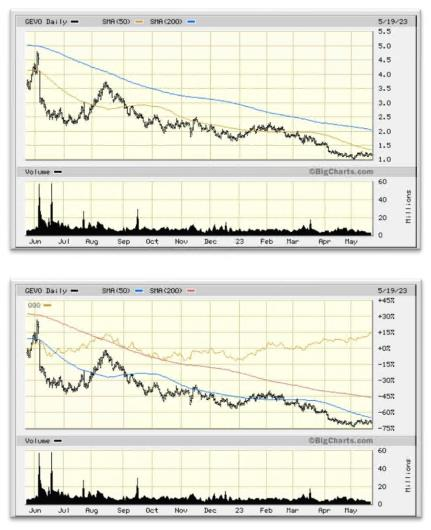

So we wait for the demand bull market in US vegetable oils to unfold but nothing bullish is happening any time soon until those CME soybean oil receipts disappear and the futures curve begins to invert. Overall commodities continue to drift lower (see above chart of the widely followed CRB commodity index) and other major nearby bearish themes continue to outweigh the demand bull market for vegetable oils that the CEOs continued to indicate is under way.

My general sense is these bearish factors remain equally weighted (maybe a little higher weighting to the great weather in the Americas) and include:

- Excellent US planting and crop emergence growing conditions

- A record Brazilian double cropped corn crop, also experiencing excellent growing conditions, coming to market in the next 60 days

- US loss of global export market share for corn and soybeans to Brazilian exporters (ultimately this keeps these feedstocks at home for US processing industries which is beneficial for margins)

- The growing specter for US exporters and farmers that the world will not need US supplies at our peak harvest availability (October, November, and December) due to the size and scope of this year’s Brazilian production traded into world markets which means lower physical prices as well lower futures prices and significant carrying charge structures in the respective futures curves

- An Argentine miracle recovery story brought to us by the USDA’s first forecast for what’s in store for global oilseeds in the coming year issued two weeks ago.

A quick review of the equity price chart of a company focused on the intersection of agriculture and aviation today and a chart relative to the NASDAQ 100 as represented by the ETF QQQ would suggest this mega trend needs some time for this agriculture/aviation co-dependency to yield profitability. And so we do the hardest part of any traders’ job: we wait and do nothing. And we read this again: