Insight Focus

October cold snaps may have slowed NZ milk production gains. GDT Event 367 saw a surprising rise in milk powder prices amid strong New Zealand supply. China may disrupt dairy dynamics with lower demand and competitive milk powder offers into Southeast Asia, while a weaker EUR/USD supports EU export competitiveness.

New Zealand Expects Long Flat Peak

The latest milk collection figures for September have been released by all dairy processors, showing a 5.2% year-on-year increase, driven by warm and wet conditions across the country.

Like August’s results, this marks the second-highest September milk production in New Zealand’s history, only behind 2020. It’s worth noting that the milk collected during Fonterra’s 2020/21 financial year set the record for the highest production to date.

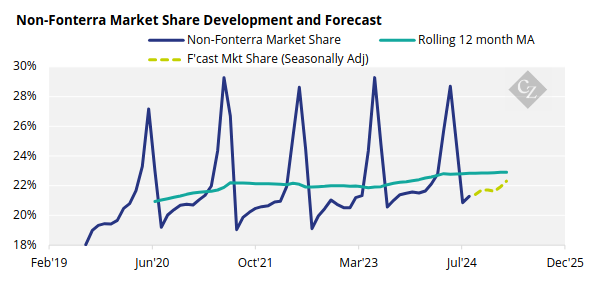

Fonterra themselves were up 4.8% YoY in September, with outsized strength in the South Island. While the non-Fonterra group were up 8.2% (likely due to their relative tilt to South Island market share).

The non-Fonterra group continued their solid growth, with market share for Fonterra FYTD sitting at 21.1%. This is 0.3% above trend.

Temperatures in October 2024 continued to be on the warmer side in New Zealand, 0.8°C above the 30-year average. However, the “average” doesn’t fully capture the day-to-day conditions that defined October for us Kiwis. We experienced several very cold snaps and periods of significant rain in the south.

I am told that this materially impacted milk collections and we should see the October 2024 milk production print nearer to +2% YoY for a total of approximately 260 million kgMS.

According to NIWA: “A La Niña Watch remains in effect, with a little over 50% chance that La Niña officially develops by the end of the year. However, this event is likely to be weak and short-lived and might stay below traditional La Niña thresholds.”

Forecast breakeven milk prices for NZ this season are in the range of NZD 8.00-8.40/kgMS. Fonterra’s forecast for the 2024/25 season’s farmgate milk price is NZD 8.25–9.75/kgMS, plus dividend. At time of writing, the last traded price for MKP futures was NZD 9.55.

With this in mind, farmers will be eager to maximise output in order to capitalise on what could be a highly profitable season. As a result, feed demand is expected to be very high.

If all of the above plays out, then we can realistically expect this season to reach a smaller peak than the record pace initially anticipated (based on strong August and September). However, with robust feed inputs, the peak could extend longer, meaning overall collections this season could still be in for a podium finish.

Demand Dynamics and China’s Influence

In our previous article we discussed how New Zealand’s production is increasingly shifting towards the SMP/Fat stream, meaning an additional 200,000 tonnes of NZ SMP will need to be placed this season.

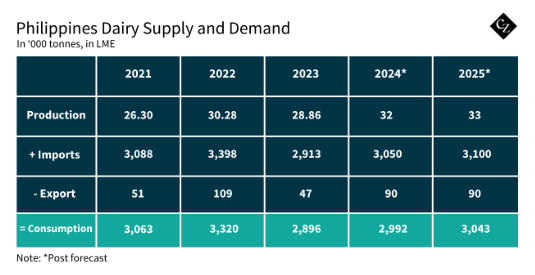

Imports to Asia (excluding China) have been keeping the powders markets tensioned. SMP and whey imports to the Philippines have been notably strong, and the USDA projects total dairy imports to the Philippines to increase by over 1.6% in 2025, reaching 3.1 million tonnes (liquid milk equivalent), primarily driven by continued growth in these products.

Source: USDA

We are hearing from Suppliers that sales were generally slow from August through mid-October. However, recent weeks have seen a noticeable increase in inquiries, suggesting potential restocking ahead of 2025. This is somewhat surprising to us, as many customers we speak to seem well-stocked on milk powders, particularly SMP, until Q2 2025.

Meanwhile, Chinese domestic milk production continues to grow, and its influence on Southeast Asia’s market is increasing as buyers report receiving offers for Chinese WMP at prices below global levels. This is often for unstandardised specs which are higher in fat and protein than CODEX. We understand that Chinese WMP with all typical certifications is now sold out and are expecting offers for February ETD to start hitting the market soon as the Chinese approach their own peak.

The recent SGX-NZX volume profiles traded for dairy commodities suggest an active spread activity. That being, selling the MKP contract and buying what they believe to be the matching profile of commodities.

This trading activity may further de-link futures pricing from physical markets, as traders attempt to capitalise on potential mispricing’s of the derivatives.

GDT Event 367 Price Surge Amid Strong Supply Demand Factors

GDT Event 367 saw an unexpected price increase in milk powders, a move that had been anticipated by futures markets. Meanwhile, the price increases for butter and AMF were as expected.

However, supply fundamentals remain largely unchanged. New Zealand’s production is still strong amid warm and wet conditions, while the EU faced a challenging summer, with high temperatures and Bluetongue virus impacting production.

Although this reduction in EU supply is less impactful during New Zealand’s peak, it has contributed to a complex landscape where freight disruptions and inter-product spreads are affecting production choices and competition across regions. In the US, milk output volume declined, but solids content is up, which could redirect some production flows.

Demand seasonality has been unusually strong this year, driven by early 2025 Chinese New Year and Ramadan purchases, which should have been completed in October. Despite this timing, inter-market spreads—especially for fats—are exerting upward pressure on GDT pricing, particularly for New Zealand-origin products.

Overall, I still expect milk powder prices to slowly decrease from current levels across origins, with New Zealand pricing being the most vulnerable. In fats, prices from different regions are likely to converge as New Zealand’s values increase and EU prices ease.

The US remains focused on cheese for the long term, but short-term SMP parcels could increase competition in Southeast Asia.

EU Milk Collections Show Decline as November Outlook Looms

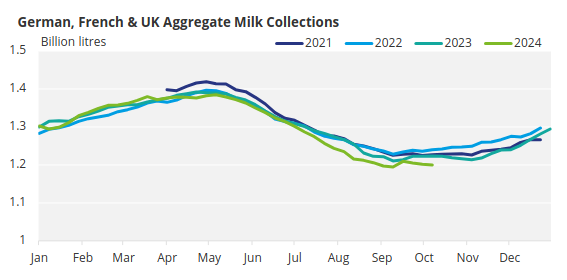

Milk collections in the major producing countries (Germany, UK and France) are now down by a cumulative 0.7% in 2024 YTD according to our calculations. Week 42 aggregate collections are down 1.94% across the group.

The UK is the bright spot of the group with collections there having bounced significantly since September. We’re hearing similar trends in Ireland as well.

We are at a critical point for EU milk collections, as the start of November typically marks the beginning of an upward trend in milk flows. The rate of this increase will be key in determining how well the EU is positioned for its peak production next year.

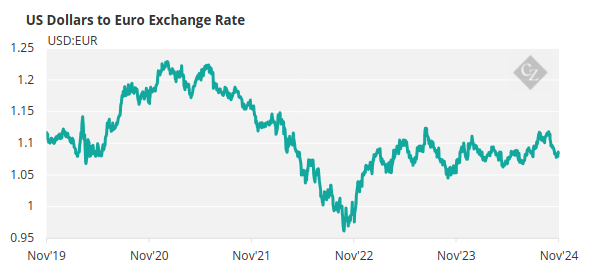

There are still questions around the full impacts of BTV-3. The extent of quantum and duration of yield reductions for infected animals is not fully understood, and we are hearing that it also may impact calving rates. The EUR/USD is also one to watch, with current FX rates the lowest since early August. This makes EU product more competitive in the world market.

Source: St Louis Fed

We are hearing that both US butter and NZ AMF are currently being prepared for export to the EU. This is unsurprising, given the substantial premium the EU cream market has recently maintained over global prices.

It is worth noting that the premium for near-month EEX futures over spot physical prices is currently at elevated levels. This suggests that one or more of the following market dynamics may be at play:

- Anticipated Shortage or Increased Demand: shortage seems unlikely at present but perhaps an Algerian tender is expected soon?

- Storage Constraints: if storage capacity is limited or costly, it might be more appealing to buy futures rather than hold the physical product. We are currently a month into “peak season” for warehousing in Europe. Global freight disruptions may mean that many European warehouses are fuller than normal as buyers seek to ensure goods are in market ready for holiday demand. But at some point the paper needs to be converted…

- Speculative Influence or Hedging Demand: In this case I think more likely to be driven by the trade.

- An Abrupt Backwardation-to-Contango Transition: A short-term shortage might cause this shift, but this seems unlikely at present.

- Risk Premiums Due to Uncertainty: If there’s heightened uncertainty around short-term availability, market players might pay a premium on near-month futures as insurance against potential disruptions. With the US election looming at time of writing, traders may have been derisking by covering shorts ahead of what is expected to be a tight result.