Insight Focus

- Sugar has strengthened since the October futures expiries.

- There’s fresh spot demand from China and Indonesia

- Rains are affecting cane crushing in Centre-South Brazil

Hello everyone, it’s Stephen from Czapp with an update on the sugar markets for October 2022.

Being an analyst is a bit like being a goalkeeper. If you make 10 decent calls on the market…. well, that’s your job.

But make one mistake and that’s what everyone remembers.

Traders are like forwards. They can fluff plenty of chances, but if they finally convert one then they’re the heroes.

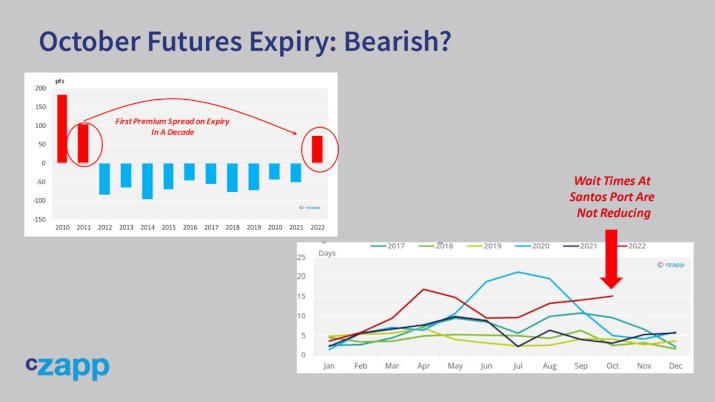

I thought the October raw sugar futures expiry was mildly bearish for the market.

Source: Refinitiv Eikon

This was because although the market was backwardated at expiry for the first time in a decade, the scarcity that the market was showing was due to a vessel queue in Centre-South Brazil, which at this time of year is the world’s largest sugar supplier.

There’s no shortage of sugar, just a shortage of berthing slots in Santos port. In time, I’d expected this shortage of slots to diminish as premium spreads pulled more sugar supply forward.

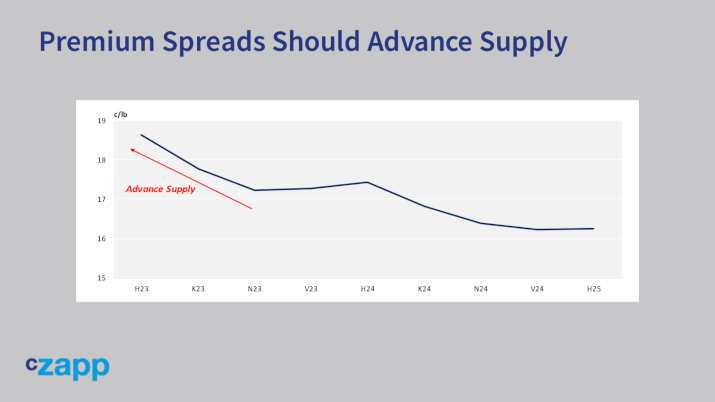

And yet here we are two weeks later and the sugar market has jolted higher – both the flat price and also the nearby spreads; I’ve shown the front raw sugar March/May spread here.

Source: Refinitiv Eikon

As always, it’s the thing you’ve not considered which counts. I’ve stressed in the past that sugar analysts shouldn’t just fixate on sugar fundamentals. This is why: a bump higher in many of the world’s energy markets helped drag sugar higher too.

Source: Refinitiv Eikon

Sugar is linked to the energy complex because cane can also be used to make ethanol.

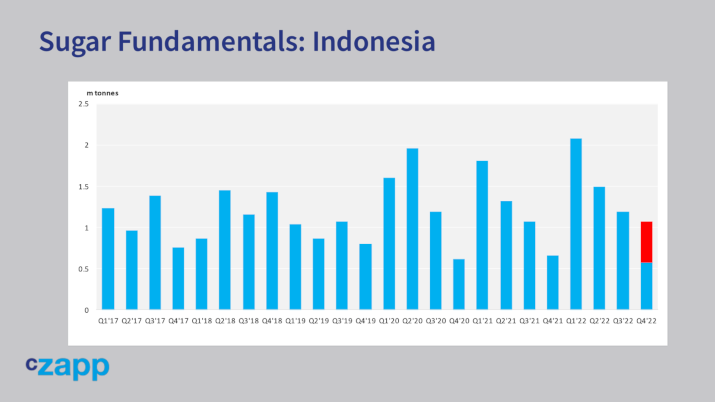

There are also some sugar-related reasons why prices might have increased after the expiry. There’s fresh demand from Indonesia, which is one of the largest sugar buyers in the world.

Half a million tonnes of sugar import permits have been issued to local mills for use this year. This tonnage is on top of usual import permits issued to local refiners.

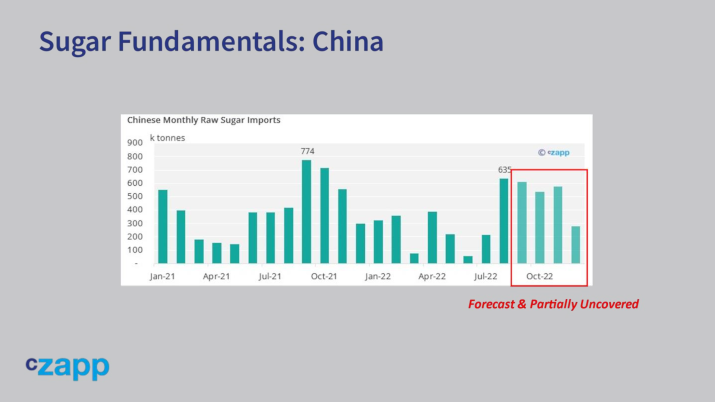

Chinese refiners will also need to use their final 2022 import licences in the next few days.

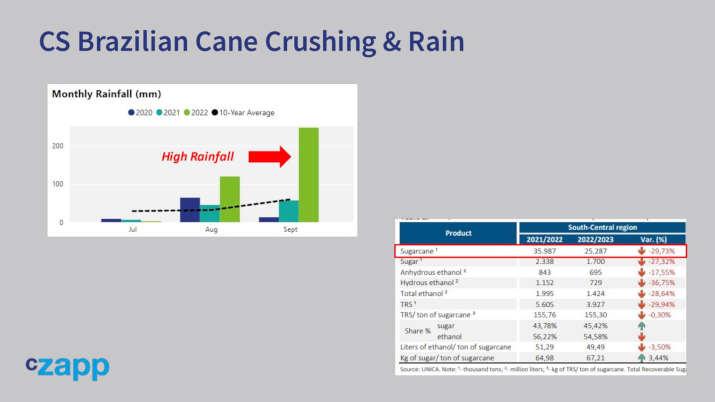

People are also worried that supply is becoming a little more constrained too. It’s becoming rainier in Centre-South Brazil which makes it harder to harvest and process sugar cane.

You could already see the effect of this in the cane crushing figures for the second half of September which were released recently.

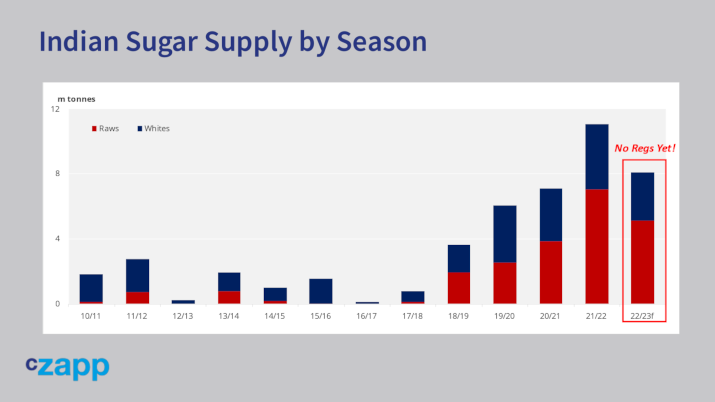

Indian traders are also waiting for the government to announce how export regulations will work this year. India is the world’s second largest supplier of sugar; we’re about a month away from the cane harvest beginning and we still don’t know how this sugar will be traded onto the world market.

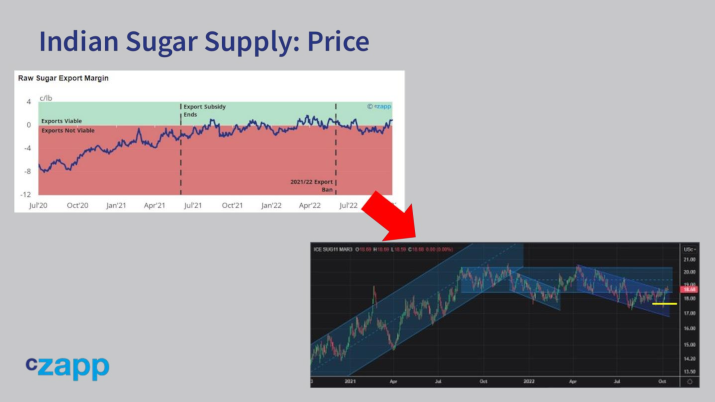

If last year’s rules are repeated then we think this sugar can be exported if the raw sugar futures are above 17.50c.

Source: Refinitiv Eikon

But the Indian government are extremely worried about food availability and are likely to impose tighter restrictions on exports this year. This probably means minimal flow of Indian sugar to the world until the New Year.

Likewise in Pakistan, the country has excess sugar stocks but the government are dragging their feet on authorizing exports.

So while we can see a path for the sugar markets to become better-supplied, this supply is always just out of reach.

Source: Refinitiv Eikon

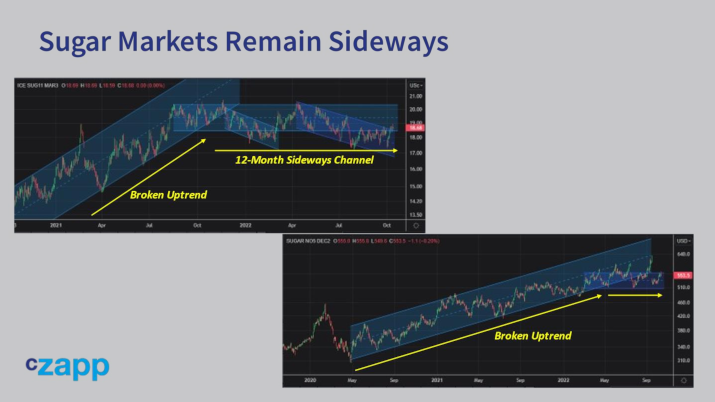

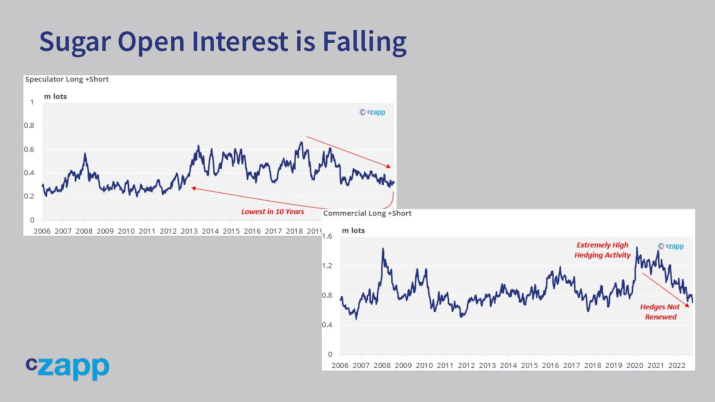

This means that sugar remains in its 2022 range, chopping sideways to lower and scaring everyone out of the market.

Open interest continues to fall.

Speculators are struggling with the lack of a convincing trend. Consumers don’t want to hedge at 18c, which is double the 2020 lows.

Source: Refinitiv Eikon

Producers would prefer to hedge near 2022 highs of 21c, not 18c, especially as their costs are increasing quickly.

Source: Refinitiv Eikon

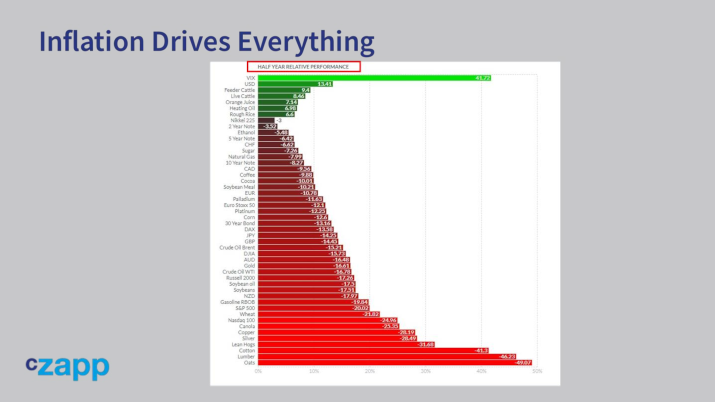

And this really is the major problem for many markets, not just for sugar……how does the world deal with rapidly rising costs?

Source: Refinitiv Eikon

Inflation, or more specifically how the American government is dealing with inflation, is driving everything right now. It’s hard to see how most commodities can strengthen in the short term when the US Federal Reserve is trying to get rid of inflation by raising rates so hard that demand for goods is squished. The twin attack of higher rates and a stronger US Dollar are strangling demand, access to credit and therefore damaging global trade.

This generally isn’t positive for commodity markets!

The Federal Reserve would like inflation to fall towards its 2% target. The most recent Consumer Price Index print was 8.2%. However, CPI data is lagging. It takes a long time for changes in prices to work their way through the supply chain to the final consumer.

Consider that almost all commodities are lower than they were 6 months ago. Yet inflation is measured year on year so it might take another 6 months for inflation to fall to Fed target levels.

I hope they are aware enough to use more leading data and to pause their rate rises, but then again I would say that because I’m not based in the USA.

The old joke goes that the US Dollar is America’s currency but the world’s problem. This is true today inasmuch as America is now getting rid of inflation by exporting it around the world. For sugar, as long as the US Dollar remains strong, it’s going to be hard for any of the bullish fundamentals to push prices much higher.

The uptrend is strong; there’s only one small glimmer of hope and that’s the volume traded at the time of the recent high, which took the Dollar outside the top of its faster uptrend channel.

Source: Refinitiv Eikon

Quite a lot of firepower was expended to stop the rally at around 114.

It’s possible, but not certain, that the US Dollar might have exhausted its 15-month uptrend and will now settle into a range between 110 and 114, which would be a relief for much of the world. Certainly it would help sugar stabilize and refocus on the bullish fundamentals. For the time being, price movements are largely out of our hands and will be determined by wider events.

For a goalkeeping analyst, this is as bad as it gets.

Thanks for joining me and we’ll speak again soon.