- The world is oversupplied with raw sugar.

- Three receivers have just taken 2.6m tonnes of raw sugar from the futures exchange at a punchy V/H spread.

- What on earth are they playing at?

It’s a Record Expiry! (Didn’t We Write This in May Too…?)

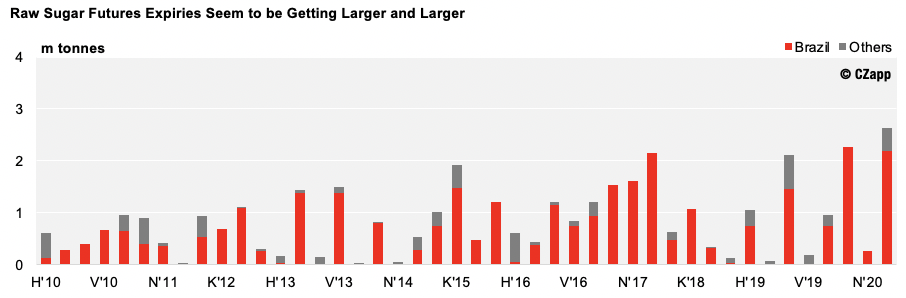

- Another raw sugar futures expiry, another record tonnage.

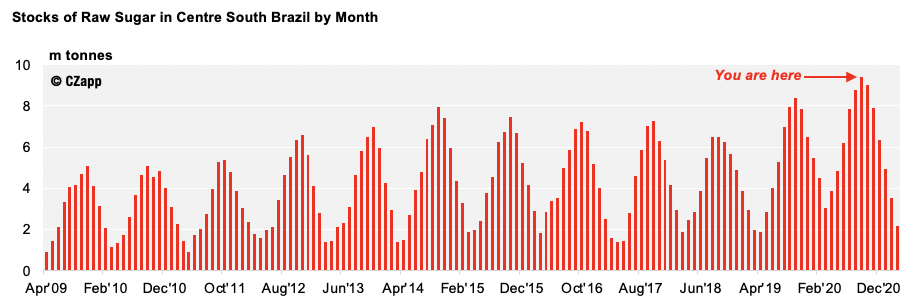

- 2.6m tonnes raw sugar was delivered into yesterday’s October’20 expiry, almost entirely from Centre-South (CS) Brazil.

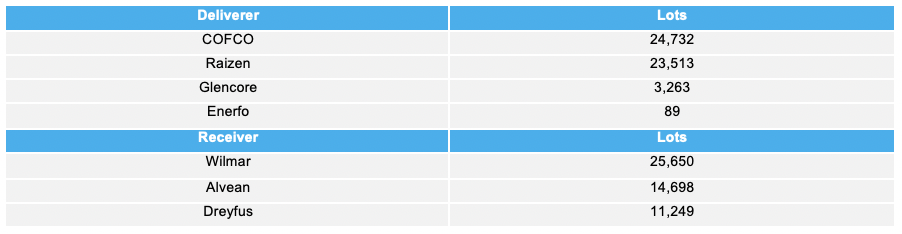

- The big receiver was Wilmar, with Alvean and Dreyfus also active.

- We know that an expiry is just a transaction like any other sugar trade, but it’s also one of four times in the year when the physical and paper sugar markets must align.

- So, we can’t help ourselves…we love to look for deeper meaning where one may not exist.

Why Are Wilmar Bidding Up Physical Sugar?

- In particular, we have been trying to understand Wilmar’s actions.

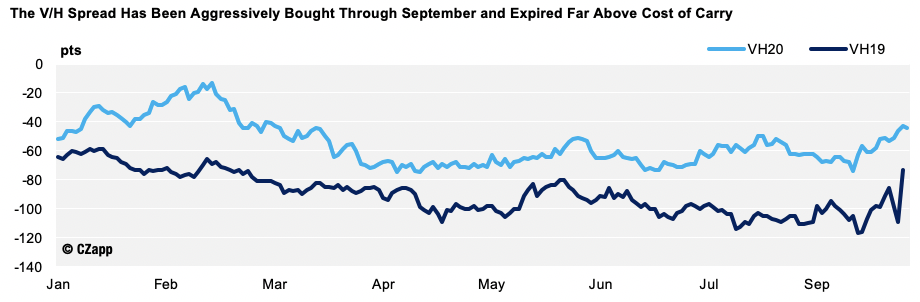

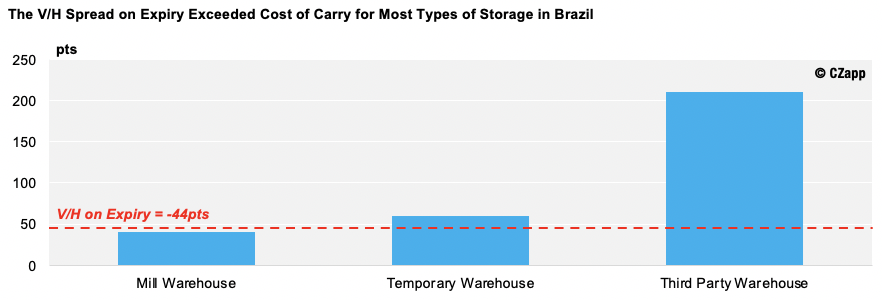

- As well as bidding up Q4 Brazilian raw sugar values by driving the V/H spread above -50pts as part of the pre-delivery futures positioning, they also won this week’s B Quota tender for March/May 15 Thai raws.

- They bid H+206pts for B Quota sugars, more than 40pts higher than the rest of the trade.

- Why are they securing raw sugar so aggressively?

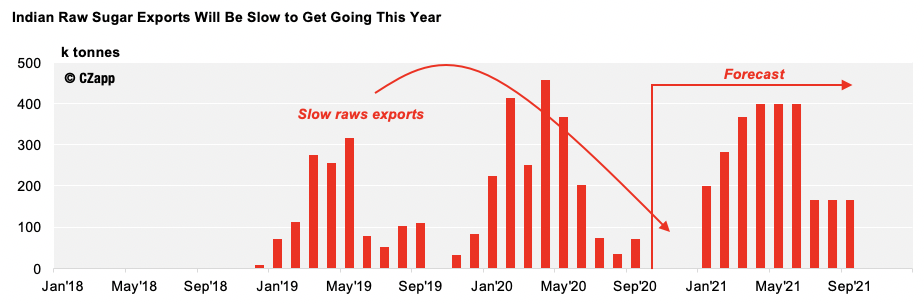

- They’ve said that they are concerned that India will be slow to approve subsidised sugar exports in 2020/21 and so they don’t think Indian raw sugar will be available in Q4’20.

- We agree; we don’t think Indian raws will be available until January at the earliest.

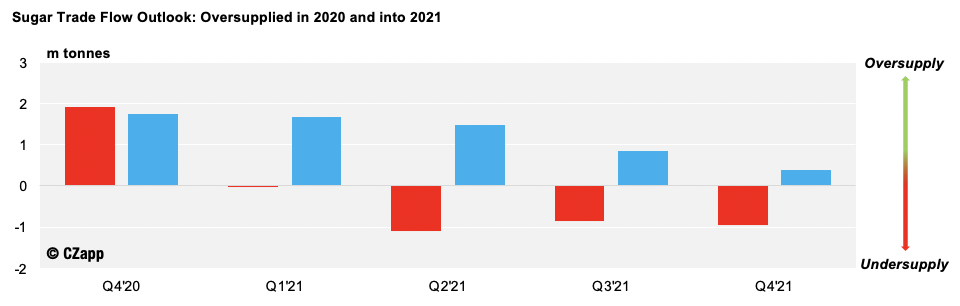

- But this still leaves the world market heavily oversupplied with Brazilian raw sugar.

- Besides, who in the sugar market was ever brave enough to build a raw sugar trading book around India?

- We suspect something else is going on.

Theory One: Bottleneck Brazil

- The world market will be heavily oversupplied with raw sugar in Q4’20 and Q1’21.

- But all of this oversupply is currently sitting in sheds and warehouses across Brazil.

- If this sugar cannot be exported form the port onto the world market, it may as well not exist.

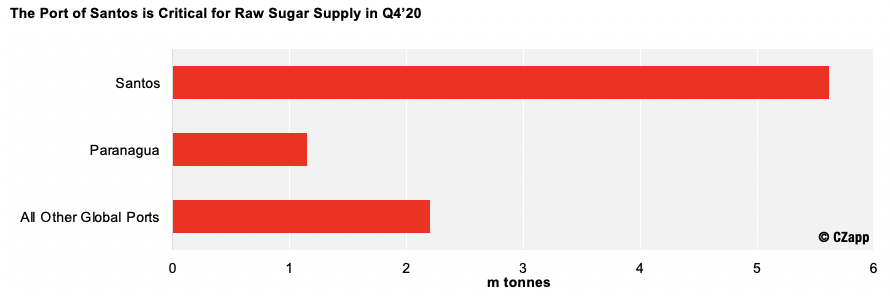

- The ports of Santos and Paranagua are potential bottlenecks; if they cannot export sugar fast enough, the raw sugar market isn’t oversupplied at all.

- By bidding the V/H spread above -50pts, the receivers have guaranteed that all raw sugar held in third party warehouses was delivered and must be loaded onto vessels by December 15th.

- If the receivers nominate enough vessels in the coming days, we could see the volume of nominations overwhelm the ability of port terminals to perform.

- This could lead to long wait times at Brazilian ports.

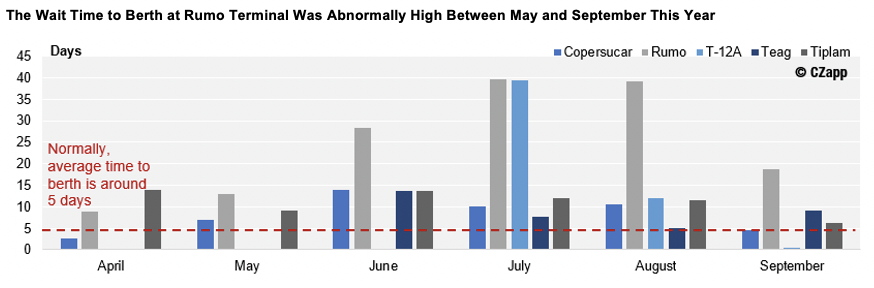

- We saw this happen immediately after the May’20 futures expiry, when the wait to berth at Rumo terminal ballooned to over one month and wasn’t fully under control until several months later.

- A repeat situation in October and November could put raw sugar shorts under considerable pressure.

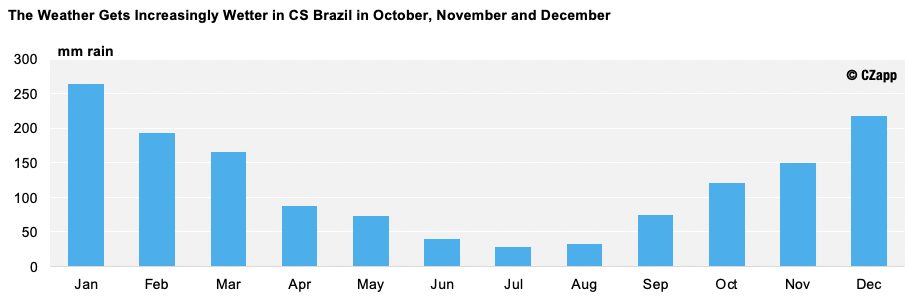

- The weather in Centre-South Brazil becomes progressively wetter from October through November and December too, which could slow port loadings and ultimately extend any queues which do form.

- We think CS Brazilian ports can load around 6.8m tonnes in Oct-Dec this year.

- By receiving 2.5m tonnes of Brazilian raws, the receivers have reduced spare loading capacity at Santos and Rumo for everyone else by 37%.

- If wait times at Brazilian ports start to increase, please be aware that the sugar market may not be as oversupplied in reality as it seems in your analyst’s models.

Theory Two: Reducing Counterparty Risk

- This theory is a lot less sexy than the first.

- We find the growth in futures expiry volumes across the last decade fascinating, especially because it’s coincided with reduced activity in the intertrade market.

- We wonder if an increasing number of trade houses are trading physical sugar through expiries because this means their counterparty on the trade is the exchange and not another trader.

- Also, did anyone else spot that Raizen have delivered to Wilmar?

- Until a month ago, they were part of the RAW joint venture, through which Raizen would source Brazilian sugar for Wilmar, and didn’t need the exchange to mediate this kind of transaction.

- Got a third theory? Tell us, we’d love to hear it.

Other Opinions You Might Be Interested In…