Insight Focus

Trade tensions with key partners threaten US dairy supply. Key import and export trade flows could face disruption. Emerging markets and competitors may help mitigate losses, particularly those in the southern hemisphere.

Since taking office, President Trump has escalated trade tensions with the US’s largest trading partners, including Mexico, Canada, China and the EU.

The dairy industry is particularly vulnerable to these tensions, with significant risks arising from tariffs on key imports and exports. Notably, the 25% tariff on goods from Mexico and Canada, along with the already enacted 10% tariff on Chinese goods, could disrupt the dairy supply chain and affect export markets, as these countries play a pivotal role in both.

Trade tensions have also extended to other nations, such as Vietnam, Colombia, Panama and several EU members, further complicating the global trade landscape and introducing uncertainty to markets essential for US dairy producers.

The economic impact could be severe. Dairy economist Charles Nicholson recently warned that the combination of tariffs, potential deportations, and cuts to food and nutrition spending could result in a USD 6 billion loss in profits for US dairy farmers over the next four years.

With ongoing tariff discussions and the potential for further escalation, the future of the dairy industry remains precarious as international relationships continue to evolve.

US Dairy Export Partners Face Trade Tensions

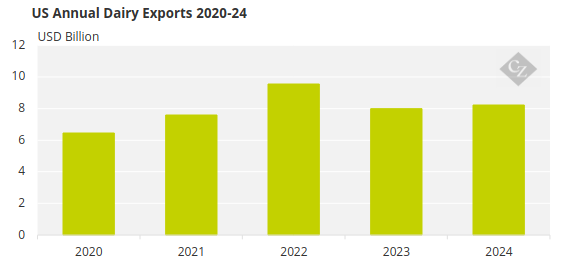

According to the USDA, the total annual export value of all US dairy products in 2024 reached USD 8.22 billion.

Source: USDA

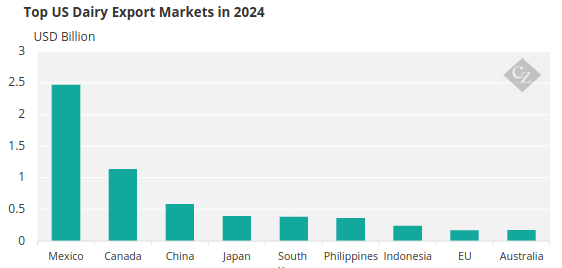

A significant portion of these exports is concentrated among three key partners: Mexico, Canada and China, which together make up the largest markets for US dairy products.

Source: CLAL

Mexico remains the top destination, with US dairy exports valued at over USD 2.47 billion in 2024. Canada follows closely with exports exceeding USD 1 billion, particularly for products like cheese and milk powders. Despite this, trade tensions with both countries have escalated in recent years.

Disputes over tariffs, trade policies and issues such as illegal immigration—particularly following the renegotiation of NAFTA into the United States-Mexico-Canada Agreement (USMCA)—have created friction. While the USMCA addressed some concerns, ongoing political shifts and regulatory changes continue to affect trade dynamics.

In Canada, longstanding disagreements over the supply management system, which controls agricultural imports and limits US market access, remain a key challenge. In China, broader geopolitical tensions, notably the US-China trade war, have disrupted trade flows. The imposition of tariffs on goods from both countries has led China to diversify its imports, sourcing more from other suppliers in response to the tariff environment. These shifting dynamics could continue to affect US exports to all three of these critical markets.

Skimmed milk powder (SMP), cheese and sweet whey powder (SWP) account for 65% of US dairy exports, with the US exporting 745,000 tonnes of SMP, 514,000 tonnes of cheese, and 512,000 tonnes of SWP in 2024.

SMP

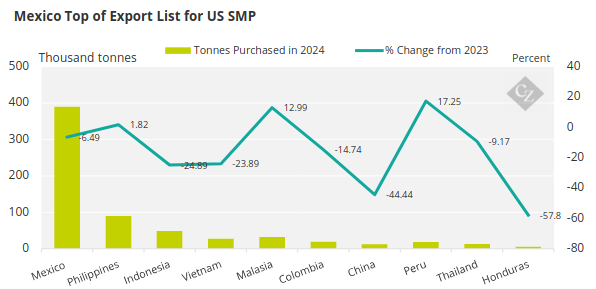

Mexico is the largest export market for US SMP, accounting for nearly 50% of total SMP exports in 2024.

Other key SMP markets facing trade tensions include Vietnam, where the US maintains a significant trade surplus; Colombia, which is in dispute with the US over repatriation; and China, a persistent focal point of trade conflicts.

Source: CLAL

As you can see in the chart above, the US has already experienced a decline in purchases from these countries since 2023, with a 44.44% decrease in SMP exports to China compared to the previous year. As tensions continue to escalate, further declines are likely, leaving a gap that may be difficult to fill in the short term.

However, markets like Malaysia and Peru have shown growth, with exports increasing by 12.9% and 17.25%, respectively, since 2023. These markets could provide an opportunity for growth, potentially helping to mitigate some of the losses from traditional markets. Without securing additional alternative markets or resolving trade disputes, US dairy exporters may face reduced profitability and increased competition from other global suppliers.

Cheese

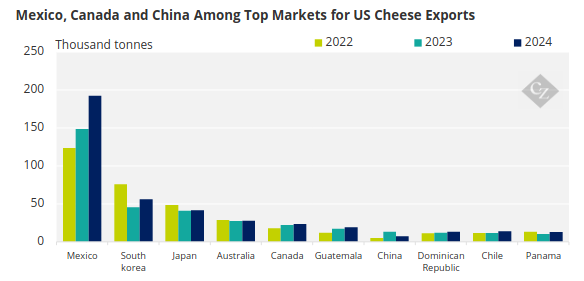

Cheese has also been a standout performer in recent years. In 2024, US cheese exports rose 17% to 508,808 tonnes, surpassing the previous record set in 2022 by over 75,000 tonnes. This marked the first time cheese exports topped 500,000 tonnes in a year and crossed the 1-billion-lb mark.

However, the key export markets for US cheese include Mexico, Canada and China, all of which face potential (and implemented) tariffs from the US.

Source: CLAL

Panama is also in the top 10 export markets. Since becoming president, Trump has intensified his rhetoric regarding the Panama Canal, raising concerns over China’s growing influence and suggesting potential US action to regain control. If these tensions escalate, Panama could become a potential target in any upcoming trade war.

In light of these uncertainties, Australia could emerge as a player in filling the gap left by these trade disruptions. Australia is not directly targeted by US tariffs and was the fourth largest export market for US cheese in 2024, with over 28,000 tonnes of cheese exported.

Treasurer Jim Chalmers has expressed confidence in Australia’s ability to adapt to US trade policy shifts, noting the country’s open economy and strong trade relationships. As tensions rise in traditional US export markets, Australia, with its robust dairy sector and stable trade relations, could step up to meet the demand.

Additionally, South Korea has experienced a notable growth of 23.8% in imports of US cheese since 2023, making it another promising market to help fill the gap.

Sweet Whey Powder

Sweet Whey Powder remains a key export for the US dairy industry, with 512,000 tonnes exported in 2024. China continues to be the largest market by a significant margin, receiving 214,000 tonnes of SWP that year. Following China, Mexico and Canada are also key markets, importing 45,800 tonnes and 29,280 tonnes, respectively.

Shipments to both China and Canada have seen a decline since 2023. If the ongoing trade tensions and regulatory challenges deepen, this downward trend in exports could persist.

Source: CLAL

However, there have been notable growth opportunities in other markets.

Indonesia experienced impressive growth of 50% compared to 2023, importing just over 46,000 tonnes of SWP. Similarly, Japan saw a 49% increase, importing 19,500 tonnes in 2024. These markets could play an important role in offsetting declines from traditional markets, providing US dairy exporters with hope for continued growth.

US Dairy Imports Hit Record, Led by Key Suppliers

According to the USDA, the total annual value of US dairy imports in 2024 reached a record USD 5.39 billion, marking an 11% increase from 2023. This is the sixth consecutive year in which US dairy imports have set a new record, with the value rising by more than USD 2.3 billion since 2020.

A significant portion of these imports comes from key suppliers, including Ireland, New Zealand and Italy, which together account for a large share of US dairy purchases. Ireland leads the pack, with US dairy imports valued at USD 908.8 million in 2024, followed by New Zealand at USD 765.1 million and Italy at USD 567.9 million.

Other notable sources of US dairy imports include Canada, France, Mexico and the Netherlands, each contributing substantial value to the total import figure. These countries play a crucial role in meeting the demand for specific dairy products not produced in sufficient quantities domestically, such as specialty cheeses, butter and milk powders.

Butter

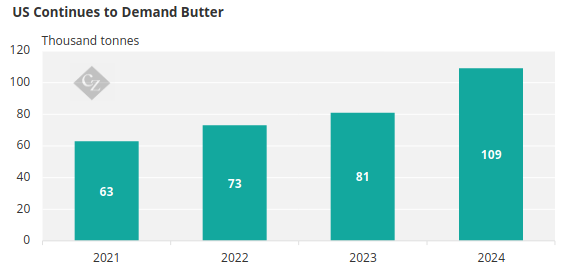

The US imported 109,000 tonnes of butter in 2024, a 34% increase compared to 2023. The US sources most of its butter from the EU, with Ireland being the largest supplier by a substantial margin. France, Germany, the Netherlands and Finland are also within the top 10 supply partners.

Source: CLAL

However, this growing reliance on EU butter comes amid heightened trade tensions between the US and the EU. Recently, President Donald Trump announced plans to impose 25% tariffs on EU imports, asserting that the EU was established to disadvantage the US.

The EU has vowed to react “firmly and immediately” to what it considers unjustified tariffs. While these threats have so far focused on products like steel and aluminium—regardless of country of origin—and retaliatory measures are expected to target key US industries such as bourbon, jeans and motorcycles, there are concerns that the scope could soon extend to agricultural products like dairy.

Given that butter imports are heavily weighted toward the EU, any introduction of reciprocal tariffs or further trade disputes could disrupt supply chains and drive up costs for US consumers. With trade tensions remaining high, the future of US-EU dairy trade remains uncertain.

Whey Powder

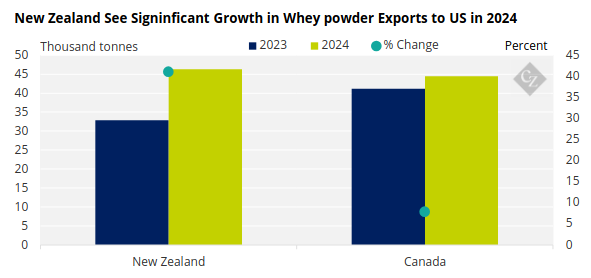

In 2024, the US imported 97,000 tonnes of whey powder, with Canada and New Zealand standing out as the two largest exporters by a significant margin. Other key suppliers included Germany and Denmark.

Trade tensions between the US and Canada remain high, with both nations threatening 25% tariffs on agricultural goods, a move that could impact dairy products if enacted. Meanwhile, relations between the US and Denmark are strained due to ongoing disputes over President Trump’s controversial remarks about acquiring Greenland. If tensions escalate, Denmark could become a target in a broader trade conflict.

In contrast, New Zealand, which supplied 46,312 tonnes—nearly half—of the US’ whey powder imports, remains optimistic about its trade relationship with the US. New Zealand Finance Minister Nicola Willis emphasised the strength of this partnership, stating, “New Zealand is distinguished in that we have a very balanced and complementary trade relationship with the United States,” and expressed hope for continued positive engagement.

New Zealand’s whey powder exports to the US saw significant growth in 2024, rising 41% compared to 2023. This surge surpassed Canada, making New Zealand the US’s top whey powder supplier for the year.

Source: CLAL

As tensions with suppliers like Canada and Denmark rise, New Zealand’s robust dairy industry could step in to fill the gap, not only for whey powder but also for other dairy products, ensuring continued stability in the US market.

Fat Filled Milk Powder

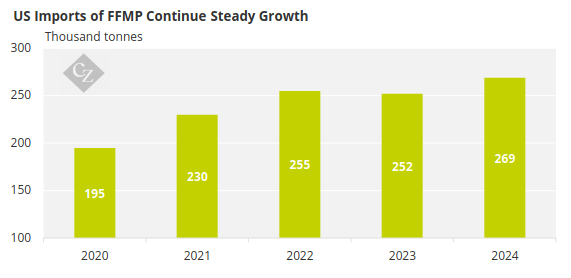

Fat-filled milk powder (FFMP) is the largest import for the US, primarily due to the broad HS Code under which multiple related products fall. In 2024, the US imported 269,000 tonnes of FFMP, which has been growing steadily over the past four years.

Source: CLAL

The US sources most of its FFMP from Canada, with other significant exporters including China and Mexico, all of which are primary targets of US tariffs. Vietnam is also among the key exporters of FFMP to the US, although its trade relationship with the US presents some challenges.

In 2024, US goods trade with Vietnam totalled USD 149.6 billion. The US exported USD 13.1 billion to Vietnam, but imported USD 136.6 billion in goods, resulting in a trade deficit of USD 123.5 billion. This represents an 18.1% increase from 2023, highlighting an ongoing imbalance.

While Vietnam is a growing source of FFMP, the overall trade deficit makes it a less balanced trade partner for the US.

Looking Ahead

The likelihood of disruptions to the US dairy market remains high due to ongoing trade tensions with many key trade partners. However, emerging markets in Asia and Latin America are showing a growing ability to satisfy at least some of the US’ dairy needs. While these markets may help fill some of the gaps, they will need time to scale up and fully offset losses from traditional markets like China and Canada.

Countries like Australia and New Zealand, with robust and established dairy industries, could also step in to supply dairy products, especially cheese and whey powder, as US trade relationships with some traditional suppliers continue to weaken. New Zealand, in particular, has already seen significant growth and could play a more prominent role in the US market, helping to mitigate disruptions.