Insight Focus

- The Panama Canal is vital for Asia – US East Coast trade.

- This summer’s dry season in Panama may be harsher than previous years.

- This will increase costs and certainty for shipping companies, and cost the global economy.

Panama Canal Runs into Issues

The Panama Canal is one of the world’s greatest feats of engineering. The Canal sees about 14,000 transits per year carrying about 270 million tonnes of cargo. The Asia-US East Coast is the busiest vessel trade route in the world, and the existence of the Panama Canal saves ships up to 8,000 nautical miles by allowing them to transit through the Americas instead of around South America’s southern tip.

The canal is fed by rainwater, which is drawn from Panama’s Gatun Lake. But recently, water levels at the lake have been extremely low due to droughts.

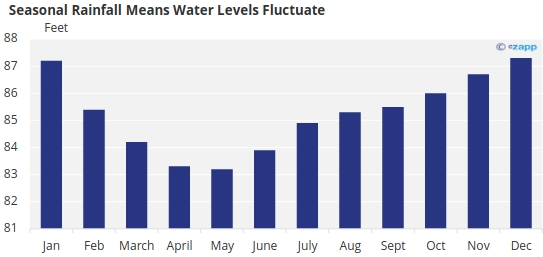

Generally speaking, the lake does experience seasonal water levels, but on average the lowest levels are experienced in May, with more rainfall causing levels to rise again in June and July.

Source: Panama Canal

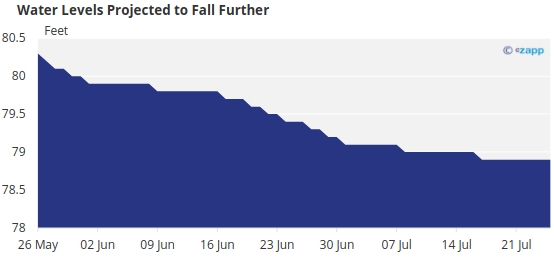

However, as we approach the months of June and July, the lake’s water levels are predicted to drop instead of rising.

Source: Panama Canal

Volatility Becomes More Common

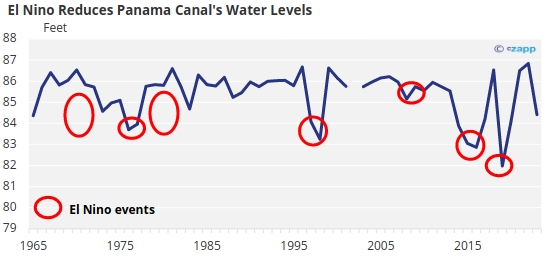

This kind of disruption has been experienced previously. During El Nino events, there is generally lower precipitation in Panama – particularly on the Pacific side where Gatun lies. In contrast, during La Nina, rainfall tends to be above average and often flooding occurs.

Note: No data provided for 2002

Source: Panama Canal

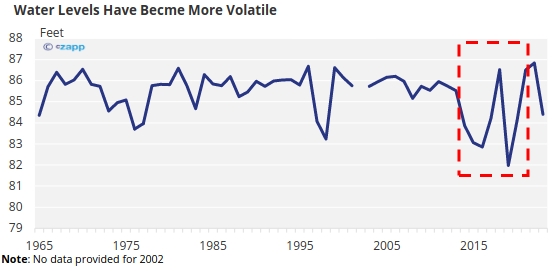

According to climate scientists, there is now a 90% chance of an El Nino event in 2023, meaning limited water levels in the Panama Canal. And even without El Nino, it seems that we have entered a period of extreme weather volatility exacerbated by climate change, which will lead to huge disruption in global trade.

Source: Panama Canal

Shipping Caught in the Crossfire

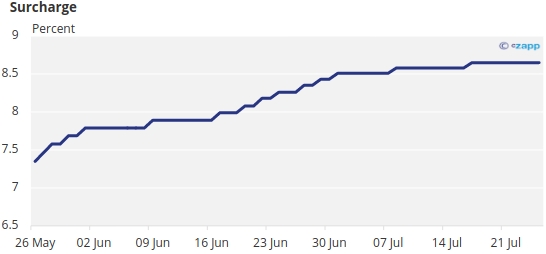

Vessels transiting the Canal already pay toll fees and increased insurance premiums due to a higher risk of piracy. Carriers pass this fee onto clients in the form of a Panama Canal Charge (PCC). Effective June 1, CMA CGM’s PCC will be USD 300 per container, while Maersk imposes a tiered system based on container sizes and cargoes.

These charges go up based on the charges levied by the Panama Canal Authority and are set to rise as water levels drop.

Source: Panama Canal

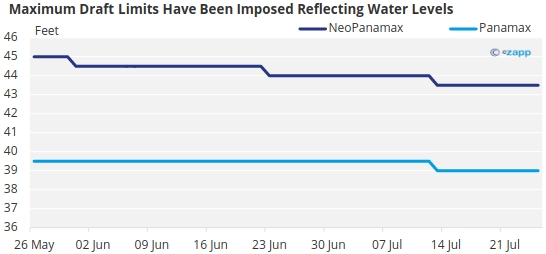

Not only this, but maximum draft limits are being imposed by the Canal due to the low water levels, which means vessels will need to sail with less cargo.

Source: Panama Canal

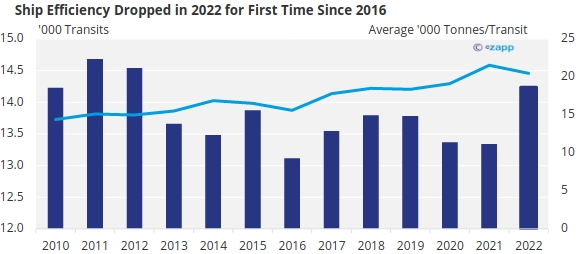

This has obvious financial implications for shipping companies and their customers. Already in 2022, efficiency dropped for vessels transiting the Canal. While in 2021, the average number of tonnes per transit was just over 21,500, in 2022 it dropped to less than 20,500 tonnes.

Source: Georgia Tech Panama Logistics Innovation & Research Center

This means shipping companies took more journeys carrying less cargoes. Given the draft restrictions and looming weather events, this trend looks likely to continue.

US East Coast Ports Could Suffer

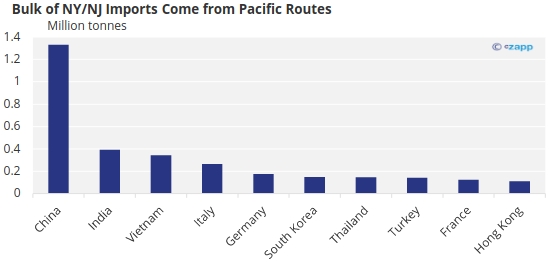

One of the biggest implications for the issues with the Canal’s water levels is a redistribution of trade from the US’ West Coast to the East Coast. China is still the US’ largest trading partner and for the major East Coast port (New York-New Jersey) and the major West Coast port (Los Angeles) the bulk of imports come from Asia.

As of March, trade at the Port of Los Angeles was down almost 25% from the same month of 2022. For about a year now, the port has been disrupted by a major labour dispute, and some shippers have chosen to divert cargoes away from the port as a result.

However, there are signs there may be a resolution to the issues. According to news outlets, a “tentative agreement” may have been reached . US West Coast ports therefore could be a good alternative for Asian shippers facing issues transiting the Canal to reach the East Coast.

Concluding Thoughts

- Issues with water levels in the Panama Canal have existed for many years.

- Shipping companies already have fee structures in place to pass on additional costs.

- But climate change is causing significant long-term changes in weather patterns.

- The Canal is likely to become a bottleneck for global trade if these weather events persist.

- Shippers will need to look closely at margins and efficiency as more of these challenges loom.