Insight Focus

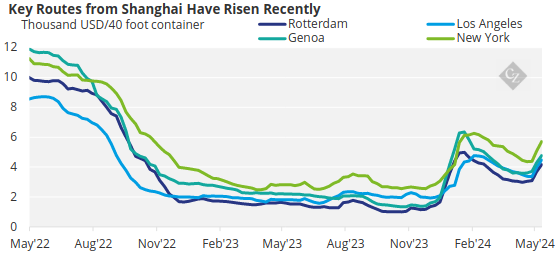

Container market struggles to cope with global conflict and weather issues. Peak season is approaching. This means that rates are likely to remain high for a sustained period.

Peak Season Approaches In a normal container market, there is some seasonality. For instance, the run up to Lunar New Year in Asia normally brings an uplift in prices due to stockpiling ahead of the holiday.

This “peak season” in the western world tends to be seen over the summer as importers stock up for the winter holiday period. Last year, high stockpiles in key importing markets like the US meant that peak season never really materialised.

However, this year, global conflicts and weather-related disruption have led to a rise in freight rates – and the extra demand from peak season could lift them even higher.

Source: Drewry

Stocks & Inventories Decline

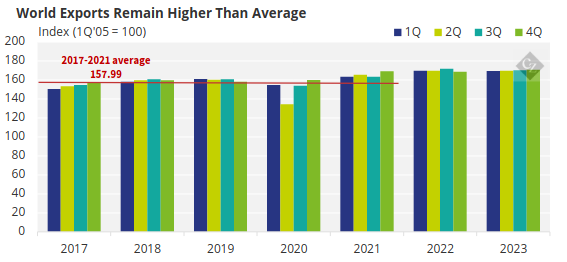

At first glance, it seems like the world should be well stocked with goods. In 2022 and 2023, world merchandise exports were consistently higher than the previous five-year average.

Source: WTO

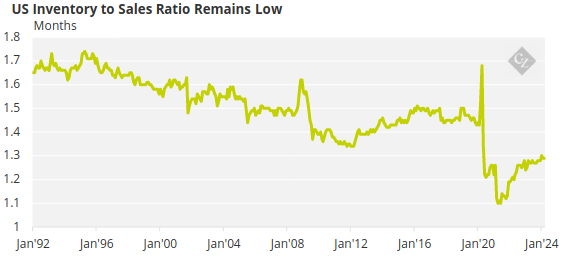

However, if we look at a key importing market – the US – it seems that inventories compared to sales are at historic lows. The below chart shows the number of months covered by existing stocks. Currently, there are around 1.3 months of inventory available, compared with about 1.5 months throughout the early 2000s.

Source: St Louis Fed

These inventory levels are probably lower than normal as a result of retailers choosing to hold less stock. Although low, this number has been climbing, but these levels do leave the US susceptible to any future supply chain disruptions.

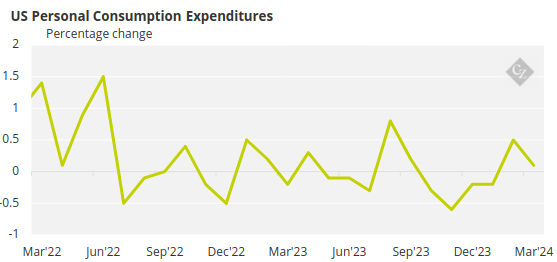

This is exacerbated by a potential increase in demand. The latest PCE data shows that US consumption of goods seems to be returning to positive territory after a slump during 2022 and 2023.

Source: US Bureau of Economic Analysis

Logistics Issues Continue

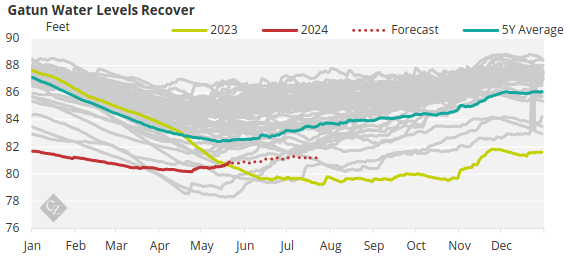

Lately, there have been plenty of disruptions in the form of weather and global conflict situations. Throughout the second half of 2023, the water levels at the key feeder lake of the Panama Canal were at historically low levels due to El Nino.

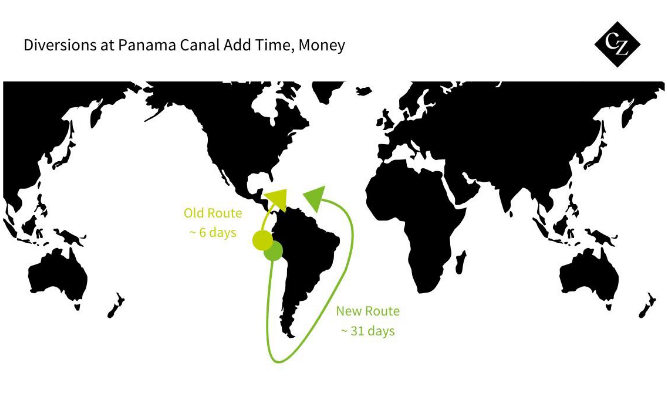

This forced authorities to restrict transit through the Canal and some vessel operators even found new routes. Of course, this pushed up journey times and meant vessel availability was lower.

Water levels at the Canal now seem to be recovering and draft restrictions are slowly being removed. However, water levels are still not nearly at historical levels and are likely to take a long time to recover.

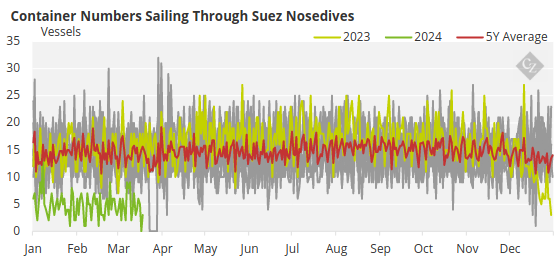

At the same time, there is major disruption at the Suez Canal as a consequence of the Gaza invasion. The number of container vessels sailing through the Suez Canal – the shortest route from Europe to Asia – has nosedived.

Source: UNCTAD

There are also reports that carriers are removing large vessels from Red Sea destinations. This has caused more congestion in transshipment hubs as more feeder vessels are routed through these ports. Vessels are also yet to be relocated to their new routings, causing blank sailings.

Vessel Availability Drops

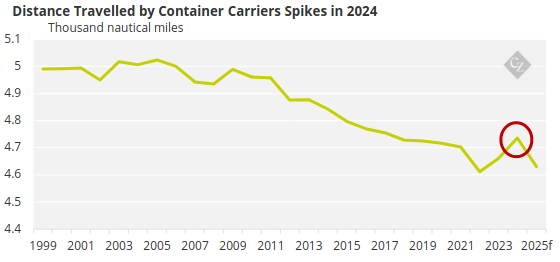

These longer routes mean there is less vessel capacity, higher tonne-miles and consequently, rates are forced upwards.

Source: UNCTAD

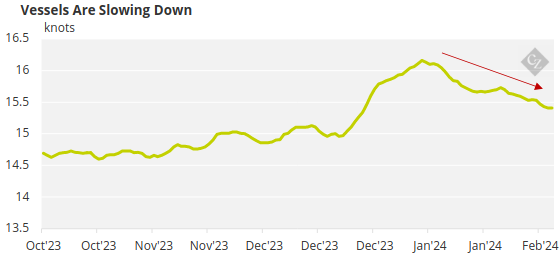

Meanwhile, sailing speed have also dropped, which puts greater pressure on availability.

Source: UNCTAD

In the longer term, there is more incentive for vessels to travel slower due to environmental regulations that penalise highly emitting vessels. According to UNCTAD, there is a 2.2% rise in fuel consumption for every 1% in a container ships’ speed.

Why Are Container Rates Rising?

- Demand is starting to rise in western markets ahead of peak season.

- Inventories – particularly at the US — are at all-time lows and retailers are likely going to have to continue building stocks.

- The market is speculating that the Fed will begin cutting interest rates this year, which is likely to increase demand further.

- This comes at a time of lower vessel availability due to logistics issues.

- As a result, freight rates are rising.

- Given that peak season usually wraps up by August or September, this means rates are unlikely to fall until at least the end of the third quarter.