Insight Focus

- Peruvian prices of household goods, including sugar have soared.

- To curb this trend, the government removed value-added tax on these products.

- However, the price of sugar has yet to fall due to restricted supply and strong demand.

Sugar prices have risen continuously in Peru, but attempts by the government to curb prices by removing value-added tax (VAT) on it have so far failed to have an effect

Peru Attempts to Curb Prices

On 1st May, authorities in Peru removed VAT on key consumer products, including sugar.

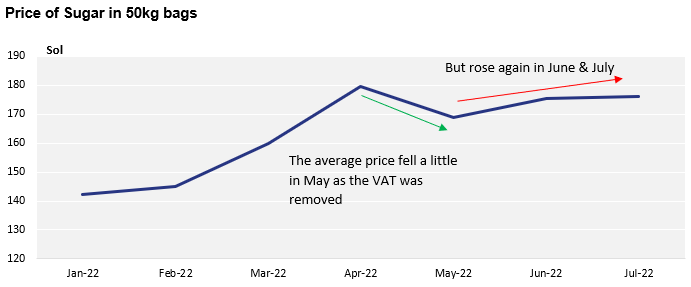

The price of sugar reached a record high in April, reaching 180 Sol per 50kg (USD 940/tonne), surging 55% in the space of five months.

Even though VAT on sugar was 18%, the price barely dropped after it was removed, and even rebounded to the highs in June.

This is due to various factors, but predominantly high world market prices, high import costs and a lack of sugar in the region.

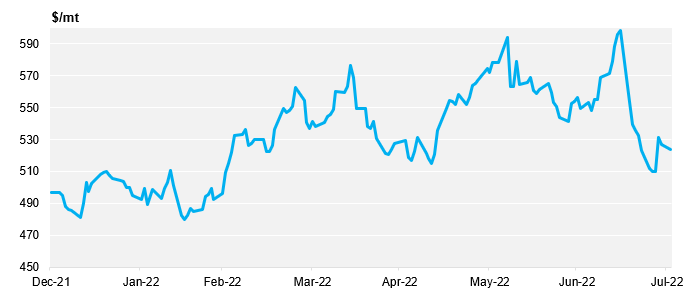

Firstly, the world market price for sugar has increased throughout 2022, making sugar more expensive around the world.

No.5 price chart

Container freight difficulties are well documented and Peruvian ports have been severely affected.

This has meant that getting any sugar into Peru has been complicated, but also much more expensive than previously.

On top of this, regional availability is very tight at the moment, meaning that there’s little sugar to ship, and anything that does is very expensive to deliver in Peru.

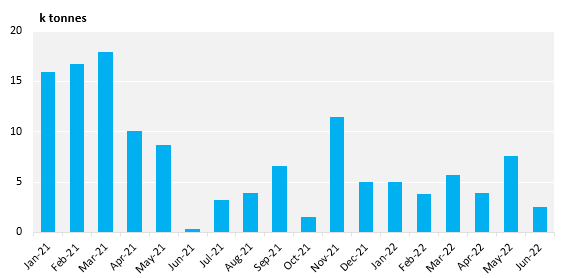

Colombia is usually the largest exporter of sugar to Peru, but has been suffering through a shortage in production.

Colombian exports of Sugar to Peru

As a result, attempts by the government to help the reduction of price has not worked. It is possible the VAT exemption also led buyers to increase demand to make the most of the exemption, in turn supporting prices while availability was low.

Will the Government Make Any More Changes?

The VAT exemption finished last week, and as result Peruvian sugar prices are likely to increase. Supply from Colombia has not been growing because rain is continuing to flood the Cauca valley. This will mean supply in Peru will remain tight for the foreseeable future.

The next available origin for supply will be Central America, but the crop does not start until November, and the container crisis does not look to be resolving soon.

Other Insights That May Be of Interest…

Future Food Security Jeopardised by Short-Term Price Taming

Have the Indicators the Supply Chain Should Monitor Changed?

Explainers That May Be of Interest…