Insight Focus

- Peruvian sugar consumption growth meagre in recent years.

- Taxes, labelling nudge consumers toward low-sugar lifestyles.

- Industrial consumers using alternative sweeteners more.

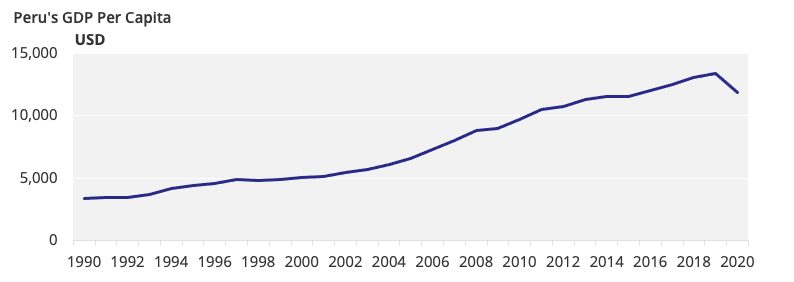

We think Peruvian sugar consumption has peaked because the country’s population growth, fertility, GDP, and urbanisation rates are declining.

In addition, sugar taxes are causing consumers to adopt healthier, low sugar lifestyles, which should help cap demand.

Peru’s Sugar Consumption Growth is Flattening

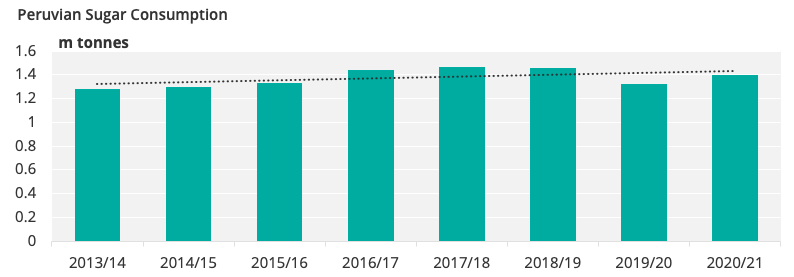

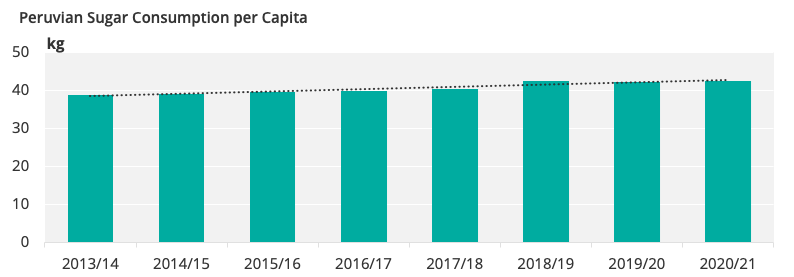

Peru consumes around 1.4m tonnes of sugar a year, making it the fourth-largest sugar consumer in Latin America, behind Mexico, Argentina, and Colombia.

This equates to around 40kg per capita, similar to other places in Latin America. Colombia consumes around 42kg of sugar on a per capita basis whilst Mexico and Chile respectively consumed 39kg and 42kg before their governments introduced taxes and nutritional labels.

We now think national consumption has peaked, though, for the following reasons:

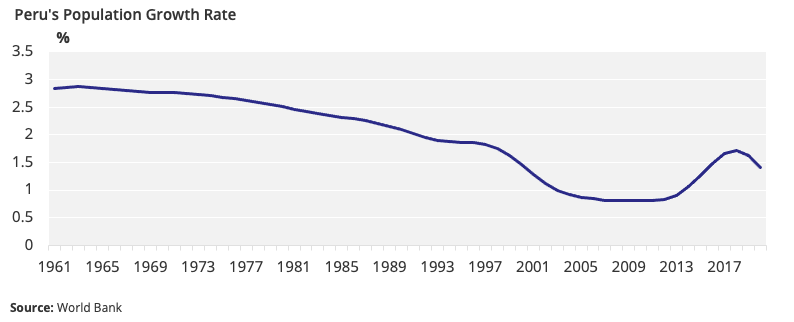

Peru’s Population Growth Rate is Slowing

Firstly, Peru’s population growth rate started to slow in 2018 and it hasn’t picked up since.

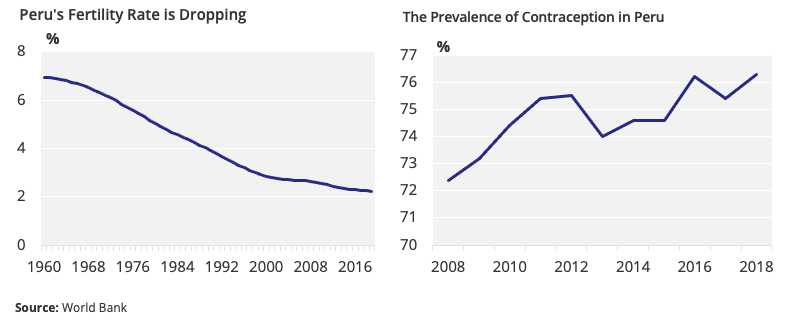

This is perhaps because Peru’s fertility rates are falling because of a more widespread use of contraception.

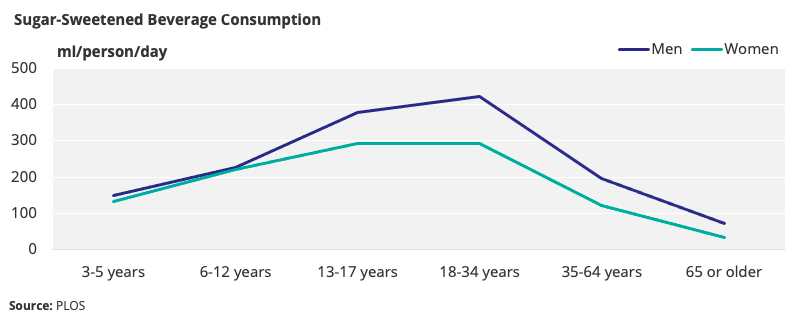

This can push sugar consumption down because, as a country’s population growth decreases, the size of its ageing population increases, as the elderly tend to consume less sugar.

Peru’s Rate of Urbanisation is Also Slowing

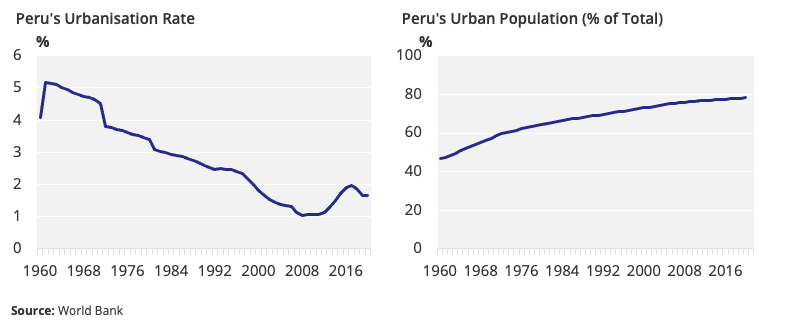

Peru’s urbanisation rate also started to dip in 2017, which, again, isn’t good for sugar consumption as we generally assume that, as countries become more urban, they consume more sugar.

This is because access to areas where sugar consumption is more common increases (such as restaurants, bars, and theatres). The average disposable income also tends to be higher in more urban areas, as does the prevalence of convenience foods, which often contain more sugar.

Government Promoting Low-Sugar Lifestyle

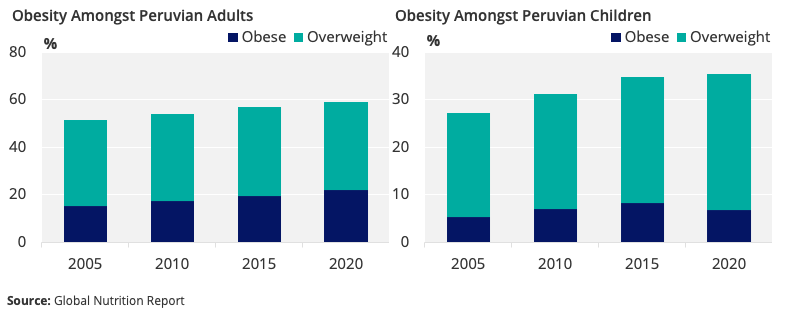

In 2014, the Peruvian government passed a law designed to promote healthy food to children and adolescents. The law imposed strict rules on the advertising of high-sugar products to combat rising obesity.

Later, in 2017, the government pushed for clearer labelling on products that contain sugar.

In 2018, it introduced a tax on sugar-sweetened beverages, similar to the one in Chile, where drinks containing more than 6 grams of sugar per 100ml are subject to a 25% duty, and those with less are taxed at 17%.

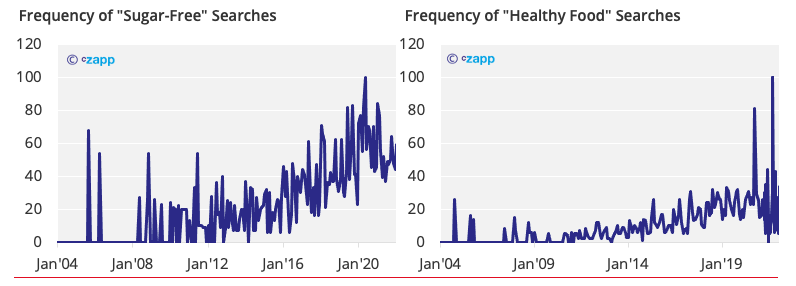

Since these measures were introduced, Peru’s obesity levels have continued to climb. Nevertheless, signs are emerging that consumer behaviour is starting to change, with Google Trends data revealing recent spikes in sugar-free and healthy food searches in recent years.

Granted, some of these spikes occurred years after the government measures were introduced, but others match their timeline.

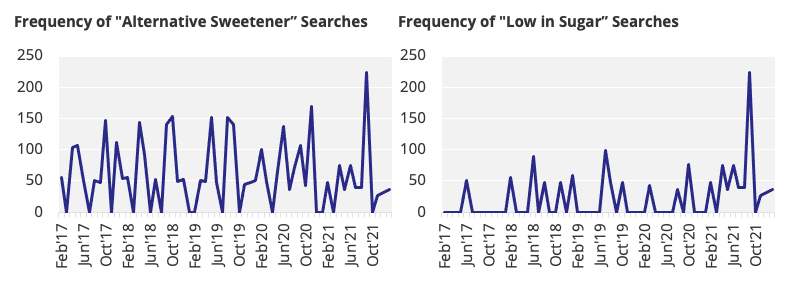

Government policy also appears to have influenced Peru’s industrial consumers who have been shifting to alternative sweeteners, which aren’t taxed as highly and contain fewer calories than sugar. Some industrial consumers have reformulated products, so they don’t need to put on nutritional labels, and their margins aren’t hit by taxes.

Concluding Thoughts

The Peruvian government hopes its regulatory measures will reduce sugar consumption as they did in Chile and Mexico. In both Mexico and Chile, per capita consumption dropped by 3kg and 2kg two years after the measures were implemented.

Although obesity levels have continued to climb following the implementation of sugar taxes and labelling, Peru’s efforts seem to be making consumers more willing to adopt healthier lifestyles and low-sugar diets.

Industrial consumers have also reformulated their products either by lowering the sugar content or switching to alternative sweeteners.

With Peru’s consumers and producers both seemingly becoming more health conscious, we believe sugar consumption there has peaked. Future growth will be held back by shrinking population, urbanisation, and GDP growth rates.

Other Insights That May Be of Interest…