Insight Focus

- PTA futures buoyed by rising crude prices and tight PX supply.

- PET resin export prices stabilise after sharp decline, margins being squeezed.

- European producers seek registration and early imposition of provisional anti-dumping duties.

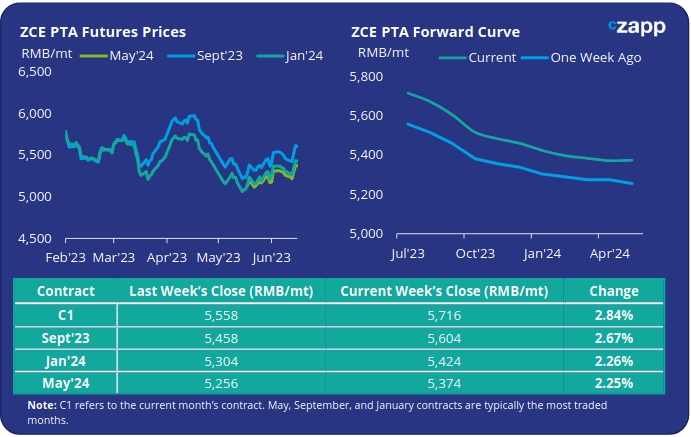

PTA Futures and Forward Curve

- PTA futures performed strongly last week, up by nearly 3% on strengthening crude prices and tight PX supply.

- Oil prices fluctuated, yet by Friday, crude was on course for a weekly gain on higher Chinese demand and OPEC+ supply cuts.

- Despite several PTA plants restarting production following turnarounds, polyester production remains high and PTA inventories relatively low.

- However, unplanned PX production cuts at several units have led to tighter supply of PX for some PTA producers.

- As a result, the PTA-PX spread has narrowed, raising the possibility of lower PTA operating rates in the future.

- The forward curve remains backwardated, by Friday, the Sept’23 contract was trading at a RMB 112/tonne discount to the current month.

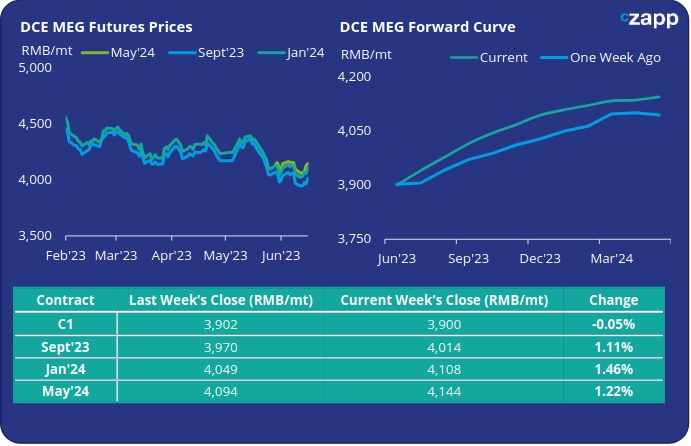

MEG Futures and Forward Curve

- MEG Futures closed marginally higher last Friday, in part tracking the near-term crude oil trend, buyers remain cautious on supply/demand prospects.

- Whilst port inventory levels continued to ebb lower, falling 1.1% last week to 927k tonnes, fresh cargoes from the US and Middle East are expected to arrive in China late-June and July.

- Domestic production has also been increasing following turnarounds, with Zhejiang Petroleum & Chemical also planning to restart 1.55Mt MEG production capacity.

- Therefore, much lies on the demand-side to soak up the added supply. While polyester operating rates remain high, downstream textile mills have lowered production due to weaker order intake.

- As a result, polyester operating rates could come under pressure in July, dampening demand, moving the balance into oversupply.

- The MEG forward curve steepened last week, with futures prices steadily increasing over the next 12-months. By Friday the Sept’23 contract was holding a RMB 114/tonne premium to the current month.

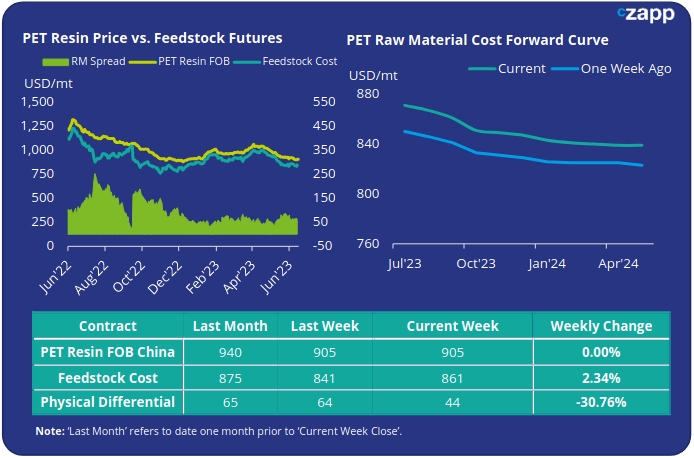

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices stabilised last week following the previous drop, averaging USD 905/tonne FOB on Friday, flat on the previous week.

- The weekly average PET resin physical differential to future feedstock costs decreased by USD 4/tonne to average USD 59/tonne for the week. By Friday, the daily spread had dwindled to just USD 44/tonne.

- Whilst the curve has floated higher versus the previous week, the shape of the PET resin raw material forward curve remains backwardated with costs expected to soften through the summer before flattening out in Q4’23.

- At Friday’s close, Sept’23 raw material costs were trading with at USD 10/tonne discount to Jun’23. Q4’23 costs are typically around USD 20/tonne lower than July futures contracts.

Concluding Thoughts

- The physical differential between future raw material costs and resin price has now retrenched to the multi-year lows seen back in April and early May.

- PET export prices are expected to remain weak, with further potential downside on the forward curve.

- European producers have also submitted a proposal for the registration and early imposition of provisional anti-dumping duties on Chinese PET resin imports.

- Margins are being squeezed right across the value chain, and any upside constrained by increased supply.

- As a result, crude and macroeconomic outlooks will be increasingly important on price direction.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.