Insight Focus

- PTA Futures stymied by an underwhelming OPEC+ meeting and increased supply.

- PET resin export prices keep rangebound, after producers fail to gain upward momentum.

- Forward curve for Chinese PET resin exports looks to have bottomed out.

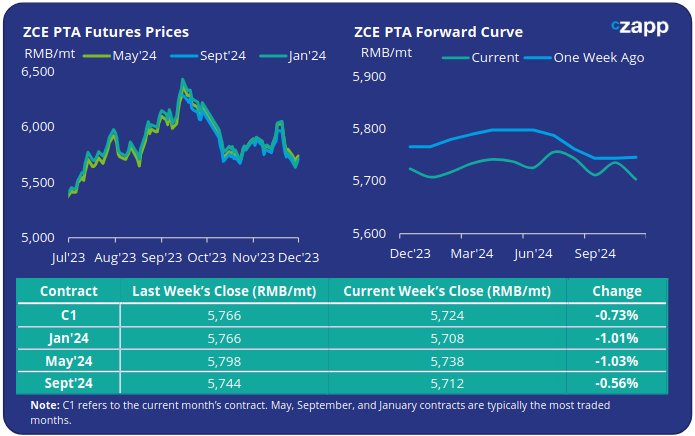

PTA Futures and Forward Curve

PTA Futures were down once again last week, dropping a further 1% on the previous week’s close, dragged lower by falling upstream prices and weaker fundamentals.

After staging something of a rally through the first half of the week, with Brent reaching over USD 84/bbl, oil prices retreated on Thursday afternoon, after the announcement of voluntary production cuts by OPEC+ members.

In the absence of a coordinated strategy from the group’s leadership, brent crude oil prices sank back down to USD 80/bbl on Friday.

PX prices also slid lower Friday, with ample PX supply continuing to squeeze the PX-Naphtha spread.

PTA fundamentals showed signs of weakness, as lines retuned from maintenance pressing production higher.

Whilst high polyester operating rates continued to support demand, supply increases have outstripped those from the demand side.

Inventory accumulation is expected through December, with traders selling out of positions exacerbating the market weakness.

This was reflected in the PTA-PX spread on a CFR spot basis, which weakened through last week, dropping from USD 101/tonne to USD 93/tonne. Although the weekly average kept flat.

By Friday, the PTA forward curve remained broadly flat/slight contango; the May’24 contract was at a RMB 30/tonne premium to the main Jan’24 contract.

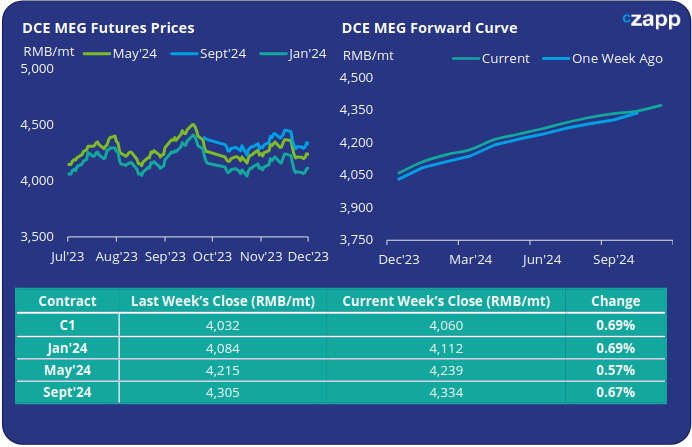

MEG Futures and Forward Curve

MEG Futures increased slightly last week, following the larger sell of the previous week.

Main port inventories showed a very slight decline last week, down just 0.58% to 1,173k tonnes by Friday. Port inventory is expected to decrease slightly into early December due to a slowdown in deep seas arrivals but maintain high levels overall.

However, domestic MEG operating rates continue to increase, which is likely to pressure market sentiment in the coming weeks. Yuneng Chemical’s new 400kta unit is also now commercially operational; Zhongkun’s 600kta unit is also expected to exit trial production soon.

Whilst high polyester rates support from the demand side, a seasonal easing of production is expected to occur through December and into January, adding to the likelihood of MEG stock accumulation over this period.

The MEG forward curve remains in contango over the next 12-months. Jan’24 futures are showing a RMB 52/tonne premium to the current month; the May’24 contract held a RMB 127/tonne premium over Jan’24.

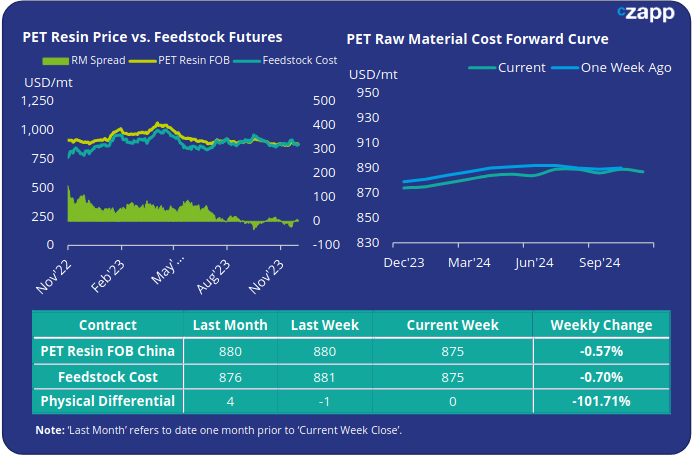

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices reached USD 875/tonne last Friday, broadly on par with the previous week, only USD 5/tonne lower.

The weekly PET resin physical differential swung higher into positive territory, increasing USD 12/tonne to average USD 5/tonne for the week.

However, by Friday, the daily spread was back at zero. Will we now start to see spreads move in a channel higher or simply oscillate back down once again.

Whilst the raw material cost forward curve remained in a slight contango position through to mid-2024. The May’24 and Sep’24 contracts were both at a USD 10/tonne premium to Jan’24.

Concluding Thoughts

Although October saw an increase in new order intake, largely for forward business, momentum seems to have fizzled out through November.

Now entering December, producers continue to report an underwhelming volume of enquires, as some PET bottle chip units also return following turnarounds, pressuring sales further.

Weaker demand for Chinese and Asian resin is echoed in almost every key destination market, where buyers are either experiencing a slowdown in consumer demand, or our taking a more conservative approach to buying due to demand uncertainty in 2024.

In the Middle East, changes in retail product selection and consumer choice due to the Gaza conflict have also subdued the market.

And despite Sanfame’s comparatively low level of provisional EU ADD, and aggressive pricing from other Asian origins, European buyers are increasingly leaning into domestic supply off-the-back of very attractive contract offers.

Taking into consideration projected PET resin margins, and the slight contango in raw materials, the forward curve for Chinese PET resin exports looks to have bottomed out. May’24 China export prices could see around a USD 60/tonne premium to current spot values.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.