Insight Focus

PTA Futures slipped a further 0.5% despite a rebound in crude following the Fed’s rate cut. Asian PET resin export prices remained steady having previous hit multi-year lows. There is a potential market bottom with raw material and PET forward curves showing premiums.

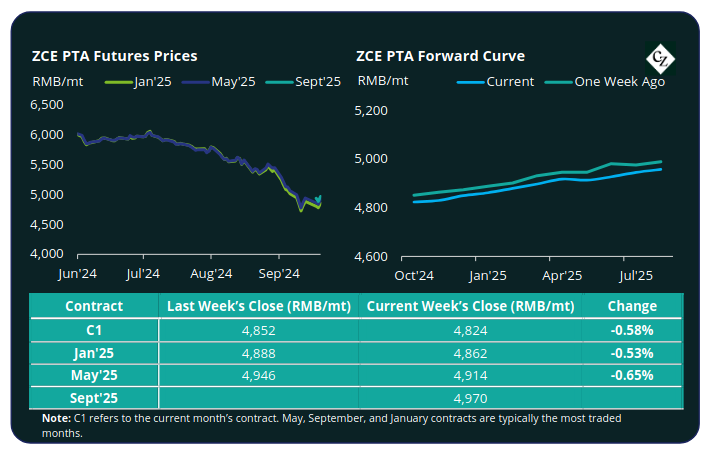

PTA Futures and Forward Curve

PTA futures weakened by a further 0.5% last week, dragged down by weak PX fundamentals, despite crude rallying and ending the week with a rare gain.

Chinese Futures were closed September 16-17 due to the Mid-Autumn festival, reopening Wednesday for a shorter week.

Brent crude reached over USD 74.50/bbl on Friday, up nearly 5% from the previous week, supported by the Fed’s decision to cut the key interest rate by 0.5%.

The average weekly PX-N spread contracted by a further dragging PTA prices down, despite the PTA-PX CFR spread remained steady. The average PTA-PX spread was around USD 75/tonne last week.

During last week’s festival, Typhoon “Bebinca”, the strongest typhoon in 75 years, slammed into Shanghai impacting regional PTA production.

Combined with delayed restarts at other plants due to poor margins, overall PTA operating decreased. Downstream polyester producers also stocked up ahead of Golden week, improving sentiment.

Although PTA inventories continue to ease, stock remains relatively high and spot availability sufficient, PTA fundamentals are expected to remain steady in the near-term.

The PTA forward curve continues to show a carry; Jan’25 had a RMB 38/tonne premium over the current month’s contract, with Mar’25 at RMB 90/tonne premium over Sept’24.

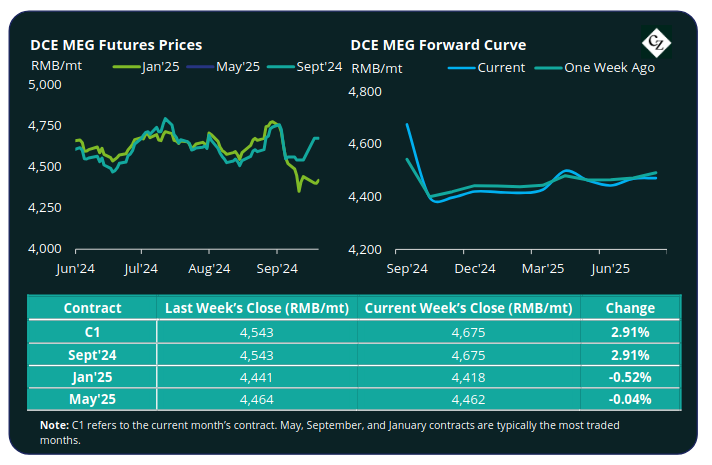

MEG Futures and Forward Curve

In the MEG Futures, beyond the soon to end current Sept’24 contract, the Jan’25 main contract month softened by around 0.5% last week.

East China main port inventories increased by around 1.1% to 554,000 tonnes by last Friday, with deep sea arrivals increasing and lower offtake due to Typhoon related shipment delays.

Whilst destocking is apparent, as the market begins peak season, deep-sea arrivals are expected to continue to increase through into October, as US supply gathers pace again following recent hurricane disruption.

As a result, inventory reduction likely to slow, moving towards accumulation through Q4’24. As a result, MEG fundamentals are expected stable-to-soft.

Beyond the current month, the MEG forward curve remained relatively flat through H1’24. The Jan’25 contract holds a RMB 257/tonne discount over Sept’24, with May’25 at a RMB 213/tonne discount.

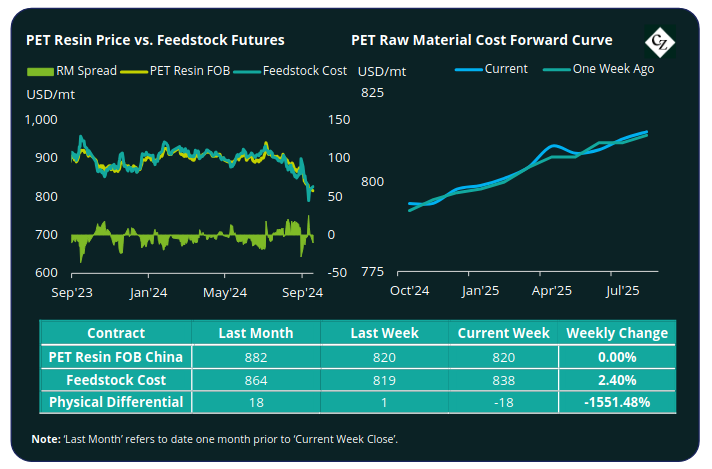

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept relatively stable following the mid-Autumn break ending the week flat at 820/tonne by Friday, same as the previous week.

The average weekly PET resin physical differential against raw material future costs decreased by USD 23/tonne to minus USD 13/tonne last week. By Friday, the differential had fallen further to minus USD 18/tonne.

The raw material cost forward curve maintained its modest forward premium, with Jan’25 feedstock costs holding a USD 5/tonne premium over the current month, and May’25 a USD 14/tonne premium.

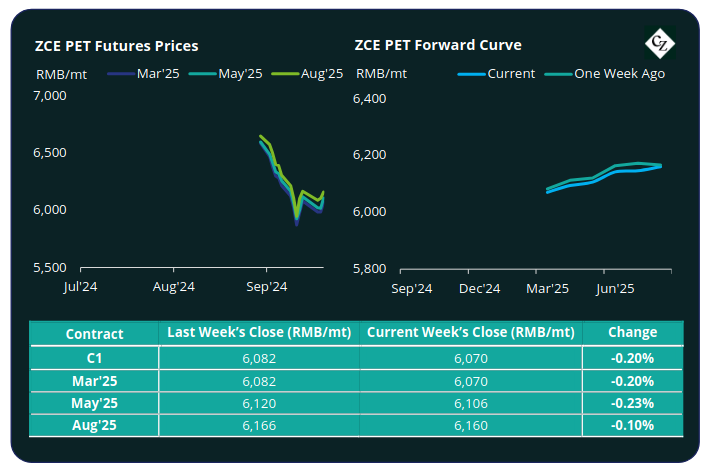

***NEW PET Resin Futures and Forward Curve

Mar’25, the first contract month of the new PET Resin Futures, closed very slightly down by just 0.2% last Friday.

With PET Futures falling slow than raw materials, the average weekly premium over Raw Material Futures increased by a few dollars to USD 17/tonne. By Friday, the daily premium had increased to USD 18/tonne.

The PET Resin Futures forward curve kept steady at similar levels to the previous week, with May’25 showing a small RMB 38/tonne premium and Aug’25 a RMB 90/tonne premium. Although current trading volume for contacts beyond Mar’25, the first contract month, is still limited.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

The PET resin export market stabilised following the mid-Autumn Festival in China, following the lows of the previous week. Despite the short trading week, prices firmed through to Friday with producers receiving strong order volumes on the lowest prices seen all year.

Buyers are also taking advantage of the sharp decline in freight on some lanes, particularly in the Northen Hemisphere where we’re now entering off-season. As a result, other Asian PET producers are also experiencing an increase in demand into Europe and North America.

In terms of price outlook, the raw material forward remains in contango with a forward premium, and beyond Mar’25 the PET Futures also show a carry suggesting that prices will experience a modest uplift through the next six to nine months.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.