Insight Focus

Raw material and PET resin futures continued to rally on the post-holiday reopening. PET resin prices across Asia followed suit, moving higher, giving buyers pause for thought. Macro factors are key to near term PET price direction as futures forward curves show limited premiums.

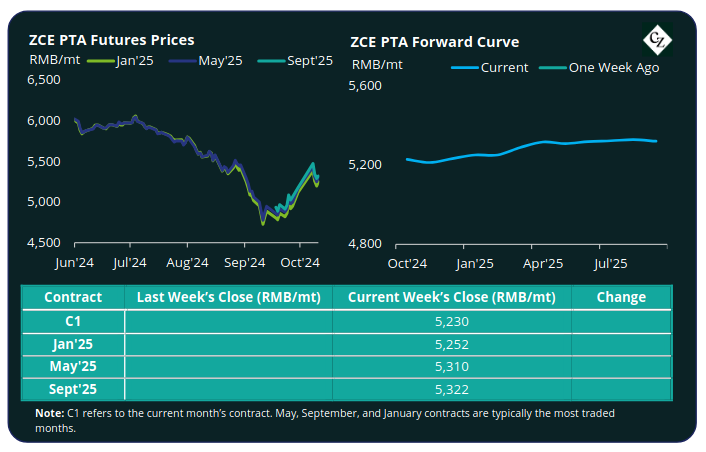

PTA Futures and Forward Curve

PTA futures surged on the market reopening following Golden week, correcting upwards on the back of the rise in crude oil and global commodities. PTA futures ended last week nearly 7% higher than September 27.

Brent oil has surged since the beginning of the month and the start of China’s Golden week. Brent crude oil was at around USD 73.50/bbl on October 1, leaping to touching distance of USD 81/bbl in just a week.

By last Friday, oil prices had eased with Israel’s attack on Iranian oil infrastructure failing to materialise and the limited impact of Hurricane Milton’s impact on US oil output, with Brent at around USD 78.70/bbl.

On average, last week’s PX-N spread was showed slight improvement versus the week prior to China’s National holiday.

Despite high polyester operating rates and improvements in PTA fundamentals before the market break, the PTA-PX CFR spread narrowed last week by around USD 5/tonne to an average of USD 74/tonne.

The pre-holiday stocking was a least partially to blame, combined with elevated port inventory levels, leaving many polyester factories and traders with ample inventories for the first half of October.

Looking ahead, the PTA market is expected to move into its traditional offseason in November/December. As a result, some PTA and polyester units will likely both move into maintenance, with modest stock accumulation.

The PTA forward curve has flattened slightly, with the Jan’25 holding a small RMB 22/tonne premium over the current month’s contract, and May’25 now at a RMB 80/tonne premium.

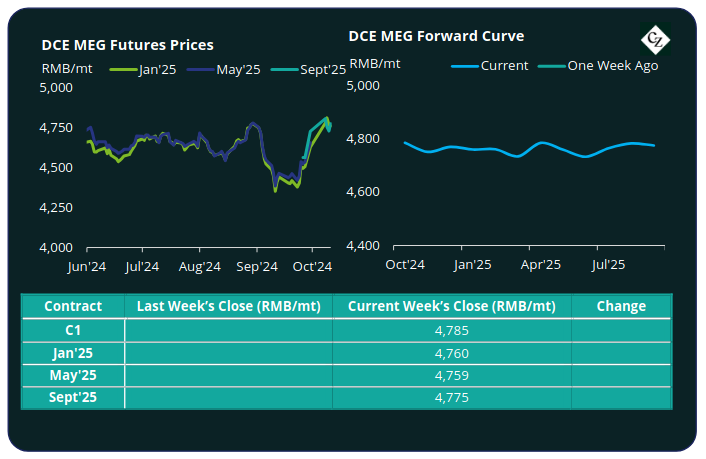

MEG Futures and Forward Curve

As with the PTA futures, MEG also opened strongly, up nearly 7% versus September 27. While global macro drivers created the surge, improved MEG fundamentals also lent support.

Polyester operating rates have increased strongly over the last month, leading into the traditional peak season, supporting both PTA and MEG demand. As a result, there’s been an overall reduction in inventory levels.

East China main port inventories decreased by around 6.4% to 529,000 tonnes compared to pre-holiday levels, with MEG fundamentals expected to remain strong through October.

The MEG forward curve remains flat through the first half of next year. Both the Jan’25 and May’25 contracts are at a small RMB 15/tonne discount over the current month.

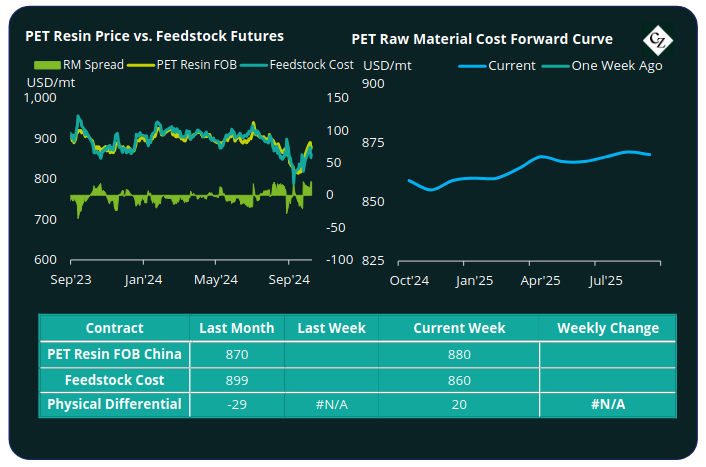

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices reopened strongly on higher feedstock costs, averaging USD 880/tonne by Friday, up USD 20/tonne on the last close before the break.

The average weekly PET resin physical differential against raw material future costs increased by USD 27/tonne to positive USD 17/tonne last week. By Friday, the daily differential was positive USD 20/tonne.

The raw material cost forward curve maintained its modest forward premium, with Jan’25 feedstock costs holding a USD 7/tonne premium over the current month, and May’25 at a similar level.

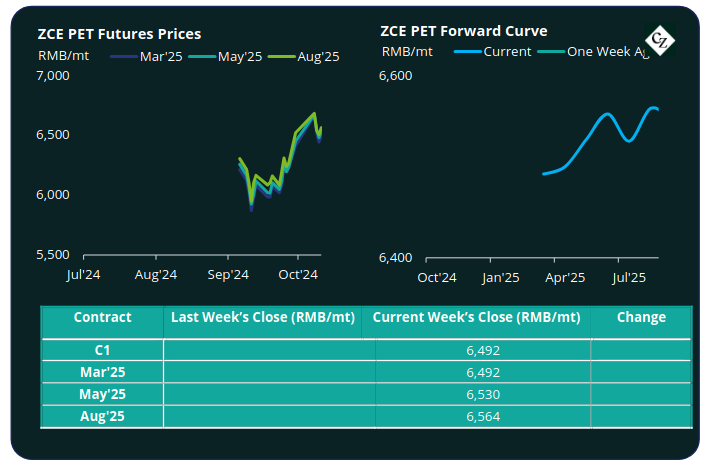

***NEW PET Resin Futures and Forward Curve

PET Resin Futures also continued their rally, with the Mar’25 contract, the first contract month of these new futures, adding over 4% on the week prior to the holiday break, to reach RMB 6492/tonne (USD 919/tonne) by Friday.

With the sharp rise in raw material prices, outpacing PET Futures, the average weekly premium over Raw Material Futures decreased to USD 13/tonne. By Friday, the daily premium was USD 12/tonne.

The PET Resin Futures forward curve moved into a slight carry, with May’25 now showing a RMB 38/tonne premium (USD 5/tonne) and Aug’25 a RMB 72/tonne premium (USD 10/tonne).

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

Asian PET resin export prices leapt following the reopening of the Chinese market, although price weakness was shown mid-week indicating resistance to higher values. At least in the near-term, the market is now in the hands of macro events and crude oil prices.

Physical differentials to raw material futures have widened significantly, following strong September sales with resin prices at multi-year lows.

Some Chinese resin producers are reporting to be sold out on some grades due to strong pre-holiday demand and export levels.

However, structural overcapacity is still a major factor that will likely constrain further upside. Sizable new PET resin capacity additions over the summer will take time to ramp up fully and are still to be fully digested by the market.

Whilst crude will dominate the underlying value, both the raw material and PET futures forward curves show only a modest USD 5-10/tonne premium through to next year’s summer season.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.