Insight Focus

- Improving macro-economic sentiment lifts crude as well as PTA and MEG futures.

- PET export prices continued to rally ahead of Chinese New Year.

- Across the polyester value chain, much now relies on the strength of restocking post-CNY.

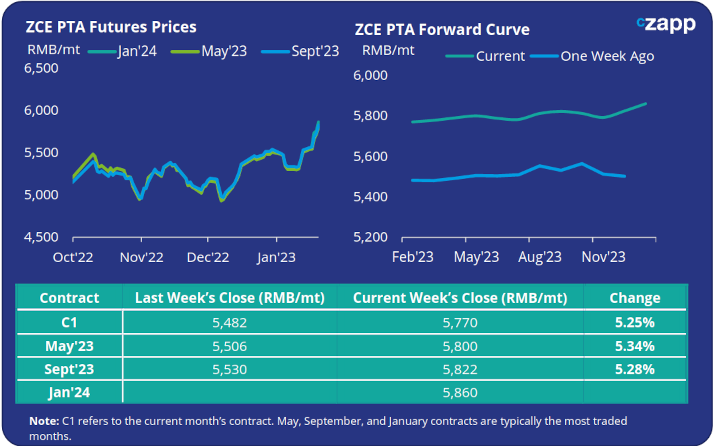

PTA Futures and Forward Curve

- PTA futures continued to rise heading into the Chinese New Year. Improving global economic sentiment, and more bullish expectations on a Chinese post-COVID recovery are key macro-drivers.

- Whilst increased crude and upstream costs have led prices higher since the beginning of January, the PTA/PX spread has narrowed further, depressed by weak downstream polyester demand as the market reaches its seasonal low point.

- Although downstream demand is anticipated to improve after the holiday, on the hopes of restocking activity, increasing PTA operating rates and new capacity additions are expected to continue to weigh on PTA margins.

- The current PTA forward curve remains relatively flat with a small forward premium; the May’23 contract closed the week trading at a RMB 130/tonne premium to current Feb’23 levels.

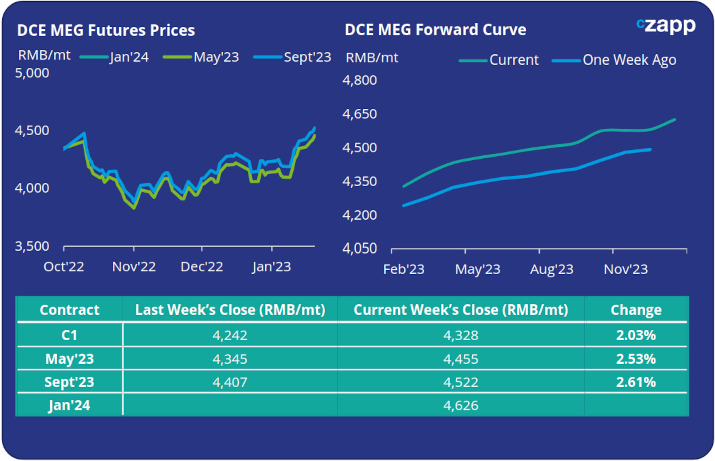

MEG Futures and Forward Curve

- MEG futures continued to recover ahead of the Chinese New Year with current month contracts up 2% on the week.

- MEG futures were driven higher by fresh restocking activity on the hopes of improved demand after the holiday. Reduced supply due to turnarounds and production cuts also supported the rise.

- East China main port inventories dipped slightly last week, down 0.1% bucking the recent trend of increasing levels.

- Although Chinese MEG units look continue to run at reduced rates until margins improve, the expected start-up of significant new Chinese and Indian MEG capacity will add pressure on the supply side.

- All eyes are now on the strength of demand following the Chinese New Year (21-27 January).

- The MEG futures forward curve remains in contango with the May’23 contract now at a RMB 127/tonne premium to the current Feb’23 contract.

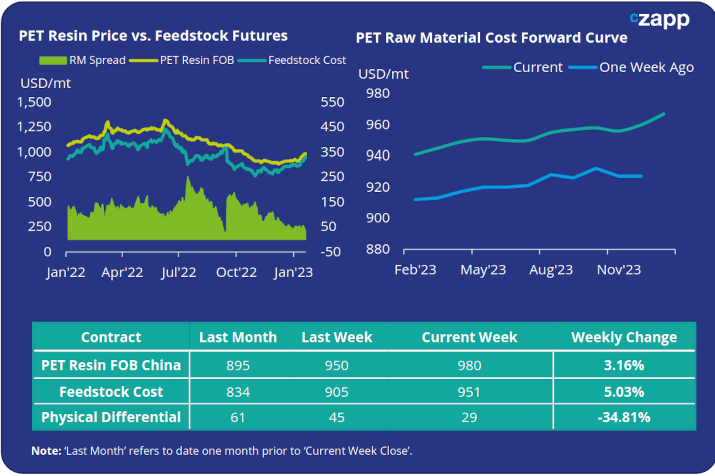

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continued to move higher quickly through the week, closing the week at an average price of USD 980/tonne, up USD 30/tonne on the previous week’s close and around USD 75/tonne on the month.

- The weekly average PET resin physical differential to feedstock costs was down slightly versus the previous week, averaging USD 45/tonne. However, by Friday the daily spread had narrowed to just USD 29/tonne.

- The PET resin raw material forward curve continued to move higher driven by increases in feedstock prices with an upward slope through the year. At Friday’s close, the May’23 contract was showing a premium of USD 10/tonne to the current month’s contract.

Concluding Thoughts

- Much will depend on crude oil price volatility in the weeks to come, itself ultimately pinned to the strength of China’s post-COVID recovery.

- With higher unemployment and a winding down of financial support over the last year, Chinese disposable incomes are much reduced compared to the 2020 COVID rebound.

- Therefore, although travel and consumption are set to boom over the Spring Festival period, the strength of restocking afterwards is questionable.

- Although the physical differential to future feedstock costs has narrowed, spot margins for exports have steadily increased through January, on tighter availability.

- Improvement in the physical differential is now also expected with major Chinese PET resin exporters increasingly sold out for February and March.

- However, further gains may be constrained by new PET resin capacity additions due in Q1/early Q2.

Please note the next PET Raw Material Futures Report will be published on the 6th February 2023 due to the Chinese New Year market close.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For information on the event click here or please get in touch at glamb@czarnikow.com