Insight Focus

- PTA futures fell sharply last week following crude’s retreat, dashed by COVID resurgence.

- Although PET export prices softened, demand and margins showed signs of improvement.

- PET resin producers face risk of Q1’23 sales shortfall, as zero-COVID threatens domestic market.

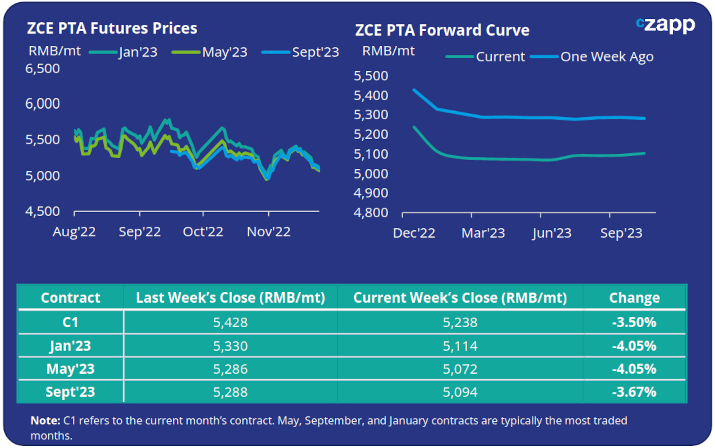

PTA Futures and Forward Curve

- PTA futures slumped last week as spiralling COVID case numbers and lockdowns in China rattled crude and global commodities markets.

- The PTA market continues to lack downstream support, as polyester plants continued to cut rates and destock ahead of year end.

- PTA margins remain low, with PX-PTA spread narrowing through the week. New PX and PTA production is expected to see inventories grow on slow polyester demand. PTA shutdowns are now expected.

- The current PTA forward curve remains slightly backwardated into year-end before flattening out in Q1, with the Jan’23 contract now trading at a reduced discount of 124RMB/mt to the current month.

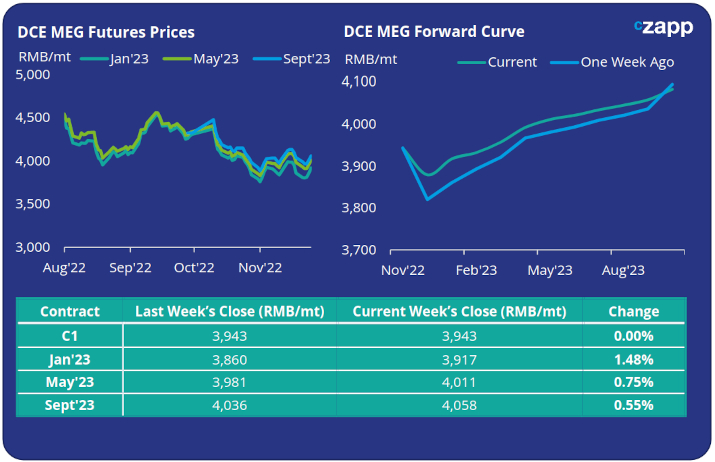

MEG Futures and Forward Curve

- MEG futures closed flat on the week, as prices continued to remain weak on low margins.

- Further polyester production cuts will weaken MEG demand, keeping MEG fundamentals bearish.

- Port inventory levels increased around 2% last week, despite reduced imports from other Asian and Middle Eastern producers, as domestic supply increased from Yulin Chemical’s new coal-to-chemical mega complex.

- The Jan’23 contract closed last week at a RMB 26/tonne discount to the current month. Whilst the forward curve is in contango, the market faces continued oversupply through Dec/Jan.

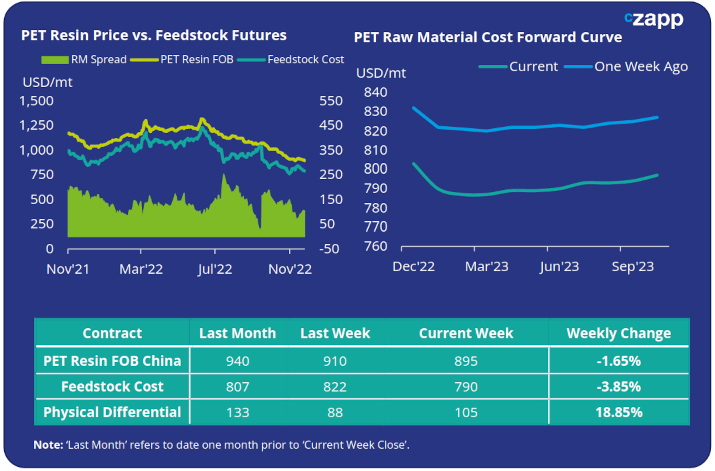

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices decreased marginally on last week’s close, moving down to an average price of USD 895/tonne by Friday.

- Some improvement in export demand was heard. However, overall export demand remains weak with producers very keen to hear firm bids, and with ample availability.

- The weekly average PET resin physical differential to feedstock costs increased with falling raw materials, up USD 23/tonne last week, to USD 104/tonne. By Friday, the daily spread was around USD 105/tonne.

- The PET resin raw material forward curve shows only a slight reduction into the new year, with the Jan’23 contract showing a marginal USD 13/tonne discount to the current month (December). A near-term market bottom for raw materials is apparent in the forward curve coming into the new year.

Concluding Thoughts

- With a slowdown in demand since September, export order intake has shown some signs of improvement over the last couple of weeks.

- The PET resin market traditionally sees an uplift in demand from mid-November to mid-December as producers target orders ahead of the Christmas holiday slowdown in key target markets, and to make arrangements for January shipments ahead of the Chinese New Year period in February.

- Inventory levels remain elevated compared to earlier in the summer, although stock levels are currently far from excessive. That said most Asian origins have ample supply and can ship within 4-weeks, reflected in narrowed export margins.

- Whilst domestic demand is expected to improve as bottlers come out of off-peak shutdowns, China’s zero-COVID policy could imperil domestic demand recovery.

- Therefore, even if export demand strengthens into Q1’23, producers face the risk of total sales being constrained by a weaker domestic market, keeping margins under pressure in Q1’23.

- Given the uncertain outlook and current weak market fundamentals, it is understood that start-up of Sichuan Hanjiang New Materials’ 500 kta plant, which was scheduled for Q4’22 start-up, has now been delayed to March 2023.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market View: European PET Producers Face Difficult Q1 as Import Delta Widens

Plastics and Sustainability Trends in October 2022

PET Resin Trade Flows: Asian PET Exports Weaken in Q3 as Seasonal Demand Withers

European PET Market View: European PET Producers Facing Losses Contemplate Further Shutdowns