Insight Focus

- PTA futures retreat with crude plunging and weakening PX market.

- PET export prices remained flat; margins narrowed on tepid demand.

- Some European buyers pushing for Q1 arrivals, fearing new anti-dumping on Chinese resin.

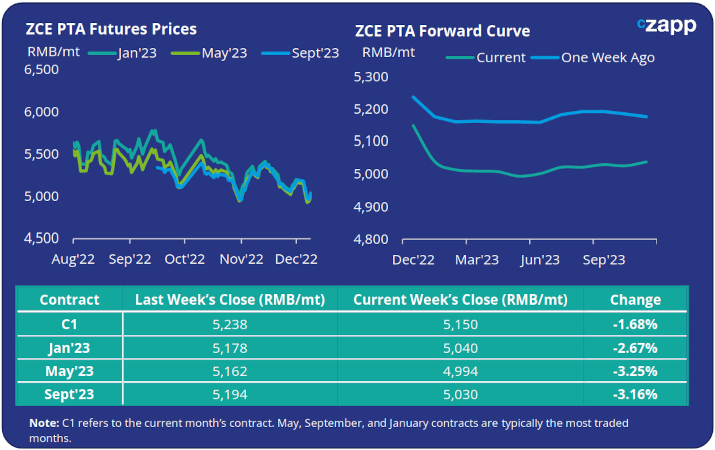

PTA Futures and Forward Curve

- PTA futures deteriorated through much of last week, largely tracking lower upstream costs as crude prices once again faulted on demand concerns.

- PTA fundamentals remain under pressure due to lower polyester polymerisation rates. However, low inventories at bonded warehouses kept the PX-PTA spread relatively stable through the week.

- In the near-term, additional PX supply from Shenghong and Dongying Weilian Phase II plants may help to improve PX liquidity and return some margin to PTA production.

- The current PTA forward curve is partially backwardated into the new year, with the Jan’23 contract trading at a small discount of 110RMB/mt to the current month, remains flat thereafter.

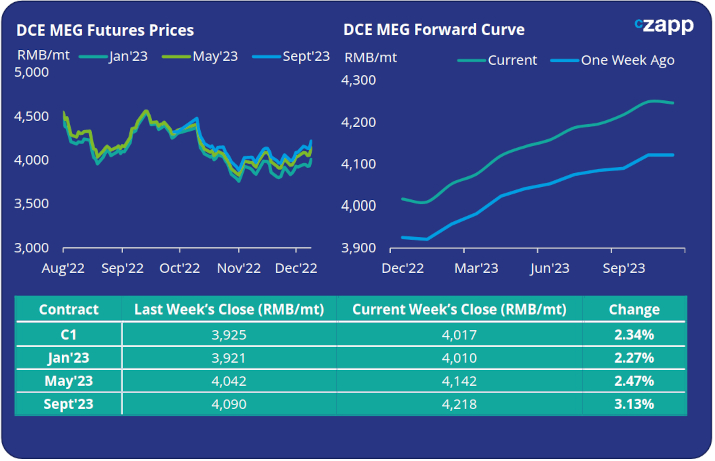

MEG Futures and Forward Curve

- MEG futures on the other hand recorded a relatively strong week, boosted by the easing of China’s zero-COVID policy and yuan appreciation.

- Despite traders reducing short positions on recent easing of COVID policy, MEG fundamentals remain weak and face continued oversupply.

- Port inventories continued to rise, up a further 6.9%, continuing the recent trend of consecutive weekly increases amid a slowdown in polyester demand.

- Despite the slow market the forward curve remains in contango supported by an expected steady demand recovery through next year.

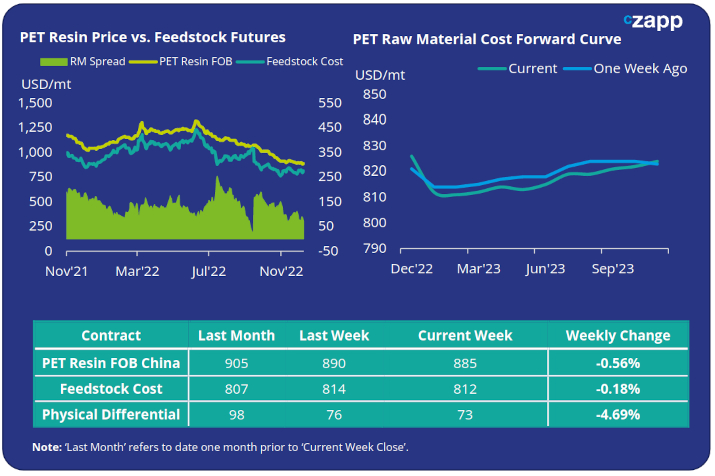

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices were relatively flat last week, with an average price ranging between USD 880-890/tonne.

- The weekly average PET resin physical differential to feedstock costs decreased USD 10/tonne last week, to USD 80/tonne. By Friday, the daily spread was around USD 73/tonne.

- The PET resin raw material forward curve continues to show a slight reduction into the new year, sharpening over the last week with PTA weakness. At Friday’s close, the Jan’23 contract had a marginal USD 14/tonne discount to the current month (December).

Concluding Thoughts

- Improving domestic and export demand, in combination with several PET plant turnarounds in December is expected to help steadily reduce stock levels and return some margin back to PET resin producers in Q1’23.

- Near term-availability has already begun to tighten. However, whilst improved in recent weeks, export demand remained slow last week, reflected in the low physical differential to feedstock futures.

- If the easing of COVID restrictions in China continues, domestic demand could rebound sharply in a repeat the Chinese reopening in Q2 2020. However, a high degree of uncertainty remains over the future direction of this policy reversal.

- Some major European buyers have begun to push through advanced purchases of Chinese resin amid concerns of future EU anti-dumping duties (ADD), with an investigation anticipated to begin March/April 2023. Although no formal confirmation of a proposal has yet been seen.

- European, and Russian markets represented a combined 25% of total Chinese PET resin exports in 2022. Deep economic recessions in these markets, combined with potential new EU ADD may challenge future Chinese export targets in H2’23.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Czapp Explains: Global PET Resin Capacity and Projects

PET Resin Trade Flows: EU PET Resin Imports Surge in Q3 Driven by Chinese Wave

European PET Market View: European PET Producers Face Difficult Q1 as Import Delta Widens