Insight Focus

- PTA futures keep rangebound, continuing to see support from high polyester production.

- PET resin export prices slip, raw material costs look to reach new bottom in Q4.

- Over 1.8Mt of new capacity has been brought online in Q2, more is now on the way.

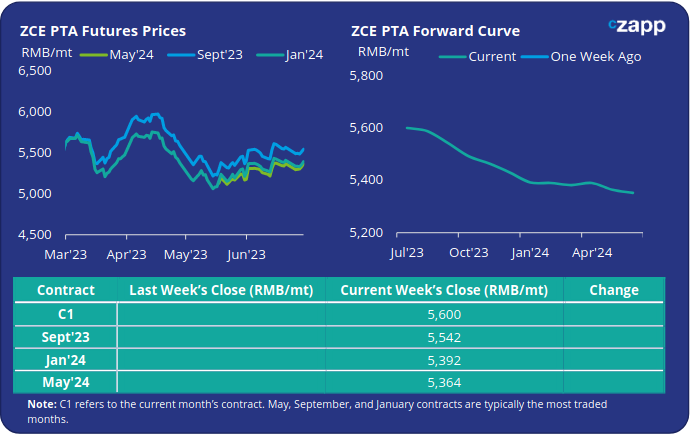

PTA Futures and Forward Curve

- PTA Futures ended the week slightly down on the last pre-holiday trading session, whilst crude slipped 3% over the same period.

- Tight PX supply could get alleviated, and PX inventory would increase in the third quarter. The prices of PX and PTA, in the lack of strong driving force, are expected to track crude oil as well as commodity market.

- PTA demand continues to see robust support from high polyester production, with operating rates remaining in the low-90% range.

- Although domestic demand is currently stable, PX and PTA supply is anticipated to increase, alleviating PX tightness and potentially resulting in a gradual inventory accumulation through Q3.

- Recent exclusion of Chinese PTA suppliers from India’ BIS certification list, which is required for PTA export to India, also raises concerns around future Chinese PTA export demand. Current BIS certification for Chinese PTA suppliers will expire at the end of June.

- The forward curve remains backwardated, by Friday the Sept’23 contract was trading at a RMB 58/tonne discount to the current month.

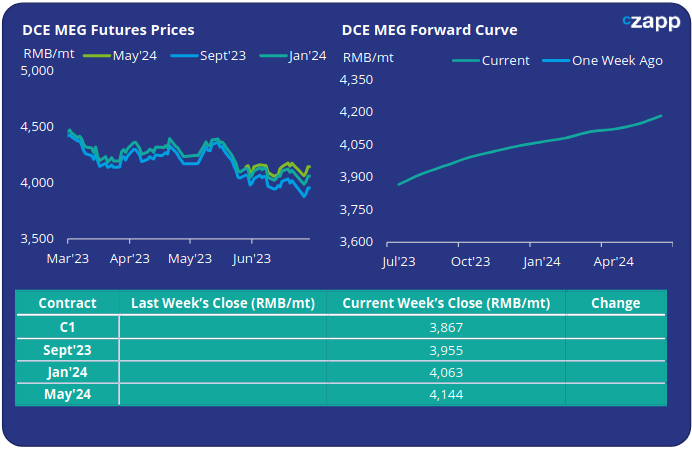

MEG Futures and Forward Curve

- Main month MEG Futures softened 1.65% versus pre-Dragon Boat Festival levels, hitting a new 12-month low on added supply-side pressure.

- Increased import arrivals from the US, Middle East, and India, are already having an impact. Port inventory leapt 6.9% last week, up by around 63k tonnes, to a total of 986k tonnes.

- Latest data also showed China’s MEG imports increased 17.7% in May.

- Recovery of domestic supply is also underway following turnarounds and unit restarts, swelling total MEG inventories.

- Whilst high polyester run rates are currently adding some support to MEG, downstream polyester inventories are also building with slower textile offtake.

- The MEG forward curve continues to show prices steadily increasing over the next 12-months. By Friday the Sept’23 contract was holding a RMB 96/tonne premium to the current month.

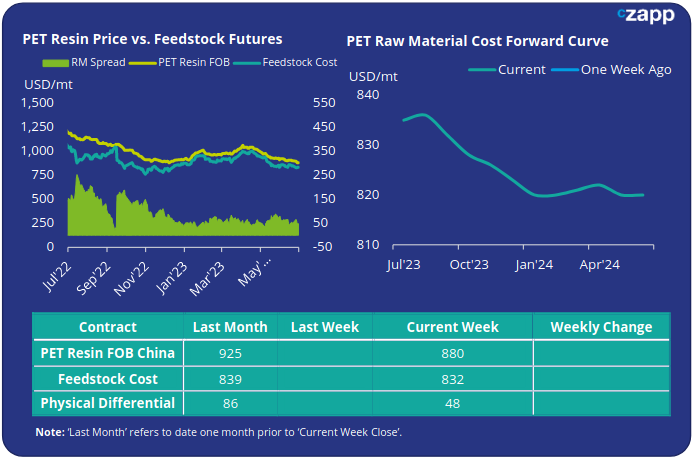

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices fell back last week following the previous period of stability, averaging USD 880/tonne FOB on Friday, down USD 20/tonne on the previous week.

- The weekly average PET resin physical differential to future feedstock costs was relatively flat on the previous week’s close, up by just USD 2/tonne to average USD 54/tonne for the week. However, by Friday the daily spread had fallen back to USD 48/tonne.

- The raw material cost forward curve remains backwardated with costs expected to soften through the summer before flattening out in Q4’23.

- At Friday’s close, Sept’23 raw material costs were trading on relative par with the current month, with just USD 3/tonne discount to July’23; Jan’24, the next main contract month, was at a USD 15/tonne discount.

Concluding Thoughts

- PET resin export margins continue to be eroded on weak demand and growing capacity expansion.

- The physical differential versus raw material futures fell sharply through last week, approaching a new low for the year.

- Although some producers report positive sales signs in recent days, others are being pushed to breakeven with costs; losses are being resisted at stage.

- Sanfame’s 1st 750k tonne new line is now fully operational, with the start-up of their 2nd 750k tonne line, previously expected in August, now believed to have been moved forward to early July.

- Since April, Chinese PET resin capacity has expanded by 1.85M tonnes, and despite the weak market environment is scheduled to add a further potential 2.15M tonnes in H2’23.

- Some older lines are expected to be retired; competition will undoubtedly intensify through the remainder of the year. Both operating rates and margins will face increased pressure.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.