Insight Focus

- PTA Futures soften as crude prices continue to fall back towards USD80/bbl.

- Whilst feedstock costs remain flat, resin margins keep negative lacking demand.

- PET resin margins must see recovery into Q1’24, amid potential further production cuts.

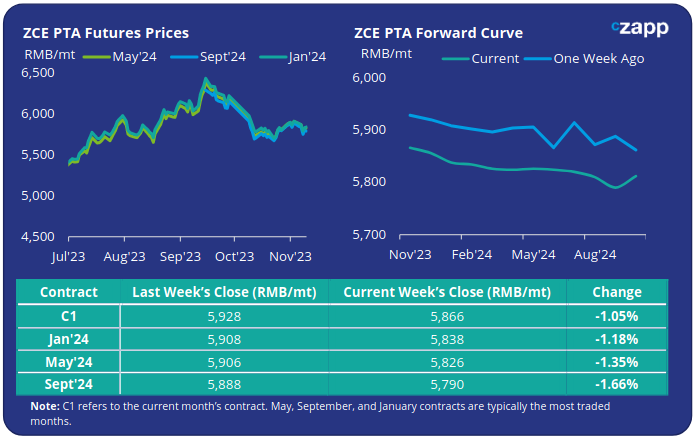

PTA Futures and Forward Curve

After PTA futures lifted entering November, prices softened last week with main month contracts declining by over one percent, following weaker upstream costs.

Crude oil retreated to just over USD80/bbl by Friday, down nearly 6% on the week, representing the third straight week of declines.

Much of the drop in crude price was a result of easing concern around potential regional supply disruption caused by the Gaza conflict, as well as weak trade and inflation data from China.

PTA fundamentals remained stable, resisting any further deterioration in the PTA-PX spread, which kept steady at around USD 90/tonne.

PTA operating rates also kept steady having reduced previously with OPSC and Yisheng Ningbo shut PTA plant for scheduled maintenance.

Although PET bottle resin plants have reduced rates since mid-summer, downstream polyester production continues to remain robust supporting PTA demand, despite inventories slowly increasing following the national holiday.

As the market enters its traditional off-peak season, end buyers are likely to be more sensitive to stock accumulation, with overall polyester rates expected to slow deeper into Q4.

By Friday, the PTA forward curve kept very slightly backwardated through H1’24. The Jan’24 contract was at a RMB 28/tonne discount to the current month; the May’24 contract was now at a RMB 40/tonne discount.

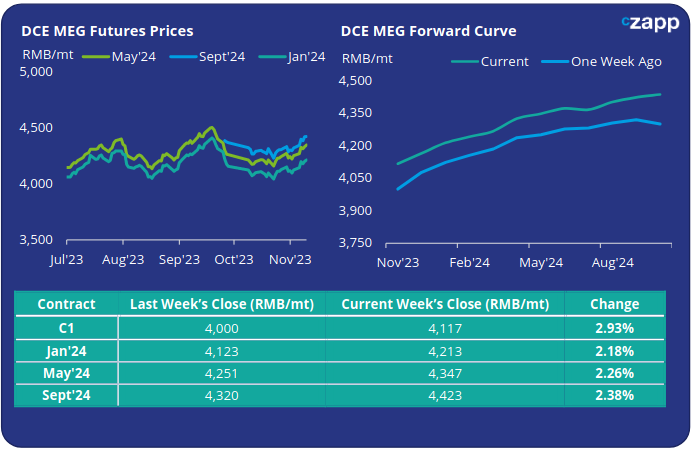

MEG Futures and Forward Curve

Whilst MEG Futures rallied last week, increasing over 2% on main forward contracts, price ultimately kept range bound.

East China port inventories increased 1.94% to over 1,214k tonnes by last Friday. However, from mid-month arrivals are expected to slow easing some pressure on the import side.

That said, recent successful trials of new units at Yuneng and Zhongkun, and Yulin Chemical delayed maintenance could lead to increasing domestic supply pressure through Dec/Jan.

Whilst fundamentals may keep in soft to stable in November, deteriorating polyester demand is expected to filter through to slower MEG offtake and inventory accumulation into Q1’24.

The MEG forward curve remains in contango over the next 12-months. By Friday, the premium held by the Jan’24 contract over the current month was at RMB 96/tonne; the May’24 contract was now at a RMB 230/tonne premium.

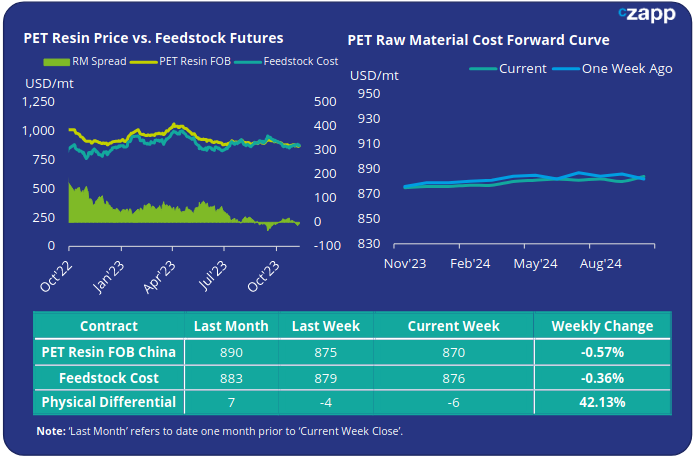

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices remained flat-to-soft over the past week, approaching USD 870/tonne by week’s end.

However, the weekly PET resin physical differential dropped by USD 10/tonne to average negative USD 10/tonne for the week. By end Friday, the daily spread had improved very slightly but remained negative at minus USD 6/tonne.

The raw material cost forward curve remained relatively flat through much of 2024 with Jan’24 flat to the current month; main forward contracts of May and September holding a very slight USD4/tonne premium.

Concluding Thoughts

Whilst interest in forward offers is likely to increase in the coming month, continued weakness in raw material spreads is indicative of continued poor sales, during a period over the previous 2-3 years that has typically experienced notable Q1 demand and margin rallies.

Whilst polyester fibre and yarn operating rates have remained relatively robust, PET bottle chip operating rates have faced a steady decline in the second half of 2023.

Without a fresh surge in new order intake, PET resin operating rates may face further decline as producers continue to face speculative negative margins.

If producers are unable to resurrect margins ahead of Chinese New Year, decisions may be made around further production cuts and potentially retirement of older lines.

US market strength is leading to other Asian origins reallocating greater volumes to the US, leaving some growth room for Chinese resin, particularly in Southeast Asia.

However, the threat of further anti-dumping and protectionist measures against Chinese resin within these traditional target markets looms large.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.