Insight Focus

- Rally in PTA futures eases as crude drops Friday, PTA margins squeezed further.

- Polyester operating rates remain strong underpinning demand for raw materials in September.

- PET resin export prices keep flat as Mexican tariff increases add sales pressure.

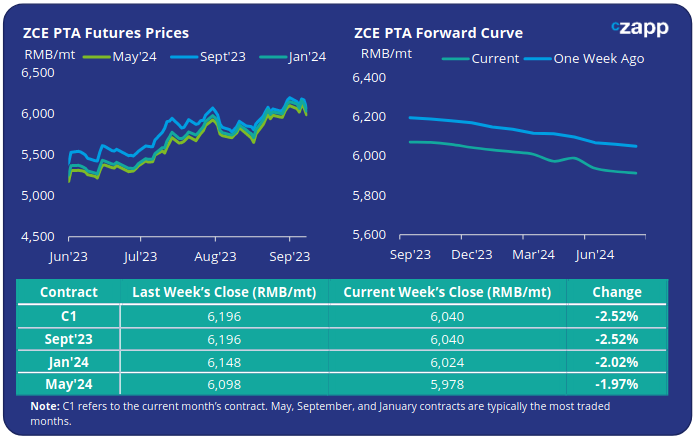

PTA Futures and Forward Curve

PTA futures prices continued to rally through the first half of last week before dropping in early Friday trading, mirroring the trend in crude prices.

Brent crude prices briefly broke through the USD 90/bbl level on Wednesday, driven higher by Saudi Arabia’s extension of production cuts and Russia’s decision to prolong its export reduction.

A series of substantial reductions in US oil inventories also bolstered analysts’ optimistic outlook.

However, oil prices receded Friday due to a strong US dollar, concerns regarding Chinese demand, and profit-taking by investors.

Thie recent rise in upstream costs continues to squeeze the PX-PTA spread, which has fallen from around USD 90-100/tonne since mid-August to below USD 75/tonne.

Despite this, PTA operating rates remain relatively stable supported by continued strong demand from polyester production, which is expected to remain high through the traditional peak season.

By Friday the Jan’24 contract was trading at a reduced RMB 16/tonne discount to the current month, with the forward curve flat through H1’24.

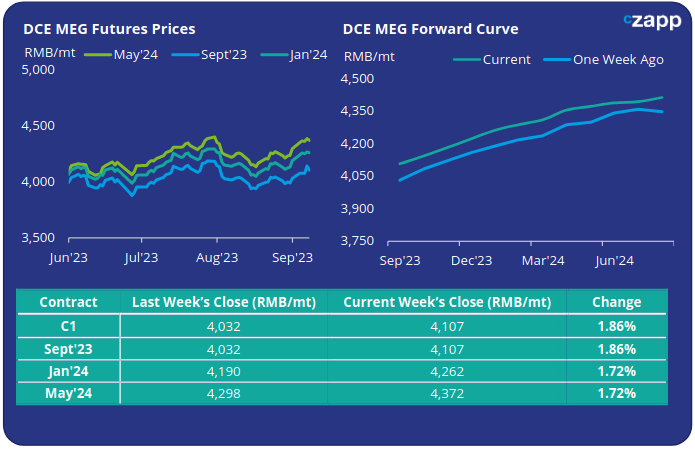

MEG Futures and Forward Curve

Contrary to the trend in PTA, MEG Futures increased by nearly 2% last week, as imports slowed, and the demand pull from polyester production remained strong.

Chinese main port inventories decreased by 5.4% last week to 1,077k tonnes. A further slowing of imports is now anticipated, with major producers in Saudi Arabia, India, and the US planning maintenance through September-October.

Extended waiting times through the Panama Canal, due to a prolonged drought in the country, have also reduced the flow of US cargoes to China.

Whilst high polyester operating rates are expected to continue to underpin MEG demand through September. Post-peak season, MEG may once again move into greater oversupply.

However, draw from downstream polyester producers and end-users located in the vicinity of Hangzhou may be impacted by the upcoming Asian Games scheduled for late September, with some producers having to suspend or reduce production.

The MEG forward curve remains in contango over the next 12-months. By Friday the Jan’24 contract was holding a RMB 155/tonne premium to the current month.

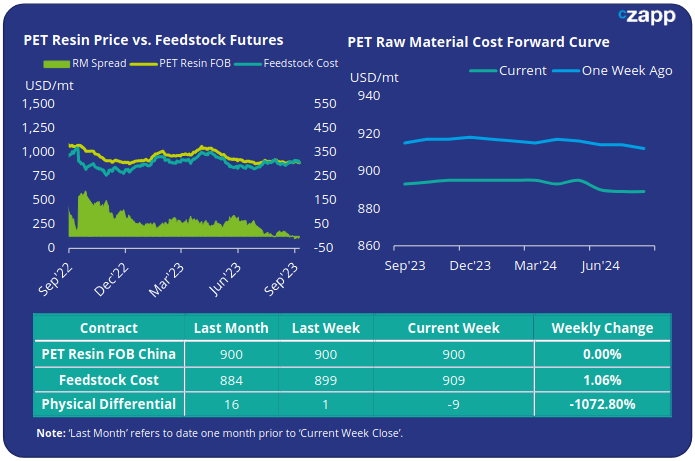

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices remained rangebound, with no major change in values for a few weeks now. Prices averaged USD 900/tonne on Friday at 880USD/tonne, flat on the previous week’s close.

However, the weekly PET resin physical differential to future feedstock costs continued to erode, losing a further USD 2/tonne to average negative USD 6/tonne for the week. By Friday the daily spread was still in negative territory at minus USD 2/tonne.

The weekly average PET resin physical differential to future feedstock costs fell further, down USD 8/tonne to average USD 4/tonne for the week. However, by Friday the daily spread had fallen into negative territory, a new multi-year low.

The raw material cost forward curve is almost completely flat through into H1’24. Jan’24 raw material costs on par to the current month’s contract, the next most liquid contract months of March and May were also on par with current levels.

Concluding Thoughts

The physical spread over raw material futures remains highly depressed. Whilst Chinese producers are still anticipated to in positive margin, some are almost certainly close to breakeven.

Billion’s new PET resin plant in China is also now operational, adding to the growing list of new supply that has come on-stream over the last 6 months.

With further near-term capacity growth still expected, margins are projected to remain squeezed into 2024, although given the recent decline any further downside may be modest.

In general, Chinese PET producers are keen to make sales but at present are not prepared to accept losses and will be keen to move into maintenance mode come October, slowing market supply.

However, another concern for Chinese producers is the growing number of countries imposing trade barriers on Chinese PET resin imports.

In addition to the on-going EU investigation, on 15th August, Mexico suddenly imposed a temporary increase in trade tariffs on a range of Chinese goods, including PET resin. The import tariff for Chinese PET resin has increased from 10% to 25%.

Last year, Chinese producers exported around 124k tonnes of PET resin to Mexico, which ranked as 9th in overall export destination. Higher Mexican tariffs are likely to see other origins gain market share, whilst placing additional pressure on Chinese export sales and pricing.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.