Insight Focus

- PTA pricing constrained by high inventory despite improved fundamentals.

- China PET resin export prices weaken, new capacity, trade barriers, and freight increase threaten.

- PET raw material forward curve remains in contango with USD10/tonne premium to Sept.

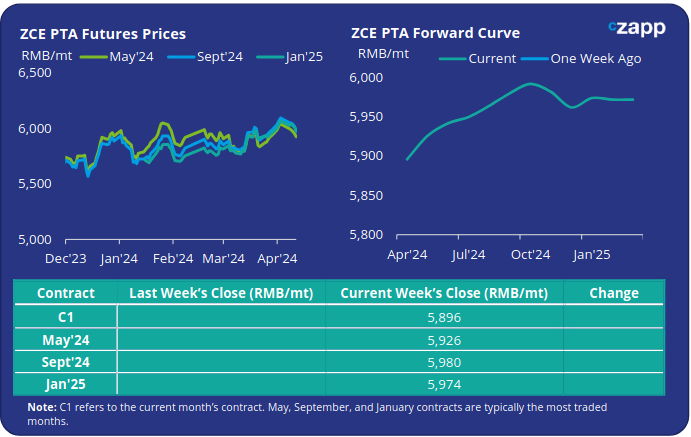

PTA Futures and Forward Curve

PTA Futures main month contracts declined around 2% versus the pre-holiday close on the 3rd April.

Whilst the latest crude oil rally took a breather, with levels just over USD 90/bbl on Friday, upward momentum could still see prices consolidate in the low/mid-90s in the near-term.

After a strong previous week, the PX-N spread eased, contributing to the lower PTA prices. On the other hand, the PTA-PX CFR spread improved marginally, averaging around USD 82/tonne last week.

Overall, there has only been minimal improvement in the PTA-PX spread since late March.

Despite improving supply/demand fundamentals, higher inventory pressure continues to squeeze PTA margins.

High polyester polymerisation rates and series of PTA plant maintenance turnarounds are expected to see inventory levels reduce through April.

The forward curve currently shows increasing forward costs through to Q3; Sept’24 has a RMB 84/tonne premium over current month.

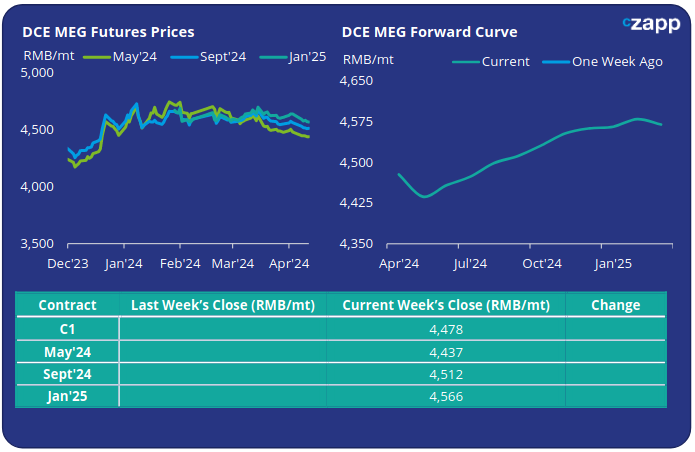

MEG Futures and Forward Curve

MEG Futures main month contracts continued to ebb lower, sliding 1% versus the pre-holiday close on the 3rd April, with spot prices near a 4-month low.

East China main port inventories increased last week to around 842k tonnes by Friday, leaping 8.35% from the previous week, whilst off-take remains slow.

Domestic operating rates continue to see declines due to seasonal maintenance plans, supporting MEG prices in the short-term.

However, as coal-based plants come-back online inventory build-up is expected to once again pressure prices into May.

The forward curve remains in contango, although the premium shown by the Sept’24 contract over the current month has continued to shrink, to just RMB 34/tonne.

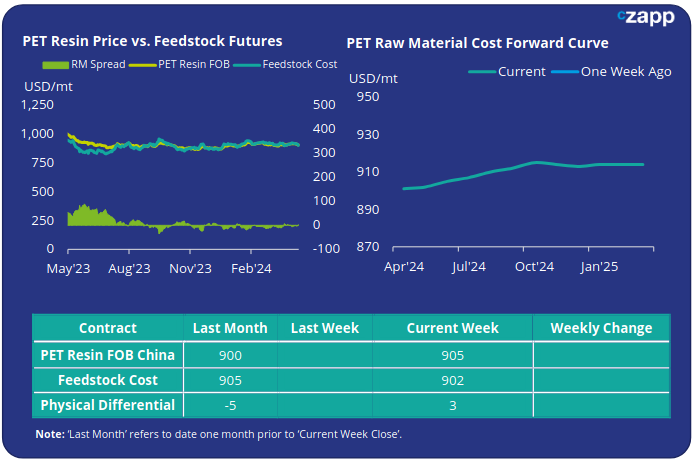

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices weakened last week, averaging USD 905/tonne on Friday, a decline of around USD 10/tonne on the previous week.

The weekly PET resin physical differential against raw material future costs improved by USD 3/tonne, to average minus USD 1/tonne for the week; by Friday the differential had turned positive, at USD 3/tonne.

The raw material cost forward curve continues to be in slight contango; Sept’24 contract has around a USD 11/tonne premium over the current month.

Concluding Thoughts

Asian PET resin export prices in large tracked raw material costs down last week, with offers from some Chinese producers, at the lower end of the range back in the 890s.

Whilst the future differential experienced slight improvement, domestic and export demand quietened, with spot spreads flat at around USD 77/tonne.

Further new capacity in April and May, is expected to keep pressure on the physical differential, whilst the raft of new trade barriers across EU, India, Mexico, and South Korea, expected to impact future Chinese export demand.

Spot freight rates to certain Latin American destinations have also risen sharply, in some cases more than doubling, tighter container availability and space on some shipping routes.

This will undoubtedly place cost pressures on end-buyers in those regions, and in doing so constraints on Chinese PET resin producers to move prices higher.

Currently forward PET resin export offers are in line with the modest forward premium shown on the raw material forward curve, with only a USD 10-20/tonne for Q3’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.