Insight Focus

PTA futures dipped as polyester operating rates continued to decrease impacting PTA demand.

Last week’s spike in Chinese PET resin export prices was erased, as buyers resisted.

Raw material forward curve remains flat, Asian PET resin export prices to experience weaker Q3.

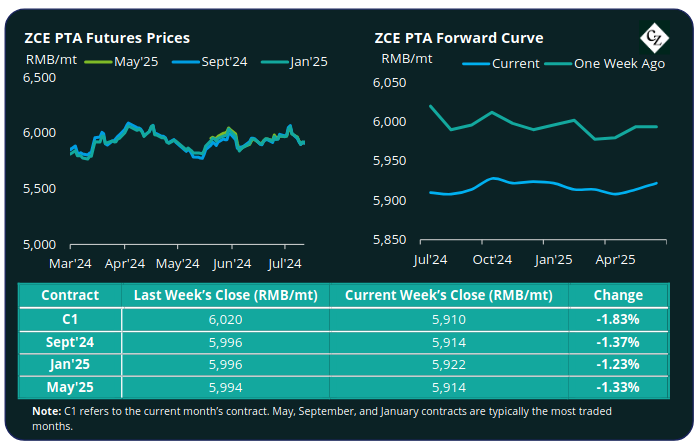

PTA Futures and Forward Curve

PTA futures dipped last week, with main contract months dropping by an average of 1.5%.

Brent crude oil dipped mid-week from USD 86/bbl to around USD 84/bbl before recovering to end broadly on par with the previous week’s close.

The mid-week rally was prompted by declining US inflation indicators fuelling expectations for interest-rate cuts this year that may lead to a rise in consumer energy demand.

PX-N spread kept relatively steady, whilst the PTA-PX CFR spread narrowed slightly by around USD 3/tonne, indicating a potential weakening of the supply/demand balance.

Late July is expected to see higher PTA production following delayed restarts and other returns, whilst downstream polyester operating rates are experiencing reductions hitting PTA demand.

July is a traditional offseason period for the polyester fibre sector. However, bottle grade production is also being curtailed due to oversupply and poor margins.

The forward curve remained relatively flat with the Sept’24 contract holding a RMB 4/tonne premium to the current month; Jan’25 with a RMB 12/tonne premium.

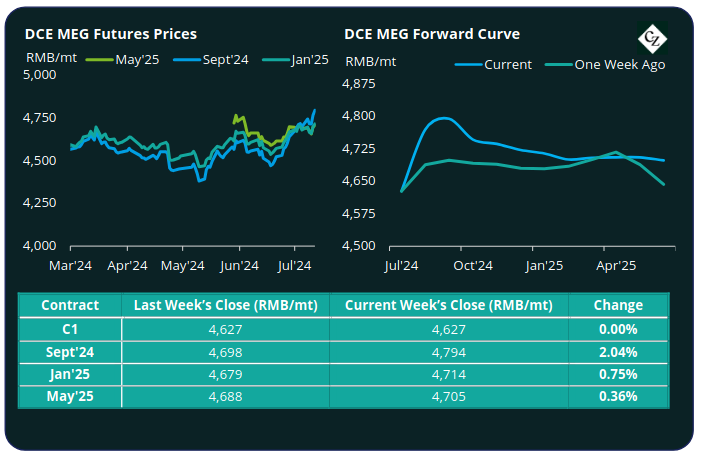

MEG Futures and Forward Curve

MEG Futures continued to show near-term strength, with the main Sept’24 contract increasing by around 2% last week.

East China main port inventories further decreased by around 5.4% to 635k tonnes last Friday, on limited import arrivals, particularly form the Middle East.

Plant shutdowns in the US resulting from the recent Hurricane Beryl are also expected to further delay arrivals buoying bullish market sentiment.

Inventories may fall further in the near-term keeping prices firm. However, lower demand resulting from polyester production cuts will need to be finely balanced against MEG supply recovery into August.

The MEG forward curve displays near-term strength into Sept before easing, the Sept’24 contract holds a RMB 167/tonne premium over the current month; the Jan’25 premium over the current month is RMB 87/tonne.

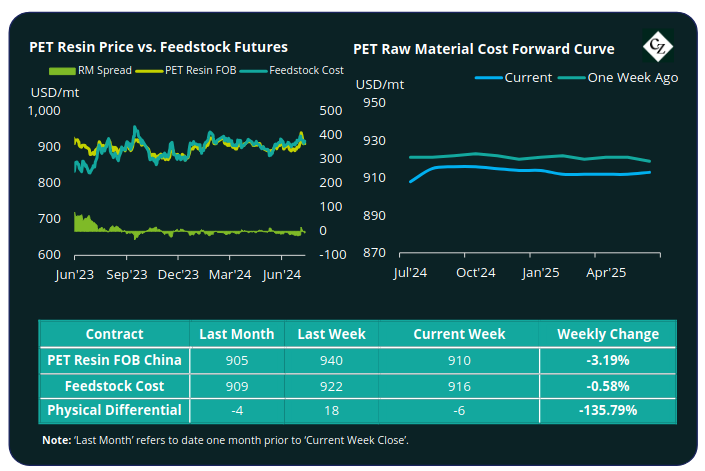

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices dropped rapidly back into range at the beginning of last week. Falling back from the spike that saw prices offered at USD 940-950/tonne, back down to an average price of USD 910/tonne by Friday.

The PET resin physical differential against raw material future costs increased USD 7/tonne to average minus USD 3/tonne last week. By Friday, the differential was minus USD 6/tonne.

The raw material cost forward curve has now flattened entirely, with no flat premium through any of the forward contract months.

Concluding Thoughts

Last week’s price spike resembled a death throe from an industry suffering from over-supply and poor margins, ominously in the later part of “peak-season”.

Producers tried to exert price pressure, as producers shut lines and slashed operating rates, hoping to drive a rally on potential tighter supply.

However, upward price movement was strongly resisted by buyers with prices quickly falling back into range. The raw material physical differential also deteriorated, although still around USD 10/tonne higher that had been seen in previous weeks.

With the raw material forward curve flat through next twelve months, expectations are for PET resin export prices to experience some weakening into the September/October off-season as spreads fall further.

New capacity additions and line restarts will also heap on pressure in Q3, despite likely continued production cuts and extended maintenance turnarounds.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.