Insight Focus

PTA and MEG futures move higher with crude, supported by high polyester operating rates.

Asian PET resin export prices fail to rise, as profitability continues to be degraded by weak demand.

New Chinese PET resin capacity to bolster oversupply, despite expectations of lower operating rates.

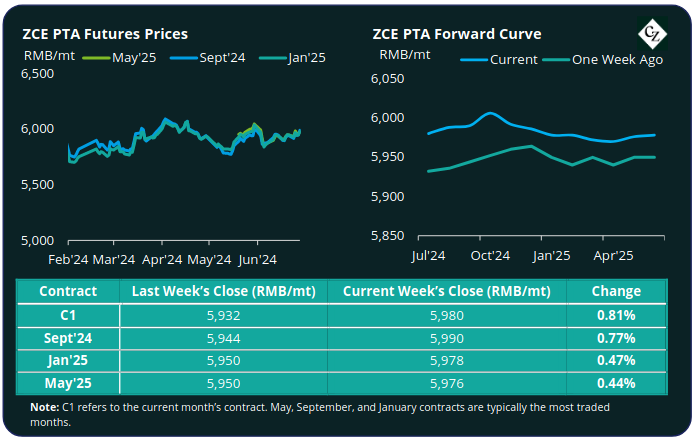

PTA Futures and Forward Curve

PTA futures gained nearly 1% last week, as crude prices lifted on added geopolitical volatility in the Middle East.

Brent crude oil prices closed around 2% higher last week, primarily driven by escalating tensions between Israel and Hezbollah, and potential supply disruptions in the Middle East.

Further down the polyester chain, the PX-N spread narrowed due to supply-side pressure, whereas the PTA-PX CFR spread kept steady at USD 90/tonne.

As PTA plants restarted after off-season maintenance, rates are slowly increasing, with the demand-side supported by high polyester operating rates and additional new PET resin capacity.

At least in the short-term inventories remain low, with tight spot liquidity supporting a relatively balanced PTA market and maintaining a steady PTA-PX spread.

Overall, the forward curve is relatively flat through the main contract months. The Sept’24 contract only holds a RMB 10/tonne premium to the current month, while Jan’25 has moved to a RMB 2/tonne discount.

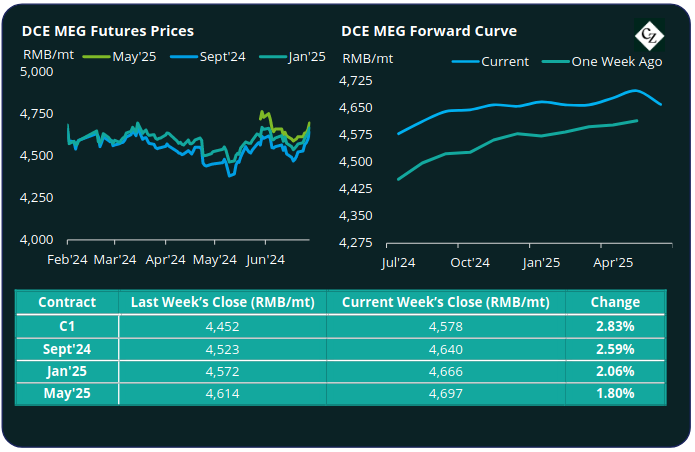

MEG Futures and Forward Curve

MEG Futures rebounded last week, closing out nearly 3% higher as port arrivals were less than anticipated.

East China main port inventories decreased by around 8.2% to 704k tonnes last Friday, as daily offtake increased.

Domestic production recovery remained slow following several plant turnarounds with no significant increase in operating rates, whilst polyester production remains comparatively high.

As a result, near-term supply/demand fundamentals are expected to support prices, although potential polyester production cuts are a threat to keep an eye on.

The MEG forward curve remains is slight contango, with the Sept’24 contract holding a RMB 62/tonne premium over the current month; the Jan’25 premium over the current month at RMB 88/tonne.

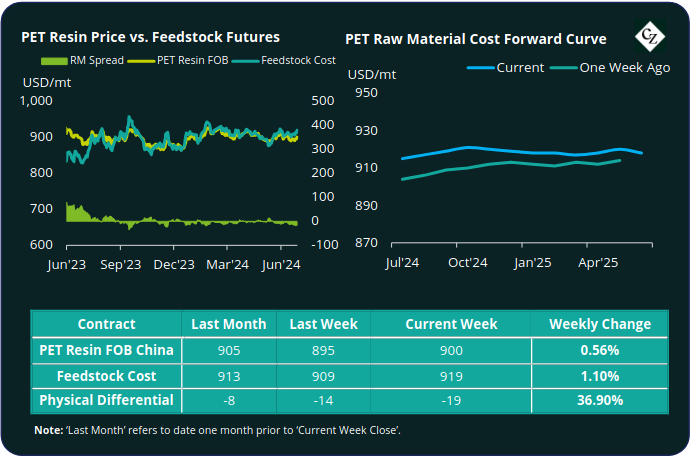

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept relatively steady last week, with the average price steady at USD 900/tonne by Friday, up just USD 5/tonne on the previous week.

The PET resin physical differential against raw material future costs also decreased USD 5/tonne to average minus USD 17/tonne last week. By Friday, the differential was minus USD 19/tonne.

The raw material cost forward curve showed little change from the previous week, flat through to year end. The Sept’24 contract shows a USD 4/tonne premium with the current month, with Jan’25 holding at similar levels.

Concluding Thoughts

Whilst spot containerised prices have kept within a tight range, the physical differential to future feedstock costs has continued to plummet, falling to the lowest levels seen since January.

Surging international container rates have severely impacted Asian PET resin export demand, with Chinese domestic demand also falling short of expectations.

Although major buyers have quickly switched to shipping product in breakbulk, outside of the major brands most converters don’t have the demand volume to make the switch feasible; instead pivoting to higher cost local production.

Nevertheless, breakbulk vessels, each carrying 20-30k tonnes of PET resin, could quickly swing the near-term balance if Chinese producers are able to quickly aggregate unallocated stocks.

With margins slumping there are indications that Chinese PET resin producers are likely to begin reducing operating rates, with older lines facing rationalisation.

However, Yisheng further expanded production capacity late-June, adding 500kta at its Dalian site. In addition, Sanfame plans to launch 750kta later in July, with Sichuan Hanjiang restarting 300kta capacity late-June, with another 300kta of new capacity due to start-up mid-July.

In total, over 1.8 million tonnes of capacity could come on-stream during this period, keeping the oversupply pressure on even if operating rates are lowered, or existing line shutdown.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.