Insight Focus

Weaker crude oil prices pressured both near-term PTA and MEG futures prices. Chinese PET resin production cuts lent support to export prices, as margins continue to improve. The raw material forward curve remains flat, while Asian PET resin export prices to face pressure into off season.

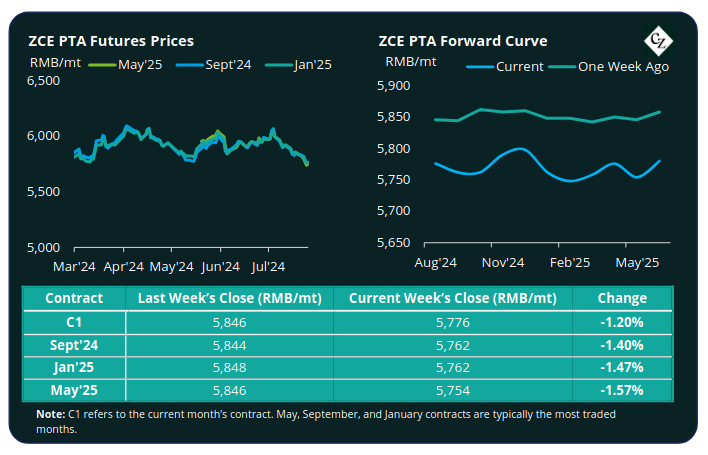

PTA Futures and Forward Curve

PTA futures continued their recent descent, dropping a further 1.5% on lower upstream costs.

Crude oil posted a third weekly loss in a row, pressured by weaker Chinese demand, even though substantial inventory draws were reported in the US.

Potential de-escalation in Middle East tensions also took some risk premium from prices. However, the latest Hezbollah rockets attacks on Israel over the weekend have the potential to deepen the conflict.

Brent crude oil prices fell close to USD81/bbl on Friday down, a meaningful decline from just over a week earlier when Brent hovered just over USD85/bbl.

Both PX and Naphtha prices fell with crude, but with naphtha prices declining faster the PX-N price spread widened by around USD 10/tonne.

Despite recent plant restarts, an unexpected shutdown at Pengwei’s 900,000 tonne/year unit meant average PTA operating rates fell last week.

Whilst polyester rates have also softened over the last month, spot availability remains relatively tight, with the PTA-PX CFR spread at USD 86/tonne, up a few dollars from the week prior.

The forward curve is flat to marginally backwardated, with both the Sept’24 and Jan’25 contracts at a RMB 14/tonne discount to the current month.

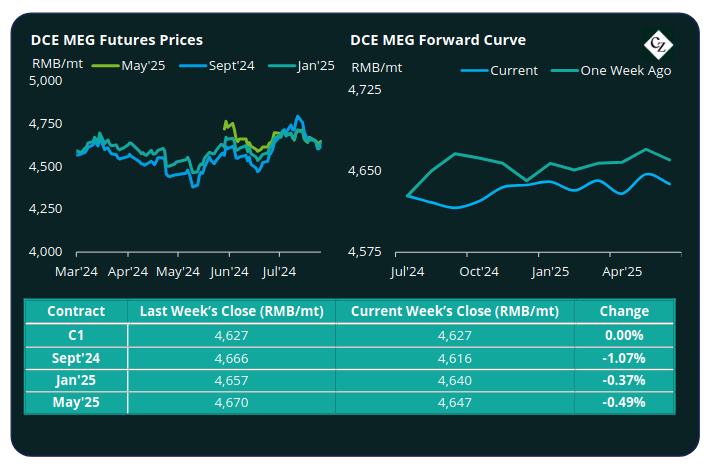

MEG Futures and Forward Curve

MEG Futures softened overall, with the main Sept’24 contract showing the largest decline of just over 1% to flatten the forward curve.

East China main port inventories decreased by around 2.6% to 580,000 tonnes last Friday, with daily offtake continuing to plummet since peaking end of May.

MEG cargo arrivals at main ports are projected to remain relatively low through Q3 due to production cuts at Saudi facilities.

Additionally, lower operating rates at Chinese coal-based MEG plants are set to constrain domestic supply, keeping the supply/demand balance firm, and inventory accumulation unlikely in the immediate near-term.

The MEG forward curve shows only a slight forward premium through H1’24; the Sept’24 contract holds a RMB 11/tonne discount over the current month; the Jan’25 premium over the current month is RMB 13/tonne.

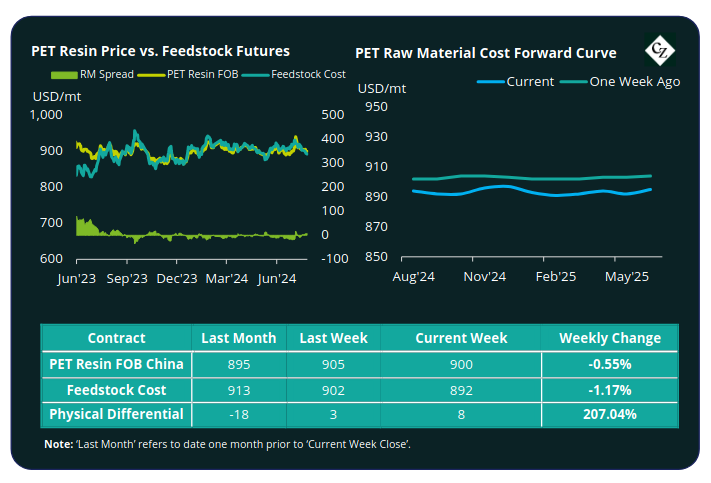

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices continued to ebb lower over the past week, down USD 5/tonne to average USD 900/tonne by Friday.

The PET resin physical differential against raw material future costs increased USD 6/tonne to average plus USD 6/tonne last week. By Friday, the differential was plus USD 8/tonne.

The raw material cost forward curve remains flat out the next 12 months, with no premium through the main Jan’25 and May’25 forward contracts.

Concluding Thoughts

Although Chinese PET resin export prices have softened over the last fortnight, production cuts have lent support, enabling producers to improve margins and spreads slightly.

Nevertheless, with deliveries now focused on for the late Q3/Q4 offseason, buyers are likely to become more cautious adding to the sales pressure faced by producers.

High ocean freight rates and limited availability also continue to impact export demand. However, there are some indications that container freight rates may be peaking, with some lanes seeing declines, although the picture is far from uniform.

At this stage in the year, any correction in freight rates is unlikely to be meaningful enough to prompt a turnaround in demand as we head into the offseason.

Therefore, with the raw material forward curve flat, can production cuts, and maintenance turnarounds, offset lower demand enough to keep PET margins and prices rangebound?

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.