Insight Focus

PTA futures lifted by a rebound in upstream costs, as PTA market fundamentals keep steady/firm.

Chinese PET resin export prices remain rangebound, no improvement in margin outlook.

PET raw material forward curve keeps flat; PET resin exports prices backwardated through H2.

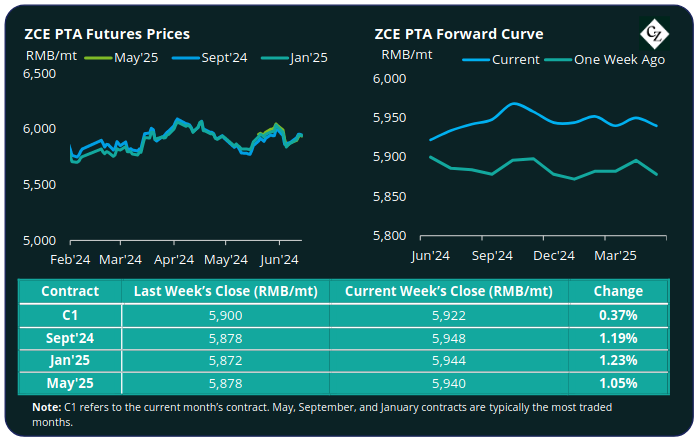

PTA Futures and Forward Curve

PTA futures corrected upwards last week, following the sharp decline seen a week earlier, with main forward contracts adding over 1%.

Crude oil prices rebounded last week, with Brent oil prices gaining 4.5% to just under USD 83/bbl by Friday, as market players turned optimistic about demand despite conflicting signals from OPEC and the IEA.

PX tightness set to experience some relief through the remainder of June, as the turnaround season that has limited supply since late March comes to an end, and operating rates gradually recover.

Last week, the PX-N spread narrowed by around USD 10/tonne to average USD 360/tonne, whilst the PTA-PX spread improved, widening to USD 87/tonne.

Low inventories and steady polyester operating rates currently support relatively balanced PTA market fundamentals.

Overall, the forward curve remains relatively flat, although a small near-term premium has developed. The Sept’24 contract holds a RMB 26/tonne premium to the current month, while Jan’25 holds a RMB 24/tonne premium.

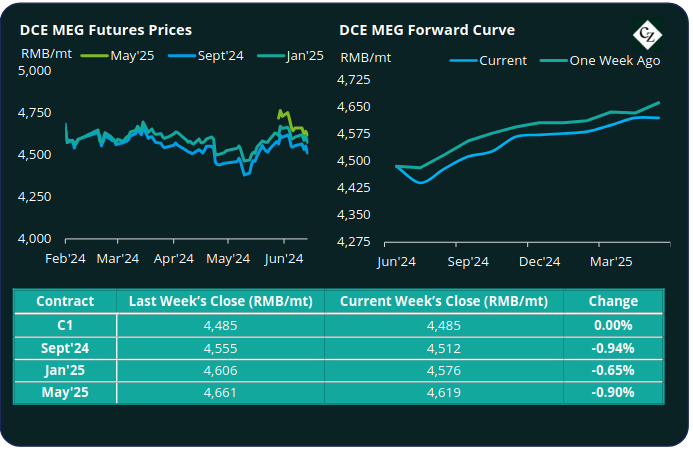

MEG Futures and Forward Curve

MEG Futures trended downwards, with the Sept’24 main forward contract dropping a further 1% amid higher inventories and increased domestic production.

East China main port inventories increased by around 1.6% to 742k tonnes last Friday, as daily offtake fell sharply, although higher than the same period a year earlier and on par with prior years.

Despite domestic production slowly recovering following turnarounds, overall market fundamentals remained steady on-the-back of low port inventories and limited deep-sea imports from the Middle East.

However, several major Chinese MEG units are still to restart, and import arrivals are expected to increase later in the month, potentially ratcheting up supply-side pressure.

Polyester operating rates kept steady, and comparatively high for June, with no signs of further production cuts, lending strong demand support despite the off-season,

The MEG forward curve remains in contango, although flattening slightly versus the previous week, with the Sept’24 contract holding just a RMB 27/tonne premium over the current month; the Jan’25 premium over the current month narrowed to RMB 91/tonne.

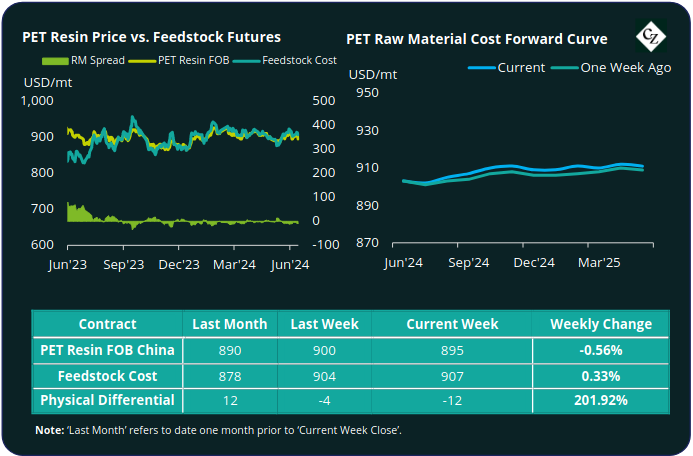

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept relatively steady, with the average price softening very slightly to USD 895/tonne by Friday, down just USD 5/tonne on the previous week.

The PET resin physical differential against raw material future costs also remained stable averaging minus USD 7/tonne last week. By Friday, the differential was worsened to minus USD 12/tonne.

The raw material cost forward curve showed little change from the previous week, flat through to year end. The Sept’24 contract shows a USD 4/tonne premium with the current month, Jan’25 just a USD 6/tonne premium.

Concluding Thoughts

Continued escalation in global ocean freight rates has dented Asian PET resin export demand. Buyers concerned around shipment delays, freight price risk, are instead switching to local and regional suppliers.

In many cases, Asian exports have also lost competitiveness versus these alternative origins, with European, Middle Eastern, and North American suppliers benefitting from less attractive import pricing.

Although the raw material forward curve remains relatively flat through into 2025, pressure on PET resin export margins is expected to intensify as the market exits peak season early Sept.

Downward pressure on producer profitability is also set to be compounded by PET resin units exiting maintenance turnarounds, and with the addition of extra new capacity in Q3’24.

As a result, the physical differential between feedstock and current PET resin spot prices is projected to deteriorate through Q3, with PET resin export prices falling into modest backwardation.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.