Insight Focus

- PTA and MEG Futures prices ended the week lower, with COVID controls weakening polyester demand.

- PET resin export premiums narrowed, with buyers facing worsening logistics and delays.

- Raw material forward curve remains flat, with slight backwardation over next 12 months.

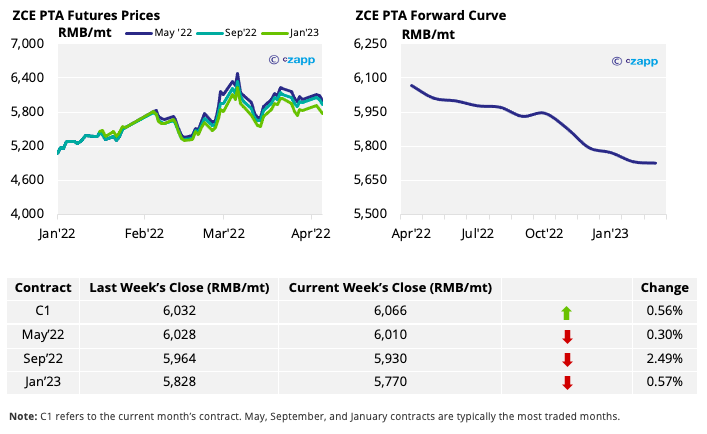

PTA Futures and Forward Curve

- The PTA futures market initially pressed higher following China’s Tomb Sweeping holiday on the 4-5th April, but reversed gains through the back of the week, following lower crude prices.

- Despite recent PTA production cuts, current COVID restrictions are precipitating weaker demand.

- Polyester fibre producers are looking to reduce operating rates, following higher inventory and weak apparel orders; FENC have also reduced PET bottle-grade resin production in Shanghai.

- The PTA 12-month forward curve remains in backwardation, with future months trading at a discount to the current April contract.

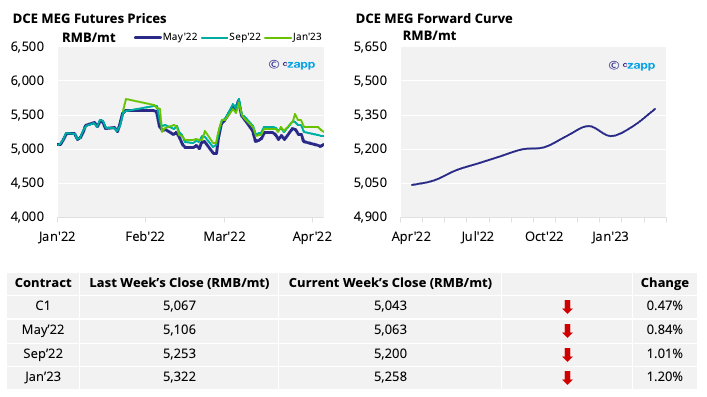

MEG Futures and Forward Curve

- MEG futures softened through the week.

- Reduced polyester production and high inventories kept market sentiment subdued.

- The MEG forward curve remains in contango with future contracts trading at a premium to current levels.

- Additional MEG production cuts amid poor margins and weak demand may help improve supply/demand, but the market is set to remain weak in the near term.

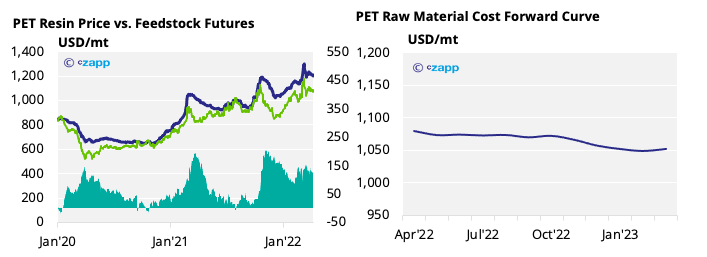

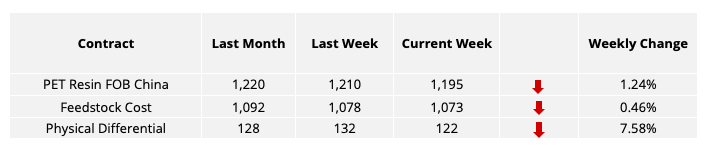

PET Resin Export – Raw Material Spread and Forward Curve

- With China’s PET resin export prices closing the week at 1,195 USD/mt, the current premium over feedstock futures has fallen by around 10 USD/mt to 122 USD/mt.

- The PET export-raw material forward curve remains flat, slightly backwardated over the next 12 months.

Concluding Thoughts

- China’s daily COVID cases are skyrocketing but remain relatively low compared to many other countries.

- Chinese authorities continue to crack down on outbreaks, with Shanghai’s lockdown now extended indefinitely.

- Work-from-home orders are also increasingly common, most recently in Guangzhou.

- PET resin producers are now faced with the prospect of weaker domestic demand and a slowdown in new export orders.

- Beyond April/May, export demand should soften with lower sales to Russia and Ukraine, as well as fewer European enquires.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Resin Trade Flows: China’s COVID Response Slows Exports

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020

European PET Market Rocked by War in Ukraine

PET Resin Trade Flows: Europe Awaits Asian Shipments

Explainers That May Be of Interest…