Insight Focus

- PTA futures rise on higher crude as Gaza hope for imminent ceasefire dissipates.

- Market activity quietens ahead of Chinese New Year holiday.

- Low operating rates and oversupply expected to keep margins constrained into March.

PTA Futures and Forward Curve

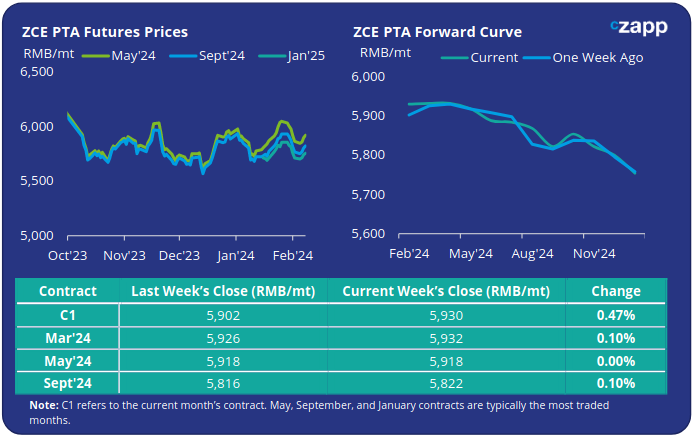

PTA Futures prices faced fresh volatility heading into the Chinese New Year, as upstream prices jostled following the collapse of the most recent Gaza ceasefire proposal.

Having fallen sharply the previous week on hopes of an end to the war, crude oil prices rebounded around 5% back above the USD 80/bbl range mark. A stronger-than-expected draw on US gasoline and distillate stocks also supported the rise.

The PX-Naphtha and PTA-PX spreads have continued to show steady improvement; the PTA-PX CFR spread averaged USD 95/tonne last week, gaining momentum through the week.

Polyester production eased, and trading was subdued ahead of Chinese New Year. Post-Spring Festival, polyester production is expected to rebound supporting PTA demand into early March.

Planned maintenance operations in March is also expected to counterbalance downstream inventory accumulation that has accumulated in the latest restocking.

The PTA forward curve has moved into greater backwardation, particularly from May onwards. The May’24 contract is now at a RMB 12/tonne discount over the current month’s contract; Sept’24 is at a RMB 108/tonne discount.

MEG Futures and Forward Curve

MEG Futures faced another consecutive weekly decline, with the main May’24 contract down by around 2%.

Main East China port inventories decline very slightly by 0.4% last week, to around 778k tonnes, as daily offtake slowed ahead of the holiday season.

Whilst plant shutdowns in Saudi, and freight disruption in and around the Red Sea, continue to delay imports, domestic MEG production is expected to reach a record high in February.

Even if port inventories continue to decline into March, further upside to prices may be constrained.

The MEG forward curve has flattened in the near-term, showing slight backwardation through the summer months. The May’24 contract currently has just a RMB 10/tonne premium over the current month; Sept’24 is at a RMB 39/tonne discount.

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices nudged up in the last couple of trading days before the break, following the increase in crude and raw materials.

Export prices averaged USD 915/tonne last Friday, an increase of USD 5/tonne on the previous week. Although trading was relatively stagnant ahead of the holiday.

The weekly PET resin physical differential against raw material future costs increased USD 8/tonne last week to average minus USD 2/tonne. By Friday, the daily spread was minus USD 4/tonne, the same as the previous week.

The raw material cost forward curve remains relatively flat in the near-term, before moving into steeper backwardation from April onwards.

The current May’24 costs were USD 1/tonne below the current month; Sept’24 was running at a consistent USD 15/tonne discount to May.

Concluding Thoughts

The market quietened last week, as participants began to wind-down ahead of the Spring Festival break.

Despite a slight firming in export prices towards the end of the week, the PET resin physical differential remains depressed.

Post-Chinese New Year, PET resin export prices are expected to continue to track raw materials closely constrained by supply pressures even as seasonal demand picks up.

Bottle-resin operating rates remain at multi-year lows, and with further capacity expansion expected over the next few months. Production rate increases may only be modest, and likely to keep margins contained.

Whilst the PET resin forward curve holds around a USD 35/tonne premium over current prices through to May, the determining factor will be what direction crude prices take in the weeks ahead.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.