Insight Focus

- Strengthening crude markets help lift PTA and MEG futures.

- PET resin export prices also tick up, margins remain squeezed close to breakeven.

- Even with more new capacity on the way, potential market bottom may be approaching.

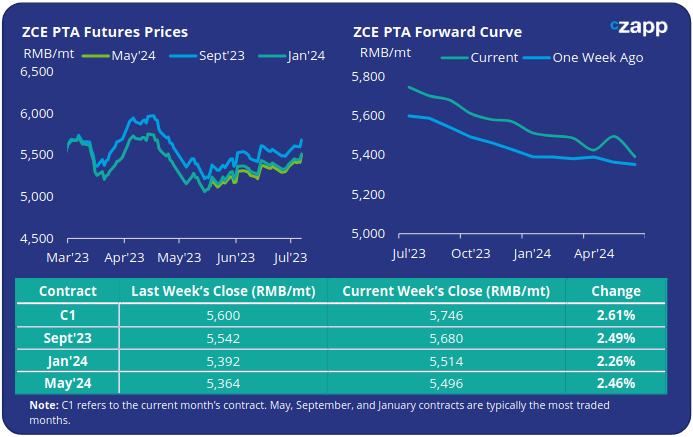

PTA Futures and Forward Curve

- PTA Futures showed robust gains last week, with main contract months rising around 2.5% on average.

- Whilst PTA fundamentals remained relatively unchanged, crude oil posted its a second consecutive weekly gain, with Brent heading back towards the USD 77/bbl mark.

- EIA reported a third draw in a row from the United States helping to alleviate some demand concerns, whilst on the supply side Russian export and Saudi production cuts are set to tighten the market.

- As we enter the US peak driving season, crude sentiment is becoming less bearish; potential further rate hikes by central banks and the threat of a global recession may see reversals later in the year.

- The forward curve remains backwardated, by Friday the Sept’23 contract was trading at a RMB 66/tonne discount to the current month.

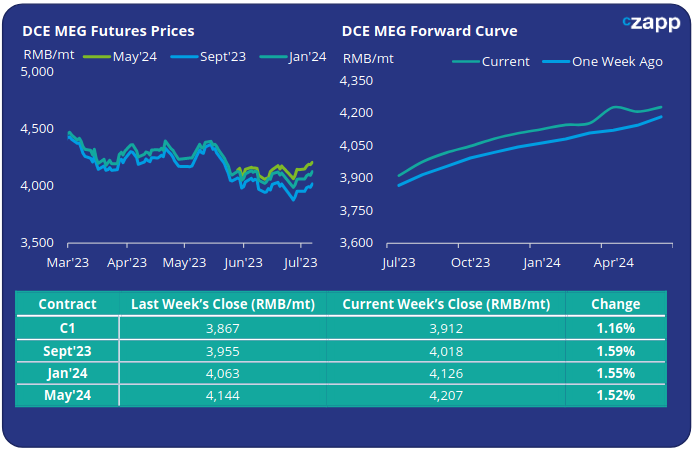

MEG Futures and Forward Curve

- MEG Futures were slower to rise, weighed down by ample availability amid an influx of import arrivals from the US, Middle East, and India.

- Port inventories ticked higher last week, increasing 0.3% to a total of 989k tonnes.

- The combination of a recovery in domestic production, and more deep-seas cargoes on their way, is expected to see inventory build through July.

- Fewer plant turnarounds are also expected in the coming months in comparison to H1.

- Whilst high polyester operating rates currently lend support to the MEG market, downstream polyester inventories are also building with slower textile offtake.

- Potential polyester production cuts would place added pressure on MEG, moving the market into even greater oversupply.

- The MEG forward curve continues to show prices steadily increasing over the next 12-months.

- By Friday the Sept’23 contract was holding a RMB 106/tonne premium to the current month.

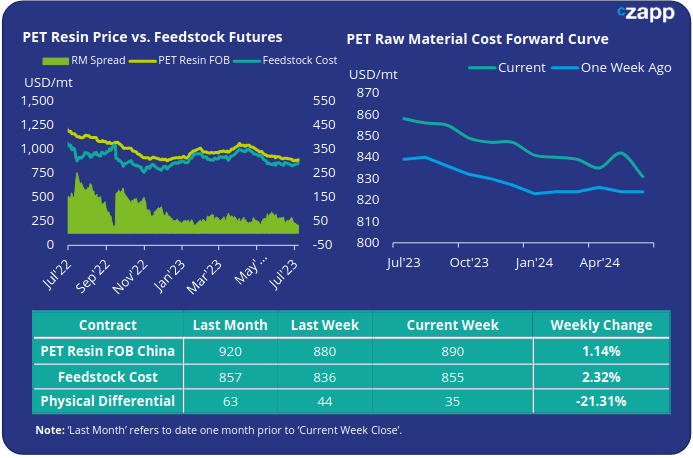

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices were stable through most of last week, increasing slightly in the later half following the upstream higher. By Friday, export prices averaged USD 890/tonne FOB, an increase of USD 10/tonne on the previous week.

- The weekly average PET resin physical differential to future feedstock costs has dropped sharply on last week’s close, down USD 17/tonne to average USD 36/tonne for the week. By Friday the daily spread had fallen further to just USD 35/tonne.

- The raw material cost forward curve shows a gradually declining cost based through the remainder of the summer and into Q1’24.

- At Friday’s close, Sept’23 raw material costs continued to trade on relative par with the current month, with a discount of just USD 3/tonne; Jan’24, the next main contract month, was at a USD 15/tonne discount.

Concluding Thoughts

- PET resin export margins continue to tumble on weak demand and growing capacity expansion.

- Whilst overall demand remains weak, some restocking activity is evident. With new capacity additions buyers are reluctant to accept higher offers, continuing to aggressively bid down.

- Questions around potential production cuts now loom, although major turnarounds are still expected to remain between September and November.

- Since April, Chinese PET resin capacity has expanded by 1.85M tonnes, and despite the weak market environment is scheduled to add a further potential 2.15M tonnes in H2’23.

- Some older lines are expected to be retired; competition will undoubtedly intensify through the remainder of the year. Both operating rates and margins will face increased pressure.

- With limited upside for margins in the near-term, and the off-season now in sight, PET resin export prices are expected to track costs closely.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.