Insight Focus

- PTA Futures rise as supply constrained by unplanned maintenance turnarounds.

- Overall, PET feedstock costs remain flat through the next 12-months.

- Chinese PET producers lower forward premiums, margins to remain depressed in 2024.

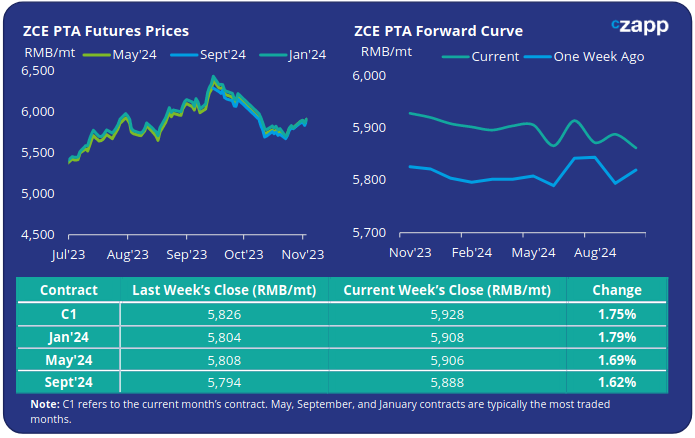

PTA Futures and Forward Curve

PTA Futures for main Jan’24 contract experienced modest gains, increasing 1.75% on the previous weeks close despite weaker oil prices.

Crude oil prices recorded a second weekly decline as the war premium stemming from the Gaza conflict eased.

Having dropped to around USD84/bbl mid-week, Brent crude prices steadily recovered to around USD87/bbl by Friday, down 2.7% on the week.

PX-PTA spreads kept relatively steady, averaging around USD 88/tonne for the week.

Additional PTA plant maintenance and continuing high polyester operating rates are expected to keep the PTA market in relative balance in November.

Over the coming months, polyester rates are expected to steadily move lower, potentially softening the demand side of the equation.

By Friday, the PTA forward curve whilst slightly backwardated into Q1 was showing some recovery in later months. The Jan’24 contract was at a RMB 20/tonne discount to the current month; the May’24 contract was now at just a RMB 22/tonne discount.

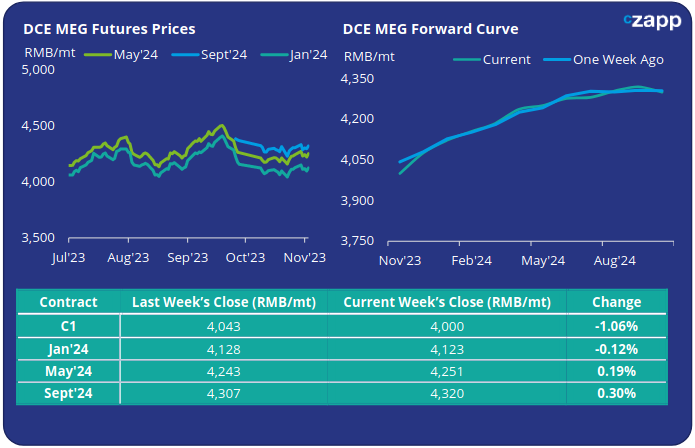

MEG Futures and Forward Curve

MEG Futures softened on high inventory pressure as domestic supply increases coincide with massive import arrivals weighing on market sentiment.

East China main port inventories increased 6.26% last week, reaching over 1,191k tonnes by Friday, a new annual high for 2023, look on course to set multi-year highs in coming weeks.

Domestic MEG units also began running at higher rates following turnarounds adding to the glut.

New deep seas arrivals are expected to see a moderate slowdown from mid-November onwards.

Any downturn in polyester operating rates, as is expected in the months ahead, is also likely to exacerbate the inventory build-up.

The MEG forward curve remains in contango over the next 12-months. By Friday, the premium held by the Jan’24 contract over the current month remained relatively unchanged on the week at RMB 123/tonne.

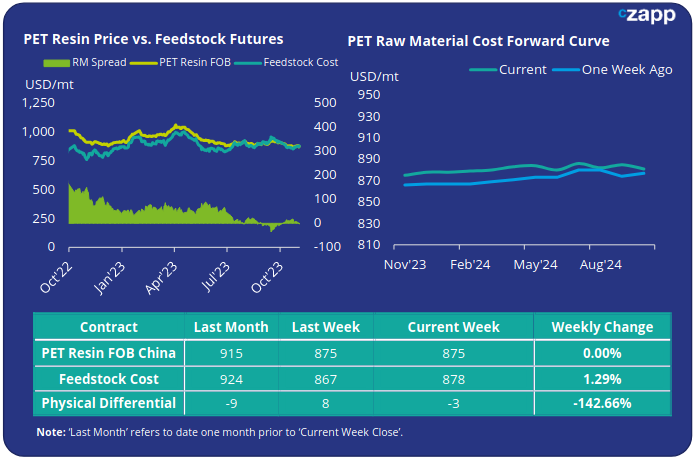

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices remained relatively flat over the previous week, returning to USD 875/tonne by week’s end.

However, the weekly PET resin physical differential fell back by USD 8/tonne to average just USD 11/tonne for the week. By end Friday, the daily spread was back in negative territory at minus USD 3/tonne.

The raw material cost forward curve remains relatively flat through H1’24, with a very slight increase of around USD10/tonne through H1’24.

By Friday, the premium held for Jan’24 feedstock over the current month was just USD3/tonne; May’24 was at a USD9/tonne premium.

Concluding Thoughts

Demand for prompt shipment remains relatively mute, with producers having ample availably and looking to make additional sales to hit Q4 targets.

However, Chinese producers are increasingly active in engaging in long forward contracts. Forward premiums over current spot rates have also declined, with Q1 offers decreasing from a USD30-40/tonne premium to parity with Nov/Dec shipment.

Further forward, Q2 and H2 2024 indications are typically ranging at just USD5-15/tonne higher.

With the raw material forward curve flat through the next 12-months, PET resin export margins are likely to remain compressed through much of H1 2024.

Notice of provisional ADD rates on European imports of Chinese PET resin has also been seen by CZ.

Although rates vary by producer, it is estimated that those at the lower end of the spectrum (Sanfame and Wankai) could still deliver into the European market at competitive rates versus European domestic producers.

As such, a fresh wave of European interest in Chinese resin may be forthcoming supporting additional export demand, with certain buyers looking secure stable supply for 2024.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.